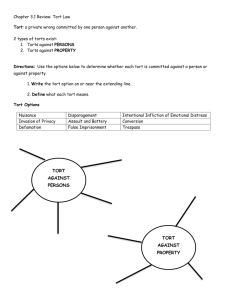

DISCUSSION PAPER Torts and the Protection of “Legally

advertisement