Accountability and Quality National Health Policy Conference February 12, 2007 Sam Ho, M.D.,

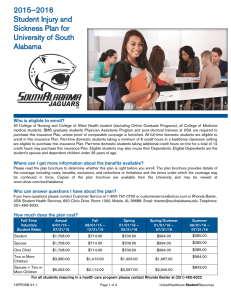

advertisement

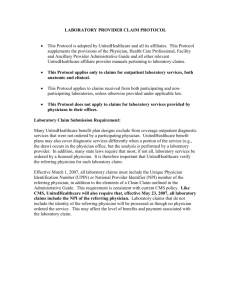

Accountability and Quality National Health Policy Conference February 12, 2007 Sam Ho, M.D., Chief Medical Officer, Pacific and Southwest Regions Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Rewarding Provider Performance: Aligning Incentives in Medicare – IOM, September, 2006 Key Messages: • Current payment system is broken and must be fixed • PFP must be a key factor, but not a “magic bullet” • Evidence base for PFP is not robust • PFP should reward quality, efficiency and “patient-centeredness” • Transparency requirement • Promote electronic data collection & systems and standardized measures • PFP should be phased in by provider via reporting, improvement, and achievement • Paid w/ existing funds • PFP should be introduced within a learning system Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. 2 4 Cornerstones of Value-driven Health Care 3 • Issued by DHHS Secretary Leavitt • Responding to President’s Executive Order, 8/06 Transparency on Health Care Quality Transparency on Price Incentives for Providers/Consumers HIT Standards Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Key Questions 4 • In addition to transparency of provider performance, how else can accountability be demonstrated? • Why pay for reporting, then improvement, then performance? Or, for all three? • Why pay for quality and efficiency? • With mixed results to date, what else can be done? Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Standardized Measures 5 • • • • • • • • • Evidence-based, consensus-driven CMS AHRQ / NQF AQA – 26 starter measures, 8 areas93 measures HQA – 21 measures, 4 areas Leapfrog – 30 safe practices BTE/NCQA – 25 measures, 3 areas ABIM MOC MDs, MG/IPAs, Hospitals Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Implications for Health Plans 6 • Velocity • Standardized Measures—focus? – Transparency measures – Incentive measures • Quality and Efficiency • Multiple units of analyses • Incentives / disincentives • High-performance networks Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Improve Performance & Reduce Variation 7 • Quality Measures – Virtually all measures only address under-use • Efficiency Measures – Required to address over-use and mis-use – Required to help mitigate HCC inflation – Urgency emphasized by CMS, employers, consumers Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Overview of PFP Impact Estimates* 8 • Rigorous studies of pay-for-performance in health care are few (17 since 1980) • Overall findings are mixed: many null results even for large dollar amounts • But in many cases negative findings may be due to shortterm nature of analysis, small incentives • Evidence suggests pay-for-performance can work but also can fail * Research reviewed by M. Rosenthal, PhD, Harvard School of Public Health Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. 2005-2006 PHS Quality Incentive Program 9 • 28 QUALITY INDEX® profile of provider organization measures • 4 QUALITY INDEX® profile of hospital measures, including Leapfrog • All measures derived from QUALITY INDEX® profile results (PC claims, encounter, CSS, OSHPD, MedPAR, PEP-C, Leapfrog and PAS) • MY2005: thresholds at 80th and 90th percentile with absolute targets established in the previous measurement year • MY2006: relative threshold at 75th and 85th percentile upon the payout calculation (IHA method) • For MY2005, 18 of 21 measures improved on an average of 10% • Incentive pool = $36M for ’05 and ‘06 Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. California IHA Program Results 10 • Amongst providers, +10% in IHA clinical measures and +2.7% in PAS since 2003 • Yet 75% of health plan measures < national 50%ile HEDIS • Incentive payments total over $140 million from 2004-2006 • Single public report card through state agency in 2004/2005 and self-published in 2006 • Successful collaboration amongst purchasers, plans and providers Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. So….Future Incentives / Disincentives for Providers • Direct incentives – IOM health care aims include Quality & Efficiency – Rational value demands Quality & Efficiency – P4P Value-based contracting w/ incentives and disincentives – Increase market share • Indirect incentives – Administrative simplicity – Network status Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. 11 SignatureValueSM Advantage 12 Example: HMO Value Network = 20% ∆ 3.50 Value Network Avg. Cost: $141.09 Avg. Quality Score: 1.34 Non-Value Avg. Cost: $168.77 Avg.. Quality Score: 1.13 Quality Score 3.00 2.50 2.00 1.50 1.00 0.50 $100.00 $150.00 Non-Value $200.00 $250.00 Value Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. $300.00 Southern California 2006 Healthcare Trends: Value vs. Full Networks Group 13 Value Trend Full Trend Company 1 -4.8% 9.1% Company 2 -0.5% 21.73% Company 3 1.2% 15.4% Company 4 4.0% 40.0% Company 5 8.6% 12.9% Note: Value Network launched in Southern California in 2003. 215 clients as of 2/1/06. Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Restructured compensation model 14 P4P Incentive Volume-based Compensation Primary Care Value-based Incentive Value-based Incentive Volume-based Compensation Procedure-based Care Chronic Care Management Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. Volume-based Compensation Integrating Provider and Consumer Incentives • Share accountability with consumers, customers, and providers • Evolve quality incentive programs for providers to value-based compensation • Consumer report cards to track behavior, choices, and results • Value-based benefits for consumers – Rewards for healthier behaviors, provider choices, and better health outcomes—e.g., preferred Rx, value-priced networks – Greater responsibility for their choices and results • Mirror and expand on auto or property/casualty insurance model Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare. 15 16 Thank you. Confidential property of UnitedHealthcare. Do not distribute or reproduce without the express permission of UnitedHealthcare.