✯ 2003 National Health Policy ... January 22-23, 2003 J.W. Marriott

advertisement

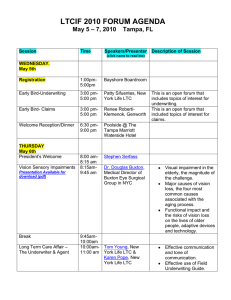

✯ ✯ 2003 National Health Policy ✯Conference January 22-23, 2003 J.W. Marriott Washington, D.C. Long-Term Care in the Era of Deficits: Minnesota’s Story National Health Policy Conference Washington, D.C. January 23, 2003 Long-Term Care in Minnesota Outline of Presentation O public financing of long-term care • status of publicly-funded long-term care in Minnesota O private financing of long-term care • activities to promote private financing of long-term care in Minnesota Definition of Long-Term Care “Assistance given over a sustained period of time to people who are experiencing long-term inabilities or difficulties in functioning because of a disability.” --Kane et al, 2000 People of all ages can need longterm care - this presentation looks only at the elderly. Who Provides Long-Term Care? Long-term care can be provided in a variety of settings, not just nursing homes. The vast majority of long-term care for the elderly is provided by family members - especially spouses and daughters and daughters-in-law. Who Provides Long-Term Care? 5% Families 95% Agencies Source: Survey of Older Minnesotans, Minnesota Board on Aging, 1995 Public Financing of Long-Term Care Majority of long-term care that is paid for is paid with public funds. O 58% of all paid long-term care is publicly financed. O Most of these funds are paid through the federal/state Medicaid program. O Long-Term Care in Minnesota O State of Minnesota spends $1.4 billion on basic and long-term care for the elderly. • $ 900 million pays for nursing home care. • $ 350 million pays for basic medical care. • $ 150 million pays for community care. Department of Human Services Continuing Care Administration DHS Expenditures to Serve Elderly Persons FY 2002 Total = $1.4 billion (includes federal and state dollars) Long-Term Care Federal/state aging grants 25% MA basic care 2% 73% Source: November 2002 Forecast, Department of Human Services Long-Term Care Issues O Minnesota Long-Term Care Task Force met in 2000 to address critical issues • Issue: we are overly reliant on institutional model of long-term care • Issue: consumers prefer home and residential options Long-Term Care Reform in Minnesota Maximize peoples’ ability to meet their own long-term care needs. O Expand capacity and availability of community options throughout the state. O Reduce reliance on the institutional model. O Long-Term Care Reform in Minnesota Achieve quality and good outcomes. O Support informal network of family, friends and neighbors. O Recruit and retain stable work force. O Reshaping Long-Term Care Highlights of 2001 Legislation O Expansion of information and assistance O Design of long-term care consultation services (aka Preadmission screening) O Start-up of new communitybased housing and services Reshaping Long-Term Care Highlights of 2001 Legislation O Increased funding for Elderly Waiver and Alternative Care services O Incentives for voluntary nursing home bed reduction O COLAs for all long-term care providers Reshaping Long-Term Care Highlights of 2001 Legislation O Initiatives to strengthen long-term care work force O Initiatives to enhance quality and improve consumer satisfaction O Redesign of payment systems O Planning and development by counties and AAAs Reshaping Long-Term Care How long-term care reform was funded O Expand community care by reinvesting money saved through voluntary nursing home closures O The reinvestment concept was necessary to gain support of Ventura administration in 2001 Reshaping Long-Term Care What has really happened? O Fewer nursing home beds closed than anticipated, but use is declining O Increase in elderly persons using waiver and state programs, and increase in average monthly costs for community care Long-Term Care Benchmarks O O O O O Percent of Total Long-Term Care Spending for Nursing Home Care Percent of Nursing Home Residents 65+ that are Case Mix A Percent Non-Case Mix A Elderly in Elderly Waiver/Alternative Care Programs Ratio of Nursing Home Beds to Persons 65+ and 85+ Ratio of Senior Housing Units to Persons 65+ Percent of MA long-term care funds spent on community-based services vs. institutional care 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 66.7 63.3 60 58.2 52.5 33.3 36.7 40 41.8 47.5 1998 1999 2000 2001 2002 Target community institutional Percent of persons in nursing facilities that is less disabled* 16 15.5 15.6 15.1 15.1 15 14.9 14.8 2001 2002 Target 14.5 14 13.5 13 12.5 12 11.5 11 10.5 10 1998 1999 2000 *Less disabled includes persons with fewer functional problems who are classified as case mix A, on a scale of A to K. Number of “supportive housing” units/1,000 persons 65+ 120 115 115 111 110 105 100 98 95 90 85 1999 2001 2003 Target Other Measures of Success Paradigm has shifted from “nursing home” to “staying at home” O Counties are transforming the way they serve elderly persons O Volunteer and community resources are more closely linked to formal long-term care services O Private Financing for Long-Term Care Private financing includes: O out-of-pocket expenditures (28%) O long-term care insurance (7%) O charitable and voluntary services offered to older persons through churches, United Way agencies, etc. (?) O Private LTC Financing Most older persons and families ask: O “What is reimbursed by insurance?” O “What am I eligible for?” O Still have sticker shock at price of formal services. O Long-Term Care Insurance LTCI is growing both through individual plans and group plans through employers. O Minnesota offered LTCI to state employees, spouses and parents in 2000. O It was very successful. O Growth in employer plans Employer-Sponsored LTC Plans 2000 1500 1000 500 0 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 Number of Plans 2500 (Sources: Health Insurance Association of America, 1996) Reasons for Buying LTCI Coverage Freedom of Choice 5% Guarantee Affordability 10% Likely to Need 5% Protect Savings 30% Protect Lifestyle 10% Peace of Mind 15% (Source: HIAA and LTCG) Not Be Burden 25% Overview of Minnesota’s plan O Available to: • 61,000 employees and their spouses and parents • 25,000 retirees and their spouses O O Fall 2000: On-cycle open enrollment for employees Fall 2001: Initial offering to retirees, but no open enrollment Group LTCI in Minnesota O O O O O O O O Total employees in top 25 ERs Minn. EEs (18-65) in 2000 # ERs offering LTCI % ERs offering LTCI # eligible # eligible/Minn. Ees # and % considering LTCI # and % offering/consider LTCI 349,479 2,965,760 12 48.0% 193,768 6.5% 10/40.0% 22/88.0% State of Minnesota LTCI Enrollment Very high enrollment, especially compared to other states O Median for other 21 states: 1.6% O Minnesota: 18% enrolled O • 83.2% employees • 16.6% spouses • 0.2% parents State of Minnesota LTCI Enrollment O Age of enrollee slightly higher than average • Population: 45.1 yrs • Enrollee: 48.4 yrs O Higher female enrollment: • Population: 50% • Enrollees: 57% More LTCI Incentives Minnesota offers $100 tax credit for taxpayers who have qualified LTCI policy O Legislature gave $100,000 to Minnesota Board on Aging to further encourage employers to offer group LTCI products to employees O More LTCI Incentives Contract with Long-Term Care Group, Inc. to survey sample of 500 employers of various sizes to determine interest and incentives needed to increase product offering O Survey to be completed by March 2003/ recommendations made O More LTCI Incentives More action on LTCI incentives in 2003 Legislature is likely O Possible increases in individual credit from $100 to $250 or more O Possible tax credit for employers that offer LTCI O Popular idea with stakeholders and politicians now in majority Conclusions Public financing will continue to be major payer for LTC. O We are shifting more and more to community/consumer-directed care. O Private options are growing but will never close the gap. O Need to maintain LTC reform principles in era of deficits, and take opportunities that arise. O