CHESAPEAKE Annual Report CHESAPEAKE ENERGY CORPORATION

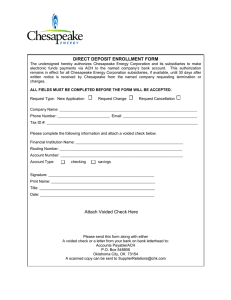

advertisement