Assessing structure in monetary policy models Ragnar Nymoen Model Evaluation in Macroeconomics

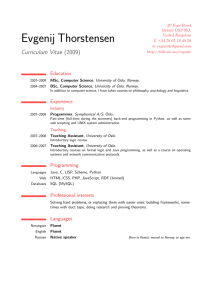

advertisement

Assessing structure in monetary policy models Ragnar Nymoen http://folk.uio.no/rnymoen/ Department of Economics University of Oslo Model Evaluation in Macroeconomics Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 1 / 19 Contents 1 Introduction 2 Structural interpretation and structural properties 3 Evaluation of the New Keynesian Phillips Curve 4 Evaluation of an econometric model of the inflation spiral Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 2 / 19 Contents 1 Introduction 2 Structural interpretation and structural properties 3 Evaluation of the New Keynesian Phillips Curve 4 Evaluation of an econometric model of the inflation spiral Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 2 / 19 Contents 1 Introduction 2 Structural interpretation and structural properties 3 Evaluation of the New Keynesian Phillips Curve 4 Evaluation of an econometric model of the inflation spiral Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 2 / 19 Contents 1 Introduction 2 Structural interpretation and structural properties 3 Evaluation of the New Keynesian Phillips Curve 4 Evaluation of an econometric model of the inflation spiral Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 2 / 19 Introduction Structural models Structure has a positive ring about it, so several model types have been dubbed structural Simultaneous equations models Ditto, but dynamic Large scale econometric models Structural VARs Models with ’deep structural’ parameters In modern macroeconomics, after Lucas’ reorientation, structural model has come to mean ’derived from modern Walrasian theory’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 3 / 19 Introduction Structural models Structure has a positive ring about it, so several model types have been dubbed structural Simultaneous equations models Ditto, but dynamic Large scale econometric models Structural VARs Models with ’deep structural’ parameters In modern macroeconomics, after Lucas’ reorientation, structural model has come to mean ’derived from modern Walrasian theory’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 3 / 19 Introduction Structural models Structure has a positive ring about it, so several model types have been dubbed structural Simultaneous equations models Ditto, but dynamic Large scale econometric models Structural VARs Models with ’deep structural’ parameters In modern macroeconomics, after Lucas’ reorientation, structural model has come to mean ’derived from modern Walrasian theory’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 3 / 19 Introduction Structural models Structure has a positive ring about it, so several model types have been dubbed structural Simultaneous equations models Ditto, but dynamic Large scale econometric models Structural VARs Models with ’deep structural’ parameters In modern macroeconomics, after Lucas’ reorientation, structural model has come to mean ’derived from modern Walrasian theory’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 3 / 19 Introduction Structural models Structure has a positive ring about it, so several model types have been dubbed structural Simultaneous equations models Ditto, but dynamic Large scale econometric models Structural VARs Models with ’deep structural’ parameters In modern macroeconomics, after Lucas’ reorientation, structural model has come to mean ’derived from modern Walrasian theory’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 3 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Theoretical underpinnings imply structure? OK, if purpose is to analyze counterfactual observations from a theoretical system but requires evaluation when the model is used to explain observations of the macro economy (e.g., last and next years national accounts and inflation), and for decision making In practice the usefulness of a model hinges on other properties as well, for example I I I explanatory power (’fit) stability (over time) and constancy (across regimes) encompassing of other evidence Important to evaluate also these other dimensions. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 4 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Structural properties Several dimensions: theoretical interpretation, fit, constancy, encompassing. ) When all features are present, a model has achieved a structural representation of the macroeconomy. In practice, structure is partial: I I all models are wrong; and are better suited for some purposes than others all models break down sooner or later Nevertheless better to know your model’s limitations than to postulate that it mimics reality to perfection (or better than other models). In practice also useful to know which part of a model is relatively structural, and which is ’soft as a grape’. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 5 / 19 Introduction Layout of the paper Structural model (rhetorics and substance). Evaluation example I: The New Keynesian Phillips Curve Can structural representations of the expected to emerge form Walrasian microfoundations? Back to square one: A Marshallian approach to macro-modelling Evaluation example II: An econometric model of the inflation-spiral (price setting wages and wage setting) Summary and discussion Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 6 / 19 Introduction Layout of the paper Structural model (rhetorics and substance). Evaluation example I: The New Keynesian Phillips Curve Can structural representations of the expected to emerge form Walrasian microfoundations? Back to square one: A Marshallian approach to macro-modelling Evaluation example II: An econometric model of the inflation-spiral (price setting wages and wage setting) Summary and discussion Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 6 / 19 Introduction Layout of the paper Structural model (rhetorics and substance). Evaluation example I: The New Keynesian Phillips Curve Can structural representations of the expected to emerge form Walrasian microfoundations? Back to square one: A Marshallian approach to macro-modelling Evaluation example II: An econometric model of the inflation-spiral (price setting wages and wage setting) Summary and discussion Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 6 / 19 Introduction Layout of the paper Structural model (rhetorics and substance). Evaluation example I: The New Keynesian Phillips Curve Can structural representations of the expected to emerge form Walrasian microfoundations? Back to square one: A Marshallian approach to macro-modelling Evaluation example II: An econometric model of the inflation-spiral (price setting wages and wage setting) Summary and discussion Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 6 / 19 Introduction Layout of the paper Structural model (rhetorics and substance). Evaluation example I: The New Keynesian Phillips Curve Can structural representations of the expected to emerge form Walrasian microfoundations? Back to square one: A Marshallian approach to macro-modelling Evaluation example II: An econometric model of the inflation-spiral (price setting wages and wage setting) Summary and discussion Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 6 / 19 Introduction Layout of the paper Structural model (rhetorics and substance). Evaluation example I: The New Keynesian Phillips Curve Can structural representations of the expected to emerge form Walrasian microfoundations? Back to square one: A Marshallian approach to macro-modelling Evaluation example II: An econometric model of the inflation-spiral (price setting wages and wage setting) Summary and discussion Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 6 / 19 Structural interpretation and structural properties Structural dimensions Claims of structural representation of the macroeconomy can be evaluated along several dimension, for example I I I I Theoretical interpretation Ability to explain data Ability to explain earlier findings (properties of existing models) Robustness to new evidence (sample period extension) and new economic analysis (hypotheses of explanatory variables) Pagan Frontier Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 7 / 19 Structural interpretation and structural properties Structural dimensions Claims of structural representation of the macroeconomy can be evaluated along several dimension, for example I I I I Theoretical interpretation Ability to explain data Ability to explain earlier findings (properties of existing models) Robustness to new evidence (sample period extension) and new economic analysis (hypotheses of explanatory variables) Pagan Frontier Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 7 / 19 Structural interpretation and structural properties Structural dimensions Claims of structural representation of the macroeconomy can be evaluated along several dimension, for example I I I I Theoretical interpretation Ability to explain data Ability to explain earlier findings (properties of existing models) Robustness to new evidence (sample period extension) and new economic analysis (hypotheses of explanatory variables) Pagan Frontier Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 7 / 19 Structural interpretation and structural properties Structural dimensions Claims of structural representation of the macroeconomy can be evaluated along several dimension, for example I I I I Theoretical interpretation Ability to explain data Ability to explain earlier findings (properties of existing models) Robustness to new evidence (sample period extension) and new economic analysis (hypotheses of explanatory variables) Pagan Frontier Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 7 / 19 Structural interpretation and structural properties Structural dimensions Claims of structural representation of the macroeconomy can be evaluated along several dimension, for example I I I I Theoretical interpretation Ability to explain data Ability to explain earlier findings (properties of existing models) Robustness to new evidence (sample period extension) and new economic analysis (hypotheses of explanatory variables) Pagan Frontier Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 7 / 19 Structural interpretation and structural properties Structural dimensions Claims of structural representation of the macroeconomy can be evaluated along several dimension, for example I I I I Theoretical interpretation Ability to explain data Ability to explain earlier findings (properties of existing models) Robustness to new evidence (sample period extension) and new economic analysis (hypotheses of explanatory variables) Pagan Frontier Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 7 / 19 Structural interpretation and structural properties A modified Pagan Frontier ’Index of structural properties’ replaces ’Empirical coherence’ along x-axis. ’Theoretical coherence’ not well defined in practice, since more than one theoretical framework to consider (a least to the heterodox). I I Modern Walrasian theory (’microfoundations’, RBC, DSGE) Post Walrasian, or ’Marshallian’ (stepwise modeling, heterogeniety, involuntary unemployment, price makers, behavioural) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 8 / 19 Structural interpretation and structural properties A modified Pagan Frontier ’Index of structural properties’ replaces ’Empirical coherence’ along x-axis. ’Theoretical coherence’ not well defined in practice, since more than one theoretical framework to consider (a least to the heterodox). I I Modern Walrasian theory (’microfoundations’, RBC, DSGE) Post Walrasian, or ’Marshallian’ (stepwise modeling, heterogeniety, involuntary unemployment, price makers, behavioural) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 8 / 19 Structural interpretation and structural properties A modified Pagan Frontier ’Index of structural properties’ replaces ’Empirical coherence’ along x-axis. ’Theoretical coherence’ not well defined in practice, since more than one theoretical framework to consider (a least to the heterodox). I I Modern Walrasian theory (’microfoundations’, RBC, DSGE) Post Walrasian, or ’Marshallian’ (stepwise modeling, heterogeniety, involuntary unemployment, price makers, behavioural) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 8 / 19 Structural interpretation and structural properties A modified Pagan Frontier ’Index of structural properties’ replaces ’Empirical coherence’ along x-axis. ’Theoretical coherence’ not well defined in practice, since more than one theoretical framework to consider (a least to the heterodox). I I Modern Walrasian theory (’microfoundations’, RBC, DSGE) Post Walrasian, or ’Marshallian’ (stepwise modeling, heterogeniety, involuntary unemployment, price makers, behavioural) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 8 / 19 Structural interpretation and structural properties A Modified Pagan Frontier Degree of theoretical coherence 'Walras' 'Marshall' Index of structural properties Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 9 / 19 Evaluation of the New Keynesian Phillips Curve The NKPC defined e ∆pt = α∆pt+1 + β∆pt−1 + δxt (1) Integral part of consensus monetary policy model. Represents the supply side The ultimate theory instigated inflation model (high on structural interpretation A declared success in terms of fit by proponents ...while the baseline pure forward looking model is rejected on statistical grounds, it is still likely to be a reasonable first approximation to inflation dynamics of both Europe and the US, (Gali, 2003). Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 10 / 19 Evaluation of the New Keynesian Phillips Curve The NKPC defined e ∆pt = α∆pt+1 + β∆pt−1 + δxt (1) Integral part of consensus monetary policy model. Represents the supply side The ultimate theory instigated inflation model (high on structural interpretation A declared success in terms of fit by proponents ...while the baseline pure forward looking model is rejected on statistical grounds, it is still likely to be a reasonable first approximation to inflation dynamics of both Europe and the US, (Gali, 2003). Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 10 / 19 Evaluation of the New Keynesian Phillips Curve The NKPC defined e ∆pt = α∆pt+1 + β∆pt−1 + δxt (1) Integral part of consensus monetary policy model. Represents the supply side The ultimate theory instigated inflation model (high on structural interpretation A declared success in terms of fit by proponents ...while the baseline pure forward looking model is rejected on statistical grounds, it is still likely to be a reasonable first approximation to inflation dynamics of both Europe and the US, (Gali, 2003). Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 10 / 19 Evaluation of the New Keynesian Phillips Curve The NKPC defined e ∆pt = α∆pt+1 + β∆pt−1 + δxt (1) Integral part of consensus monetary policy model. Represents the supply side The ultimate theory instigated inflation model (high on structural interpretation A declared success in terms of fit by proponents ...while the baseline pure forward looking model is rejected on statistical grounds, it is still likely to be a reasonable first approximation to inflation dynamics of both Europe and the US, (Gali, 2003). Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 10 / 19 Evaluation of the New Keynesian Phillips Curve Typical NKPC fits as well as a random-walk Fitted values from NPC vs. fitted values from random walk Actual inflation and fit from the NPC 3.5 3.0 3.0 2.5 2.5 NPC-FIT 3.5 2.0 1.5 2.0 1.5 1.0 1.0 0.5 0.5 0.0 1975 1980 1985 NPCRATSFIT 1990 1995 0.0 0.0 0.5 1.0 DP Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) 1.5 2.0 2.5 3.0 3.5 RW-FIT EValW 2005 11 / 19 Evaluation of the New Keynesian Phillips Curve Why is the NKPC only as good as a random-walk? Low numerical significance of forcing variable (wage-share) Hence dVAR feature of model dominates—also for hybrid ∆pt = 1.06∆pt−1 + 0.41∆2 pt−1 + 0.02wst−1 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) (2) EValW 2005 12 / 19 Evaluation of the New Keynesian Phillips Curve Why is the NKPC only as good as a random-walk? Low numerical significance of forcing variable (wage-share) Hence dVAR feature of model dominates—also for hybrid ∆pt = 1.06∆pt−1 + 0.41∆2 pt−1 + 0.02wst−1 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) (2) EValW 2005 12 / 19 Evaluation of the New Keynesian Phillips Curve Internal inconsistency of NKPC Fuhrer (2005) analyzes acf of typical US NKPC Inflation persistence is found to be due to ’intrinsic persistence’ not ’inherited persistence’ (from the forcing variable), as the theory claims it should. Hence, upon evaluation the theoretical content of the NKPC ’disappears out of the window’. Belongs near zero in the modified Pagan Frontier (poor fit, no structural interpretation after all) How to model inflation is now in the blue (Fuhrer) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 13 / 19 Evaluation of the New Keynesian Phillips Curve Internal inconsistency of NKPC Fuhrer (2005) analyzes acf of typical US NKPC Inflation persistence is found to be due to ’intrinsic persistence’ not ’inherited persistence’ (from the forcing variable), as the theory claims it should. Hence, upon evaluation the theoretical content of the NKPC ’disappears out of the window’. Belongs near zero in the modified Pagan Frontier (poor fit, no structural interpretation after all) How to model inflation is now in the blue (Fuhrer) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 13 / 19 Evaluation of the New Keynesian Phillips Curve Internal inconsistency of NKPC Fuhrer (2005) analyzes acf of typical US NKPC Inflation persistence is found to be due to ’intrinsic persistence’ not ’inherited persistence’ (from the forcing variable), as the theory claims it should. Hence, upon evaluation the theoretical content of the NKPC ’disappears out of the window’. Belongs near zero in the modified Pagan Frontier (poor fit, no structural interpretation after all) How to model inflation is now in the blue (Fuhrer) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 13 / 19 Evaluation of the New Keynesian Phillips Curve Internal inconsistency of NKPC Fuhrer (2005) analyzes acf of typical US NKPC Inflation persistence is found to be due to ’intrinsic persistence’ not ’inherited persistence’ (from the forcing variable), as the theory claims it should. Hence, upon evaluation the theoretical content of the NKPC ’disappears out of the window’. Belongs near zero in the modified Pagan Frontier (poor fit, no structural interpretation after all) How to model inflation is now in the blue (Fuhrer) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 13 / 19 Evaluation of the New Keynesian Phillips Curve Internal inconsistency of NKPC Fuhrer (2005) analyzes acf of typical US NKPC Inflation persistence is found to be due to ’intrinsic persistence’ not ’inherited persistence’ (from the forcing variable), as the theory claims it should. Hence, upon evaluation the theoretical content of the NKPC ’disappears out of the window’. Belongs near zero in the modified Pagan Frontier (poor fit, no structural interpretation after all) How to model inflation is now in the blue (Fuhrer) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 13 / 19 Evaluation of the New Keynesian Phillips Curve Encompassing Wage bargaining models, (old) Phillips-curves and NKPC can be (re)parameterized as EqC equations NKPC: e ∆pt = δ1f ∆pt+1 + η1 ∆wst + δ1b ∆pt−1 − η1 [p − 1 (ws + p)]t−1 . Bårdsen, Jansen and Nymoen (2004): Encompass existing specifications with alternative EqCM part? Encompass other with richer dynamics? Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 14 / 19 Evaluation of the New Keynesian Phillips Curve Encompassing Wage bargaining models, (old) Phillips-curves and NKPC can be (re)parameterized as EqC equations NKPC: e ∆pt = δ1f ∆pt+1 + η1 ∆wst + δ1b ∆pt−1 − η1 [p − 1 (ws + p)]t−1 . Bårdsen, Jansen and Nymoen (2004): Encompass existing specifications with alternative EqCM part? Encompass other with richer dynamics? Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 14 / 19 Evaluation of the New Keynesian Phillips Curve Encompassing Wage bargaining models, (old) Phillips-curves and NKPC can be (re)parameterized as EqC equations NKPC: e ∆pt = δ1f ∆pt+1 + η1 ∆wst + δ1b ∆pt−1 − η1 [p − 1 (ws + p)]t−1 . Bårdsen, Jansen and Nymoen (2004): Encompass existing specifications with alternative EqCM part? Encompass other with richer dynamics? Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 14 / 19 Evaluation of the New Keynesian Phillips Curve Encompassing Wage bargaining models, (old) Phillips-curves and NKPC can be (re)parameterized as EqC equations NKPC: e ∆pt = δ1f ∆pt+1 + η1 ∆wst + δ1b ∆pt−1 − η1 [p − 1 (ws + p)]t−1 . Bårdsen, Jansen and Nymoen (2004): Encompass existing specifications with alternative EqCM part? Encompass other with richer dynamics? Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 14 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Alternative (non Walrasias) models of wage and price setting jointly have been around for a long time I I I Norwegian model of inflation Phillips curve Game theory, monopolistic price setting Starting from a premise that wages, prices and productivity are I(1), and rate of unemployment I(0), but subject to deterministic shifts, possible to encompass the different models in a identified cointegration model. I I CI and error correction singularly ’in’ unemployment gives Phillips curve CI and error correction in wages (and prices) gives fair-game outcome a la Hahn and Solow (1997). Equilibrium real wage locus is ’thick’, consistent with different unemployment rates Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 15 / 19 Evaluation of an econometric model of the inflation spiral Example of identified steady-state Data for log of Norwegian CPI (p), wage rate (w), productivity (z), import price (pb) and unemployment rate (u). 1972(4)-2004(2). Applying the structural interpretation of the theory to the cointegration results, gives the following identified steady-state relationships (simplifid from Table 2, p 30) w − p − z = µw − 0.15u (3) w − p − z = µp − 0.4(w − z − pb) (4) Tempting but invalid to solve for NAIRU from this system. Instead, specify error-correction model of inflation spiral using (3) and (4) and general-to-specific modelling of I(0), system. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 16 / 19 Evaluation of an econometric model of the inflation spiral Example of identified steady-state Data for log of Norwegian CPI (p), wage rate (w), productivity (z), import price (pb) and unemployment rate (u). 1972(4)-2004(2). Applying the structural interpretation of the theory to the cointegration results, gives the following identified steady-state relationships (simplifid from Table 2, p 30) w − p − z = µw − 0.15u (3) w − p − z = µp − 0.4(w − z − pb) (4) Tempting but invalid to solve for NAIRU from this system. Instead, specify error-correction model of inflation spiral using (3) and (4) and general-to-specific modelling of I(0), system. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 16 / 19 Evaluation of an econometric model of the inflation spiral Example of identified steady-state Data for log of Norwegian CPI (p), wage rate (w), productivity (z), import price (pb) and unemployment rate (u). 1972(4)-2004(2). Applying the structural interpretation of the theory to the cointegration results, gives the following identified steady-state relationships (simplifid from Table 2, p 30) w − p − z = µw − 0.15u (3) w − p − z = µp − 0.4(w − z − pb) (4) Tempting but invalid to solve for NAIRU from this system. Instead, specify error-correction model of inflation spiral using (3) and (4) and general-to-specific modelling of I(0), system. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 16 / 19 Evaluation of an econometric model of the inflation spiral Example of identified steady-state Data for log of Norwegian CPI (p), wage rate (w), productivity (z), import price (pb) and unemployment rate (u). 1972(4)-2004(2). Applying the structural interpretation of the theory to the cointegration results, gives the following identified steady-state relationships (simplifid from Table 2, p 30) w − p − z = µw − 0.15u (3) w − p − z = µp − 0.4(w − z − pb) (4) Tempting but invalid to solve for NAIRU from this system. Instead, specify error-correction model of inflation spiral using (3) and (4) and general-to-specific modelling of I(0), system. Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 16 / 19 Evaluation of an econometric model of the inflation spiral Final equilibrium correction model, p. 30 1 + 0.26L 0 (0.06) − 0.21 + 0.18 L 1 − 0.11 L2 (0.03) 0 (0.03) 0.09 (0.05) 0 " d ∆w c ∆p # = t ∆2 y ∆z 0.03L − 0.03 0.025 ∆pb t (0.01) (0.006) (0.008) 0.12 0 (0.01) ecmw − 0 0.06 ecmp t−1 (0.015) (5) (0.008) Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 17 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Final model: some structural properties Integrates identified steady-state relationships Valid simplification of unrestricted I(0) VAR The two equation are ’recognizable’ as wage-growth and price adjustment equations, e.g.,∆wt reacts to ecmw,t−1 and vice versa. Represents ’changes in centralization’ of wage-setting Derivative coefficients of model constant across regimes Identified final ecm has a recursive ’structure’. Phillips-curve interpretation statistically rejected (confirming cointegration) Not encompassed by NKPC Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 18 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19 Evaluation of an econometric model of the inflation spiral Stepwise modelling Final model is (of course) an incomplete model of the inflation spiral. Hence a structural representation of the inflation spiral must be achieve by stepwise modelling. I I I I In line with traditions of macroeconometric model building Opposite methodology of the one-step modelling in Walrasian macroeconomics Relationship to Copenhagen methodology? Only a matter of size? Intuitive If a model of the whole economy is to be securely based, it must be grounded in an intelligible account of how a single market is supposed to work, Hicks (1965), p. 78 Ragnar Nymoen ( http://folk.uio.no/rnymoen/ AssessingDepartment structure in monetary of Economics policyUniversity models of Oslo ) EValW 2005 19 / 19