Does the Housing Market Value Energy Efficient Residential Homes †

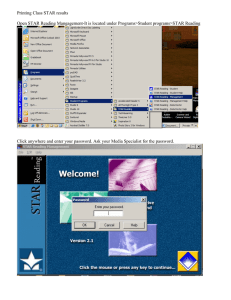

advertisement