In lecture 4 we saw that the basic idea of... changes in profitability lead to error correction in wages at...

advertisement

In lecture 4 we saw that the basic idea of wage bargaining models is that

changes in profitability lead to error correction in wages at a given level of

unemployment and for a given productivity trend.

Lecture 5. The open economy Phillips-curve

and the New Keynesian Phillips curve

ECON 3410/4410

Ragnar Nymoen, Department of Economics

In the two-sector model of the open economy, the implication is that the esector wage level follows a central tendency traced out by productivity and the

foreign price level.

Bargaining theory therefore represents a modern rationale for the older Norwegian model of inflation which states that wages will evolve inside a “wage

corridor” (dynamics) and that in the long-run the wage level will be on the

main-course (steady state).

Exogenous changes in unemployment shifts the main-course, andt wages then

adjust gradually to the new main-course.

September 14, 2007

Underlying everything is the premise that real-world wage setting is influenced

by changes in profitability.

2

1

The Phillips curve version of open economy inflation

model (Ch 3.3 in IDM)

If there is no direct link between profitability and wage setting, the main-course

may still hold since there are complementary indirect channels between profits

and wages, for example unemployment.

The first model in this lecture focuses on the indirect channel in the form of a

Phillips curve system of wage-and price setting.

The second model of the lecture is the New Keynesian Phillips curve, NPC,

which builds on entirely different assumptions than the two first models. The

focal point of this theory is price setting. Wages are assumed to be chosen by

the individual worker, so there is no wage-Phillips curve.

Let we∗ and u∗denote steady state values of the e sector wage level and the

rate of unemployment.

Assumptions

1. we∗ = me,0 + mc, with mc ≡ ae + qe exogenous both in the steady state

and in each time period.

2. Unemployment, ut , is determined in the dynamic system, it has a constant

long-run mean supported by stable dynamics.

1. is identical to the assumptions of the wage-bargaining model of lecture 4

(and with the Norwegian model). We could have used assumption 2. in that

model as well, but it was simpler just to regard ut as given and exogenous.

3

4

The open economy Phillips curve system is:

βw2 < 0,

∆wt = βw0 + βw1∆mct + βw2ut + εw,t,

ut = βu0 + αuut−1 + βu1(w − mc)t−1 + εu,t βu1 > 0

0 < αu < 1,

(1)

(2)

The “e” sector subscript has been dropped, but have added a w in the subscripts

to the coefficients of the wage equation.

The autoregressive coefficient ( which would have been αw ), is set to unity in

(1). Thus, direct wage error-correction is ruled out. Instead, unemployment

error corrects, as captured by the second equation (2).

Without further restrictions on the coefficients, it becomes too complicated to

derive the final equation of for example wt.

However, we are usually able to characterize the steady-state, assuming that it

exists and that the solution is stable. Usually we can also discuss the dynamics

in qualitative terms (i.e., words and graphs rather than maths). We follow this

approach in the following.

As just noted, we could have introduced (2) in Lecture 4, but it was not needed

in that model (to stabilize wage dynamics).

(1) and (1) make up a dynamic system.

For known initial conditions (w0,u0, mc0), the systems determines a solution

(w1, u1), (w2, u2), ...(wT , uT ) for the period t = 1, 2, ...., T . The solution also

depends on the values taken by mct, εw t, εu,t over that period.

5

Assume that the system has a stable solution

The solution based on εw t = εu,t = 0 and ∆mct = gmc (the constant growth

rate of the main course) approaches the following steady state:

∆wt = gmc,

ut = ut−1 = uphil , the equilibrium rate of unemployment.

Substitution into (2) and (1) gives the following long-run model:

gmc = βw0 + βw1gmc + βw2uphil

uphil = βu0 + αuuphil + βu1(w − mc)

The first equation gives

6

Qualitative discussion of dynamics and stability.

Consider the solution based on ∆mct = gmc, and εw t = εu,t = 0 in all periods.

In this case (1) becomes

∆wt − gmc = βw0 + (βw1 − 1)gmc + βw2ut, or, using (3):

∆wt − gmc = βw2(ut − uphil )

Assuming that βw2 < 0, wage growth is higher than the main-course growth

as long as unemployment is below the natural rate.

Moreover, from the second equation of the system:

β

β −1

uphil = ( w0 + w1

gmc),

(3)

−βw2

−βw2

which is the natural rate of unemployment in this model. We can also call

the “main-course rate of unemployment”, since it is the rate of unemployment

required to keep wage growth on the main-course.

it is seen that growth in w − mc contributes to higher unemployment in the

next period. This analysis suggests that from any starting point on the Phillips

curve, stable dynamics leads to the steady state solution.

uphl is independent of foreign inflation when βw1 = 1 (Some authors would

reserve the term natural rate for this case).

We conclude that the restrictions βw2 < 0 and βu1 > 0 are necessary for

stability. And that for example βw2 = 0 harms stability.

7

8

ut = βu0 + αuut−1 + βu1(w − mc)t−1, βu1 > 0

In equilibrium initially: A negative shock to u leads to u0 and ∆w0. Dynamics

“along the short-run PC”.

Short and long run Phillips curves

The short-run Phillips curve is in this model given by (1). The slope coefficient

is

wage growth

βw2 < 0

long run Phillips curve

Δ w0

g

The long run Phillips curve characterizes a steady state situation in which

∆wt = ∆mct. Replacing ∆mct on the right hand side of (1) by ∆wt implies

that the slope of the long-run Phillips curve is

mc

u

0

u phil

log rate of

unemployment

βw2

<0

1 − βw1

showing that the long-run Phillips curve is steeper that the long-run Phillips

curve, i.e., as long as 0 < βw1 ≤ 1. Vertical if βw1 = 1.

Figure 1: Main-course Phillips curve dynamics and equilibrium.

9

10

A price Phillips curve derived from the Norwegian model

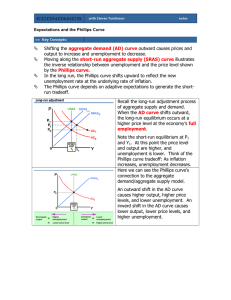

We often want to include an expectations term on the right hand side of the

Phillips curve. For example, instead of (1) we might have

∆wt = βw0 + βw1∆wte + βw2ut + εw,t,

e

or ∆wt+1

for that matter. However, as long as expectations are influenced by

the main-course, we get the same conclusion as above. For example

∆wte = ϕ∆mct + (1 − ϕ)∆wt−1, 0 < ϕ ≤ 1

In Lecture 2 a conventional price Phillips curve was shown as an example of

the ADL model. Lecture 4 showed the main-course inflation equation in the

case of error correction in wages setting.

Also in the model that we now investigate, a dynamic price equation can be

derived. From IDM p 91, we have

∆pt = φβw0 + {φβw1 + (1 − φ)}∆qe,t + φβw2ut + φβw1∆ae,t −φ∆as,t + φεw,t.

(4)

which is a price Phillips curve augmented by

In steady state there are no expectations errors, so

∆wte = ∆wt−1 = gmc

1. productivity growth, note the different signs of the two sectors,

2. and “imported inflation”.

Expectations, in e-sector wage setting, or in s-sector price setting would result

in further augmentation of the price Phillips curve.

11

12

Summary of open economy wage and price dynamics (ch 3.4 in IDM)

A bargaining based Phillips curve? (Box 3.1 in IDM)

1. The wage bargaining model of the steady state leads to an ECM model of

wages.

2. Wage growth and inflation are dynamically stable in this model, for any

given rate of unemployment. The main stabilizing property is that wage

growth is linked to firm profitability.

3. This model gives a new rationale for the older Norwegian model of inflation.

4. The Phillips curve version of the Norwegian model of inflation hinges on

error correction in the rate of unemployment for stability.

Other textbooks, give a completely different message from ours, namely that

wage bargaining gives raise to a standard price Phillips curve. However, this

argument takes to lightly on the distinction between static relationships and

dynamic adjustment. To show how, consider a closed economy version of our

static model. Wage bargaining is then for the whole economy so we may write:

w∗ = m0 + p∗ + a + γ1u,

γ1 < 0,

(5)

> 1.

(6)

and the steady-state price equation is simply:

p∗ = ln( ) + w∗ − a,

5. Logically speaking, the rate of unemployment cannot be a target variable

(held constant by economic policies), in the Phillips curve model (other

than fixing ut at uphil ).

The textbook expositions then set w∗ = w in both equations. However, in

the wage equation p∗ is replaced by pe which denotes the expected price level,

while in the price equation p∗ = p. Finally, time subscripts are added in both

equations to give

6. Both the wage bargaining model and the Phillips curve are ECMs. But the

error-correction mechanisms are different.

wt − at = m0t + pet + γ1ut, and

13

14

wt − at = − ln( t) + pt.

Norwegian evidence (ch 3.5 in IDM)

This section is cursory reading, as background you may want to know that.

Solving for pt gives

1. An empirical wage PCM is estimated for Norway.

(a) Coefficients have right signs.

(b) Fit is good.

(c) The estimated U phil is a little below 3%.

pt = ln( t) + m0t + pet + γ1ut,

and taking the difference on both sides of the equation gives:

∆πt = ∆(ln( t) + m0t) + ∆πte + γ1∆ut.

(7)

Next, the “bargaining Phillips curves” also assume

∆(− ln( t) + m0t) = a(Yt − Ȳ ).

where Yt is GDP and Ȳ the full employment output, in other words the outputgap (which is seen as perfectly correlated with difference between current unemployment and the natural rate.)

2. An empirical wage ECM is also estimated, with correctly signed coefficients

and good fit.

3. Interesting differences between the theories appear when the competing

wage equations are grafted into larger system which also explains unemployment.

(a) In ECM, both the w − q − a (the log of the wage-share) and ut react

quickly to shocks (the dynamic multipliers converge fast)

(b) In the PCM, adjustment is very slow. Hence the relevance of the natural

rate property is weak on this evidence.

15

16

Δp t

tu t

0.10

0.08

Actual rate of unemployment

−3

0.05

−4

0.07

1970

0.06

1980

1990

2000

Δwc t

0.20

1970

1990

2000

−0.4

u phil

1970

0.02

1985

1990

1995

1980

1990

tu t : Cumulated multiplier

0.050

−2 se

2000

1970

0.000

0.025

−0.005

0.000

−0.010

wc t −a t −q t : Cumulated multiplier

2000

−0.015

−0.025

0

Figure 2: Sequence of estimated wage Phillips curve NAIRUs (with ±2 estimated standard errors), and the actual rate of unemployment. Wald-type

confidence regions.

10

20

30

0

Δp t

−3

0.05

−4

1980

1990

2000

1980

1990

2000

0.15

−0.3

0.10

0.05

−0.4

1970

1980

tu t : Cumulated multiplier

1990

1970

1980

wc t − a t −q t : Cumulated multiplier

2000

0.000

30

The New Keynesian Phillips curve (Ch 3.6 in IDM)

1970

wc t −a t −q t

−0.2

20

18

tu t

0.10

10

Figure 3: Dynamic simulation of the Phillips curve model. Panel a)-d) Actual

and simulated values (dotted line). Panel e)-f): multipliers of a one point

permanent exogenous increase in the rate of unemployment

17

0.04

1980

0.05

0.03

Δwc t

2000

−0.3

0.10

+2 se

0.04

0.20

1990

0.15

0.05

1970

1980

wc t −a t −q t

−0.2

1990

2000

Unlike the bargaining models, and older PCMs, the NPC focuses on price

setting exclusively.

The underlying assumption is that a representative firm takes account of the

expected future path of nominal marginal costs when setting its price, given

a probability that the price thus set “today” will remain fixed for many time

periods ahead.

−0.001

0.03

These assumptions lead to:

−0.002

0.02

−0.003

0

10

20

30

40

0

10

20

30

40

∆pt = bp1 Et∆pt+1 + bp2xt + εpt, bp1 > 0, bp2 ≤ 0,

(8)

where pt is the (domestic) price level.

Figure 4: Dynamic simulation of the ECM model Panel a)-d) Actual and simulated values (dotted line). Panel e)-f): multipliers of a one point increase in

the rate of unemployment

19

Et∆pt+1 is the rational expectation of ∆pt+1, given information available at

the start of period t.

20

Solution of NPC.

xt denotes the logarithm of marginal costs xt. In practice it is proxied by the

logarithm of the wage share:

∆pt = bp1 Et∆pt+1 + bp2(wt − pt − at) + εpt,

In the standard NPC model there is no specific theory about how wt is determined, the underlying assumption being that it is at its competitive equilibrium

level.

(9)

where the wage share is for the total economy, the distinction between e-sector

and s-sector is not a part of the model.

In the literature solutions of the NPC are often based on the assumption that

the xt follows an exogenous process. We follow this standard approach here.

There are both similarities with, and differences from, the inflation equation

that we derived from the bargaining perspective.....

First replace Et∆pt+1 with the right hand side of:

Et∆pt+1 = ∆pt+1 − ηt+1

where nt+1 is the expectations error, to obtain

∆pt = bp1∆pt+1 + bp2xt + p,t

(10)

p,t = εpt − bp1ηt+1 is a composite disturbance term.

21

(10) looks like an ADL, only that ∆pt+1 and ∆pt have changed places. Hence

(10) is the same as

bp2

1

p,t

∆pt+1 =

∆pt −

xt −

bp1

bp1

bp1

22

Repeated substitution gives

j

∆pt = bp1∆pt+j + bp2

j−1

X

bip1xt+i,

j = 1, 2, .....

(11)

i=0

For (moderate) inflation the relevant solution is a stable solution. Try first the

usual recursive solution method, and discover that unless bp1 > 1 this solution

is unstable or explosive.

Based on known x-values in all future periods and zero disturbances in all future

periods, (11) represents a unique solution for ∆pt as long as we can fix the

value of ∆pt+j , which is often referred to as the terminal condition.

Most economists believe that bp1 < 1, so the backward recursive solution

method is inconsistent with stability.

Of course “fixing ∆pt+j ” is not a trivial requirement (very much unlike the

status of “fixing the initial condition”).

However another recursive method gives the desired result, by way of repeated

forward substitution:

For this reason, the NPC and other models with forward-looking terms are

impractical to use. In general, there is a continuum of solutions to consider,

each solution corresponding to a different value of the terminal condition.

By combining equation (10) with the NPC equation for period t + 1, we obtain

∆pt = bp1(bp1∆pt+2 + bp2xt+1) + bp2xt

= b2p1∆pt+2 + bp2xt + bp1bp2xt+1.

There are ways around the non-uniqueness problem. To follow up these in detail

is beyond the scope of this course. But we can consider two simple solutions.

23

24

First, some terminal conditions may stand out as ‘natural’ or relevant. For

example, for a central bank which is committed to the NPC view of the world,

and which runs an inflation targeting monetary policy, it is natural to choose

∆pt+j = π ∗ as the terminal condition, where π ∗ denotes the inflation target.

Hence the solution

j

∆pt = bp1π ∗ + bp2

j−1

X

bip1xt+i,

j = 1, 2, .....

i=0

The second, more general, way around the non-uniqueness problem is to invoke

the asymptotically stable solution.

Subject to 0 < bp1 < 1, bj → 0, when j gets infinitively large, and we can

write the asymptotically stable solution as

∞

X

∆pt =

(12)

might be said to represent the rate of inflation in the case of a credible inflation

targeting regime, given that the NPC model is the correct model of inflation,

and given that all future x−values can be fixed.

∆pt = bp2

which, subject to the further simplifying assumption of constant xt in all periods

(xt = mx, for all t), can be written as

bip1xt+i,

bp2

mx

1 − bp1

(13)

An important characteristic of this solution is that future changes in x imply

that inflation should react today. Some economists find this incredible, and

have criticized the NPC for not capturing the inflation persistence.

To rectify that, the favoured NPC is of the following hybrid type:

f

∆pt = bp1Et∆pt+1 + bbp1∆pt−1 + bp2xt + εpt.

(14)

f

where both bp1 and bbp1 are assumed to be non-negative coefficients. bbp1 represents the expectations effects that are due to the share of firms without rational

expectation.

i=0

25

Heuristically the solution of the hybrid NPC shows more inflation persistence,

and the response to changes in xt will be less sharp than in the case of the

‘pure’ NPC.

Subject to further assumptions, see IDM Ch 3.6, the solution of the hybrid

model is

bp2

∆pt = r1∆pt−1 + f

xt

bp1(r2 − bx2)

where r1 is a coefficient which is less than one in magnitude. r2 is a coefficient

f

which is larger than one. If bbp1 = 0 it can be shown that r1 = 0 and r2 = 1/bp1,

so the solution reduces to the simple NPC.

27

26

The NPC has become a huge success in terms of affecting beliefs. It has been

used by many central bank as the supply-side equation in their monetary policy

models. Norges Bank adopted this view in 2003.

The empirical status and explanatory power of the NPC is however contested.

For one thing, the hybrid NPC includes only one explanatory variable of inflation

The comparison with the multivariate inflation explanation of the (stripped

down) main-course bargaining model is striking. Nevertheless, the NPC has

been applied to data from open economies.

28