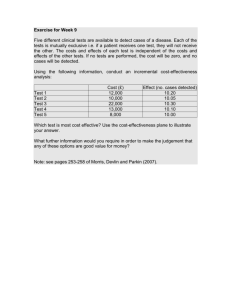

Understanding Cost-Effectiveness of Energy Effi ciency Programs: Issues for Policy-Makers

advertisement