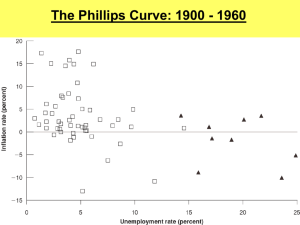

In lecture 4 we learnt that the basic idea of... bargaining models) is that changes in profitability lead to error...

advertisement

In lecture 4 we learnt that the basic idea of the main-course theory (and wage

bargaining models) is that changes in profitability lead to error correction in

wages. The implication is that the e-sector wage level follows a main-course

traced out by productivity and the foreign price level.

Lecture 5. Phillips-curve dynamics

Exogenous changes in unemployment shifts the main-course, but wages adjust

gradually to the new main-course.

If there is no direct link between profitability and wage setting, the main-course

may still hold since there are complementary indirect channels between profits

and wages, for example unemployment.

ECON 3410/4410

Ragnar Nymoen, Department of Economics

The first model in this lecture focuses on the indirect channel: in the form of

a Phillips curve system.

February 9, 2006

The second model is the New Keynesian Phillips curve, NPC, which builds on

entirely different assumptions. For example, wages are set by worker individually; no unemployment.

1

1

2

The Phillips curve version of the main-course model

(Ch 3.2.5 in IDM)

The autoregressive coefficient, which would be αw , is set to unity in (1). Thus

direct wage error-correction is ruled out. Instead, unemployment error corrects,

as captured by the second equation (2).

We could have introduced (2) in Lecture 4, but it was not needed in that model

(to stabilize wage dynamics).

Recall that according to main-course theory it is assumed that

1. we∗ = me,0 + mc, i.e., H1mc above.

(1) and (1) make up a dynamic system.

2. Unemployment, ut has a constant long-run mean and stable dynamics.

A Phillips curve system which is consistent with this is:

For known initial conditions (w0,u0, mc0), the systems determines a solution

(w1, u1), (w2, u2), ...(wT , uT ) for the period t = 1, 2, ...., T . The solution also

depends on the values taken by mct, εw t, εu,t over that period.

(2)

Without further restrictions on the coefficients, it becomes too complicated

to derive the final equation of for example wt. This is frequently the case for

systems!

The “e” sector subscript has been dropped, but have added a w in the subscripts

to the wage equation coefficients.

However, we are usually able to characterize the steady-state, assuming that it

exists (that the solution is stable). Usually we can also discuss the dynamics

in qualitative terms (i.e., words and graphs rather than maths). We follow this

approach in the following.

3

4

∆wt = βw0 + βw1∆mct + βw2ut + εw,t,

βw2 < 0,

ut = βu0 + αuut−1 + βu1(w − mc)t−1 + εu,t

0 < αu < 1,

βu1 > 0

(1)

Assume that the system has a stable solution

Qualitative discussion of dynamics and stability.

The solution based on εw t = εu,t = 0 and ∆mct = gmc (the constant growth

rate of the main course) approaches the following steady state:

Consider the solution based on ∆mct = gmc, and εw t = εu,t = 0 in all periods.

In this case (1) becomes

∆wt = gmc,

ut = ut−1 = uphil , the equilibrium rate of unemployment.

Substitution into (2) and (1) gives the following long-run model:

uphil

gmc = βw0 + βw1gmc + βw2

uphil = βu0 + αuuphil + βu1(w − mc)

The first equation gives

βw0

β −1

+ w1

gmc),

(3)

−βw2

−βw2

which is the natural rate of unemployment in this model. We can also call

the “main-course rate of unemployment”, since it is the rate of unemployment

required to keep wage growth on the main-course.

uphil = (

∆wt − gmc = βw0 + (βw1 − 1)gmc + βw2ut, or, using (3):

∆wt − gmc = βw2(ut − uphil )

Assuming that βw2 < 0, wage growth is higher than the main-course growth

as long as unemployment is below the natural rate.

Moreover, from the second equation of the system:

ut = βu0 + αuut−1 + βu1(w − mc)t−1, βu1 > 0

it is seen that growth in w − mc contributes to higher unemployment in the

next period. This analysis suggests that from any starting point on the Phillips

curve, stable dynamics leads to the steady state solution.

We conclude that the restrictions βw2 < 0 and βu1 > 0 are important for

stability. And that for example βw2 = 0 harms stability.

5

6

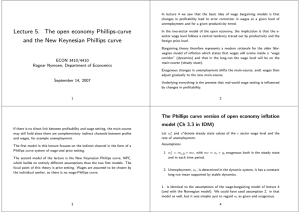

In equilibrium initially. A negative shock to u leads to u0 and ∆w0. Dynamics

“along the short-run PC”.

The short-run Phillips curve is in this model given by (1). The slope coefficient

is

wage growth

βw2 < 0

long run Phillips curve

Δ w0

g

Short and long run Phillips curves

The long run Phillips curve characterizes a steady state situation in which

∆wt = ∆mct. Replacing ∆mct on the right hand side of (1) by ∆wt implies

that the slope of the long run Phillips curve is

mc

u

0

u phil

log rate of

unemployment

βw2

<0

1 − βw1

Showing that the long-run Phillips curve is steeper that the long-run Phillips

curve, i.e., as long as 0 < βw1 ≤ 1. Vertical if βw1 = 1.

Figure 1: Main-course Phillips curve dynamics and equilibrium.

7

8

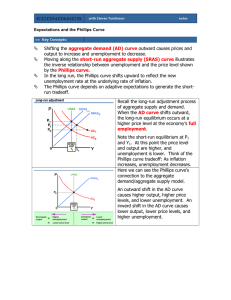

A derived price Phillips curve

We often want to include an expectations term on the right hand side of the

Phillips curve. For example, instead of (1) we might have

∆wt = βw0 + βw1∆wte + βw2ut + εw,t,

e

or ∆wt+1

for that matter. However, as long as expectations are influenced by

the main-course, we get the same conclusion as above. For example

∆wte = ϕ∆mct + (1 − ϕ)∆wt−1, 0 < ϕ ≤ 1

In Lecture 2 a conventional price Phillips curve was shown as an example of

the ADL model. Lecture 4 showed the main-course inflation equation in the

case of error correction in wages setting.

Also in this model a dynamic price equation can be derived. From IDM p 83,

we have

∆pt = φβw0 + {φβw1 + (1 − φ)}∆qe,t + φβw2ut + φβw1∆ae,t −φ∆as,t + φεw,t.

(4)

which is a price Phillips curve augmented by

In steady state there are no expectations errors, so

1. productivity, note the different signs, and

∆wte = ∆wt−1 = gmc

2. and “imported inflation”.

Expectations, in e-sector wage setting, or in s-sector price setting would result

in further augmentation of the price Phillips curve.

9

2

10

The New Keynesian Phillips curve (Ch 3.6 in IDM)

Unlike the bargaining models, the NPC focuses on price setting exclusively

Solution of NPC.

First replace Et∆pt+1 with the right hand side of:

The underlying assumption is that a representative firm takes account of the

expected future path of nominal marginal costs when setting its price, given

a probability that the price thus set “today” will remain fixed for many time

periods ahead.

Et∆pt+1 = ∆pt+1 − ηt+1

where nt+1 is the expectations error, to obtain

∆pt = bp1∆pt+1 + bp2xt + p,t

(6)

p,t = εpt − bp1ηt+1 is a composite disturbance term.

These assumptions lead to:

∆pt = bp1 Et∆pt+1 + bp2xt + εpt, bp1 > 0, bp2 ≤ 0,

(5)

where pt is the (domestic) price level.

(6) looks like an ADL, only that ∆pt+1 and ∆pt have changed places. Hence

(6) is the same as

∆pt+1 =

Et∆pt+1 is the mathematical expectation of ∆pt+1, given information available

in period t.

xt denotes the logarithm of marginal costs xt. In practice this unobservable is

proxied by either the logarithm of the wage share or the rate of unemployment.

11

bp2

1

p,t

∆pt −

xt −

bp1

bp1

bp1

For (moderate) inflation the relevant solution is a stable solution. Try first the

usual recursive solution method, and discover that unless bp1 > 1 this solution

is unstable or explosive.

12

Most economists believe that bp1 < 1, so the backward recursive solution

method is inconsistent with stability.

However another recursive method gives the desired result, by way of repeated

forward substitution:

Of course “fixing ∆pt+j ” is not a trivial requirement (very much unlike the

status of “fixing the initial condition”).

By combining equation (6) with the NPC equation for period t + 1, we obtain

For this reason, the NPC and other models with forward-looking terms are

impractical to use. In general, there is a continuum of solutions to consider,

each solution corresponding to a different value of the terminal condition.

∆pt = bp1(bp1∆pt+2 + bp2xt+1) + bp2xt

= b2p1∆pt+2 + bp2xt + bp1bp2xt+1

There are two ways around the non-uniqueness problem.

and repeated substitution gives

j

∆pt = bp1∆pt+j + bp2

j−1

X

bip1xt+i,

j = 1, 2, .....

(7)

i=0

Based on known x-values in all future periods and zero disturbances in all future

periods, (7) represents a unique solution for ∆pt as long as we can fix the value

of ∆pt+j , which is often referred to as the terminal condition.

13

14

First, some terminal conditions may stand out as more ‘natural’ or relevant.

For example, for a central bank which is committed to the NPC view of the

world, and which runs an inflation targeting monetary policy, it is natural to

choose ∆pt+j = π ∗ as the terminal condition, where π ∗ denotes the inflation

target. Hence the solution

which, subject to the further simplifying assumption of constant xt in all periods

(xt = mx, for all t), can be written as

j

∆pt = bp1π ∗ + bp2

j−1

X

bip1xt+i,

∆pt =

j = 1, 2, .....

(8)

bp2

mx

1 − bp1

(9)

i=0

might be said to represent the rate of inflation in the case of a credible inflation

targeting regime, given that the NPC model is the correct model of inflation,

and given that all future x−values can be fixed.

An important characteristic of this solution is that future changes in x imply

that inflation should react today. Some economists find this incredible, and

have criticized the NPC for not capturing the inflation persistence.

The second, more general, way around the non-uniqueness problem is to invoke

the asymptotically stable solution.

To rectify that, the favoured NPC is of the following hybrid type:

Subject to 0 < bp1 < 1, bj → 0, when j gets infinitively large, and we can

write the asymptotically stable solution as

∆pt = bp2

∞

X

i=0

15

bip1xt+i,

f

∆pt = bp1Et∆pt+1 + bbp1∆pt−1 + bp2xt + εpt.

f

(10)

where both bp1 and bbp1 are assumed to be non-negative coefficients. bbp1 represents the expectations effects that are due to the share of firms without rational

expectation.

16

Heuristically the solution of the hybrid NPC shows more inflation persistence,

and the response to changes in xt will be less sharp than in the case of the

‘pure’ NPC.

Subject to further assumptions, see IDM Ch 3.6, the solution of the hybrid

model is

bp2

∆pt = r1∆pt−1 + f

xt

bp1(r2 − bx2)

where r1 is a coefficient which is less than one in magnitude. r2 is a coefficient

f

which is larger than one. If bbp1 = 0 it can be shown that r1 = 0 and r2 = 1/bp1,

so the solution reduces to the simple NPC.

17

The NPC has become a huge success in terms of affecting beliefs. It has been

used by many central bank as the supply-side equation in their monetary policy

models. Norges Bank adopted this view in 2003.

The empirical status and explanatory power of the NPC is however contested.

For one thing, the hybrid NPC includes only one explanatory variable of inflation

The comparison with the multivariate inflation explanation of the (stripped

down) main-course bargaining model is striking. Nevertheless, the NPC has

been applied to data from open economies.

18