Young and Uninsured: Closing the Gap for the Invincible and the Ineligible

advertisement

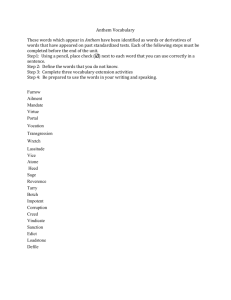

Young and Uninsured: Closing the Gap for the Invincible and the Ineligible Steve Northrup Vice President, Federal Affairs, WellPoint, Inc. 2008 National Health Policy Conference Capital Hilton, Washington, D.C. February 4, 2008 Agenda Young Adult Characteristics • Initial Perceptions and Misconceptions • The Reality • How They View Health Insurance • Why They Aren’t Buying Health Insurance Anthem Solutions for Young Adults • Why TONIK®? • TONIK Benefits • The TONIK Experience Consumer-Friendly Solutions • Cost and Quality Transparency • Innovative Consumer Tools Our Uninsured Action Plan Lessons Learned 1/30/2008 2 Young Adult Characteristics Initial Perceptions and Misconceptions • Young invincibles • Don’t want and can’t afford health insurance • Willing to live on the edge and take a chance • Not worried about the future • Indestructible • Irresponsible 1/30/2008 3 Young Adult Characteristics The Reality • Men and women 19-29 years old - post college/pre-marriage • Want to be seen as independent and responsible • $30K+ annual income • Heavy internet users • Want a consumer-friendly product that is affordable and simple to apply for, use, and manage 1/30/2008 4 Young Adult Characteristics How They View Health Insurance • Sign of being mature • Offers security and peace of mind Why They Aren’t Buying Health Insurance • Too expensive • Too confusing • Insurance companies don’t offer products to fit their needs and lifestyle • Procrastination 1/30/2008 5 Anthem Solutions for Young Adults Why TONIK? • Extensive market research led to products designed to provide what young adults want • Most plans under $100/month with some premiums as low as $69/month • Plans cover medical, dental, vision, and pharmacy • First-dollar coverage for preventive benefits • Automated payment option • Straightforward, conversational communication style • 3 plans with only 2 variables • Simplified online application, 20 minute process • Instant, downloadable ID cards 1/30/2008 6 Anthem Solutions for Young Adults Benefits Thrill Seeker Part-Time Daredevil Calculated Risk Taker Annual Deductible/Out of Pocket Max $5,000 $3,000 $1,500 $20 4 visits/year $30 4 visits/year $40 Unlimited visits Doctor Visit Copay Deductible waived Inclusive of all services received in office, including x-ray, lab, etc. In/Outpatient Hospital $0 after deductible Prescription Generic Only $10 Dental $25 Deductible $0 Cleanings, Exams, X-rays 20% Fillings Vision $50 for Exam, Glasses, Contacts 1/30/2008 7 Anthem Solutions for Young Adults The TONIK Experience • More than 80,000 individual enrollees (most in California where TONIK was introduced at end of 2004) • 78% previously uninsured • Majority of members are 19-29 years old • Six current markets: CA, CO, NV, NH, CT, GA • Planned expansion to all 14 states in which Anthem or one of its affiliates is the Blue Cross or Blue Cross and Blue Shield licensee • All plans purchased online • Has expanded insured market by introducing the importance of insurance to a new segment 1/30/2008 8 Consumer-Friendly Solutions Cost and Quality Transparency Efforts • Anthem Care Compare – Hospital and surgical center cost and volume information • Zagat Online Physician Rating Tool – Allows members to view other members’ ratings of physicians, percentage of members who recommend that physician, and member comments. Physicians rated in four categories: • Trust • Communication • Availability • Environment • Blue Precision • Physician cost and quality information 1/30/2008 9 Consumer-Friendly Solutions Innovative Consumer Tools • 360° HEALTH® Program • An integrated suite of resources and health programs designed to give members the information and support they need to reach their highest possible level of wellness. Includes web-based solutions like a health risk assessment, Daily Health Tips, Online Preventive Guidelines. Also offers Healthy Newsletters, Wellness Materials, 24/7 Audio Tape Library, 24/7 Nurse Line, Diet/Nutrition resources. • MyHealth RecordTM • Secure internet access to self- and claims-populated health information, customized health management tools, clinical alerts for medication safety and gaps in care, and a Secure Message Center to allow consumers to communicate virtually with customer service representatives. • E-Prescribing • To enhance patient safety, quality of care and health care affordability and spur more widespread adoption of health information technology tools. Combination of local initiatives and sponsorship of the National Electronic Prescribing Patient Safety Initiative (NEPSI). 1/30/2008 10 Uninsured Action Plan When $100/month is too much… • Our plan to reduce the number of uninsured: • Universal coverage for children • Public programs for children in families up to 300% FPL • Private products designed to appeal to families with previously uninsured children • Improving and expanding public programs for the most needy • Public program coverage for parents up to 200% FPL and childless adults up to 100% FPL • Providing a bridge to self-sufficiency for the working poor • Premium assistance programs for all individuals and families up to 300% FPL 1/30/2008 11 Lessons Learned Moving Forward • Legislative and regulatory flexibility enable innovative, affordable products • Consumers can determine the type and benefits of health insurance coverage best suited to their individual situations • Third-party benefit review panels can provide insight into fiscal impact of proposed or enacted mandates • Educating consumers on the value of health insurance is a key part of outreach 1/30/2008 12