Topic 4: Financial markets and the macroeconomy

advertisement

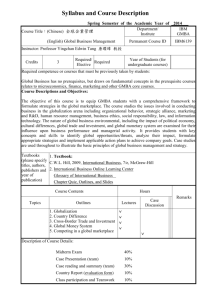

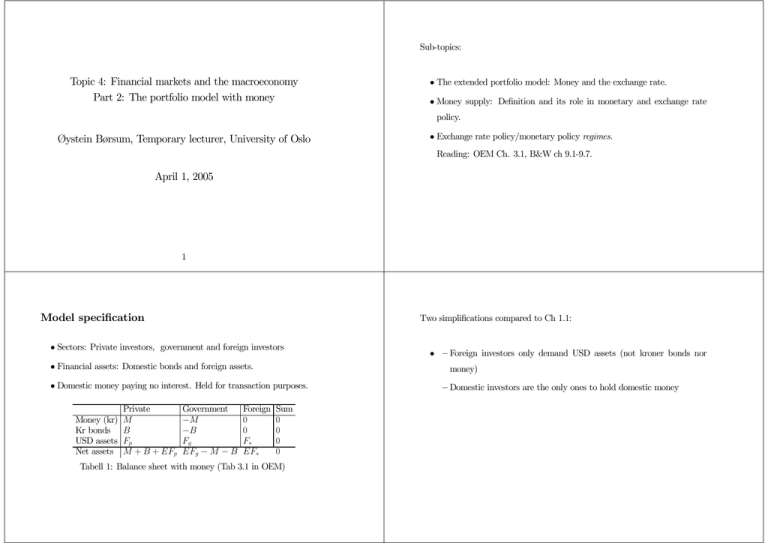

Sub-topics: Topic 4: Financial markets and the macroeconomy Part 2: The portfolio model with money • The extended portfolio model: Money and the exchange rate. • Money supply: Definition and its role in monetary and exchange rate policy. Øystein Børsum, Temporary lecturer, University of Oslo • Exchange rate policy/monetary policy regimes. Reading: OEM Ch. 3.1, B&W ch 9.1-9.7. April 1, 2005 1 Model specification Two simplifications compared to Ch 1.1: • Sectors: Private investors, government and foreign investors • Financial assets: Domestic bonds and foreign assets. money) • Domestic money paying no interest. Held for transaction purposes. Money (kr) Kr bonds USD assets Net assets Private M B Fp M + B + EFp Government −M −B Fg EFg − M − B Foreign 0 0 F∗ EF∗ • — Foreign investors only demand USD assets (not kroner bonds nor Sum 0 0 0 0 Tabell 1: Balance sheet with money (Tab 3.1 in OEM) — Domestic investors are the only ones to hold domestic money Endogenous: Wg , Wp, W∗, F∗,Fp, r, ee + 3 depending on regime. B + M + EFp P −M − B + EFg P F∗ P∗ r ee M P B P EFp P Fg + Fp + F∗ B0 + M0 + EFp0 = Wp P −M0 − B0 + EFg0 = = Wg P F∗0 = = W∗ P∗ = i − i∗ − ee = = ee(E) e0e < 0 = m(i, Y ) mi < 0 (note: 10 endogenous variables, not 12, since only 10 independent equation, explained on page 65 in OEM). (3.2) (3.3) (3.4) Exogenous: i∗, Y, P, P∗, M0, B0, Fp0, Fgo,F∗+ 2 depending on regime. Regime-dependent variables: E, Fg , M, B, i (3.5) mY > 0 = Wp − f (r, Wp) − m(i, Y ) = f (r, Wp) (3.1) 0 fr0 < 0 fW >0 = 0 (3.6) (3.7) (3.8) (3.9) Equlibrium in the market for foreign exchange The role of money supply −M − B + EFg −M0 − B0 + EFg0 = = Wg P P Consider Fg exogenous to find the properties of the supply curve from Fg = −F∗ − Fp (3.10) Fg = −F∗0 − P B0 + M0 + EFp0 f (i − i∗ − ee(E), ) E P At the time of a trade dWg = 0 and dE = 0, so the central bank’s trading constraint is: dM = E dFg − dB (Insert (3.1), (3.4), (3.5) and use F∗ = F∗0 to obtain 3.10) (3.11) The slope of the supply curve is: where dM = M − M0, dFg = Fg − Fg0 and dB = B − Bg0. Fundamental money-supply function of an open economy. It links a change ∂Fg 1 = [Fp0(1 − fW ) + P fr e0e] ∂E E SE > 0 under the same set of condition as in the first model. (3.11) SE = in the money supply to changes in other stocks. Sterilisation Overview of key policy regimes The degree of sterilization in monetary policy denotes how much B is changed when there is a change in Fg . Coefficient of sterilisation: dB s= EdF g s = 1: Full sterilisation. s = 0: No sterilisation. No sterilisation: The link dFg → dM is not sterilized by bonds sales. dM dB = 0 equivalent with =1 EdFg EdFg Full sterilisation: The link is broken (dFg 9 dM ). Domestic money supply Exchange No sterilisation Full sterilisation rate Fixed rate Regime II: (E, B) exogenous. Regime III: (E, M) exog. Monetary policy must acco- Sterilisation enables indepen- Floating modate exchange rate policy dent monetary policy Regime V: (Fg , B) exogenous. Regime VI: (Fg , M) exog. rate Choice of portfolio has full ef- Monetary policy has no effect fect on monetary policy and on foreign exchange reserves the exchange rate Tabell 2: Policy regimes (Tab 3.2) is “insulated” from foreign exchange interventions. dM dB = 1 equivalent with =0 EdFg EdFg "Left-out" regime: (E, Fg ) exogenous. Fixed exchange rate with fixed foreign Regime V and VI are equivalent as long the there is a “clean float” dFg = 0. Solving the model reserves. Monetary policy must accomodate exchange rate policy through the use of i(M ). Two-step procedure: Exogenous variables are either monetary or exchange rate policy targets, or 1. Determine the interest rate. instruments set aside to attain other target variables (not specified in this 2. Given the solution for the interest rate, find the solution for E or Fg from model). the equilibrium in the market for foreign exchange. Step 1: Determining the interest rate When M is endogenous: i is determined in the domestic bond market (3.7). This is the case for regime II. When M is exogenous: i is determined in the money market (3.6). This is the case for regime III, and for V and VI with clean float. Also Equilibrium in the domestic bond market (insert (3.1), (3.4), (3.5) and (3.6) into (3.7) to obtain 3.12): relevant for "left out" regime where i determines M. (Remember: Y and P are exogenous and constant in the short run) (3.12) B M0 + B0 + EFp0 M0 + B0 + EFp0 = −f (i−i∗ −ee(E), )−m(i, Y ). P P P M = P m(i, Y ) ∂i 1 < 0. = ∂M P mi ∂B = −P (fr + mi) > 0 ∂i Demand for foreign exchange and demand for money are decreasing in i. Remaining wealth is in bonds, so demand for bonds is increasing in i. Step 2: Solving for E or Fg from the foreign exchange market equilibrium Example of monetary policy analysis in regime III: Fixed exchange rate with sterilisation Fixed rate regime: E is constant. Derivation of (3.14) gives Suppose the government wants monetary expansion (increase M 1 billion kro- P ∂Fg = − fr > 0 ∂i E Floating rate regime (clean float): Fg is constant. Implicit derivation of (3.14) gives ∂E P fr = <0 ∂i (1 − fW )Fp0 + P e0efr ner) to stimulate the real economy. Uses market operations (M is exogenous, the instrument B is endogenous). Effect on i from money market equilibrium (3.12): ∂i 1 = < 0. ∂M P mi Effect on B from the money supply function. dB = EdFg − dM implies: dFg dB =E −1 dM dM As the interest rate falls, the central bank must sell foreign currency to support Clean and managed float the exchange rate (the supply curve of foreign currency is shifted leftwards): 1 fr P dFg ∂Fg ∂i 1 =− <0 = = − fr dM ∂i ∂M E P mi E mi This means that dB/dM < −1: The central bank must buy bonds for more than 1 billion in order to increase M by 1 billion since reserves are worn down. Clean float (dFg = 0): dM > 0 is achieved by market operations dB = −dM. Effect: i & (money market) and E % (market for foreign exchange). Effect on E depends on degree of capital mobility: Role of capital mobility: 1 fr dFg =− dM E mi → −fr →∞ −∞ dE P fr = di (1 − fW )Fp0 + P e0efr → −fr →∞ 1 e0e Full sterilization is impossible when capital mobility is perfect: The central bank cannot control the money supply. Managed float (float with interventions): • Regime V (interventions without sterilisation): dM = EdFg > 0 and dB = 0. Leads to i & and E %. Foreign exchange market: Negative An important “left out” regime Characterised Sweden and Norway in the 1990s + several other countries. horizontal shift in the S-curve, and demand increases. Both imply higher Both Fg and E exogenous with i and M endogenous. Allows a fixed exchange E (depreciation). The policy work also with high capital mobility, since rate while freezing Fg at a certain level. Monetary policy accomodates the i is affected. exchange rate policy. dM is achieved by market operations dB = −dM. High • Regime VII (sterilised interventions): dB = EdFg > 0, dM = 0. No (short-term) interest rates may be necessary to fend off speculative attacks. change in i. E % since Fg increases (demand for foreign exchange). In the model, i is determined by the equilibrium condition for the market for Perfect capital mobility takes away the effects of sterilized interventions. foreign exchange. Graphically, the regime can be analysed using the Ei-curve along with a the money-market graph. Model formulation with perfect capital mobility Possible regimes: No separate asset demand functions. ALL capital flows to where expected returns are highest. The model reduces to: (0.1) M = m(i, Y ) P r = i − i∗ − ee(E) = 0 (3.13) 1. Use the interest rate to target E (given e0e 6= 0) 2. Clean float with M −targeting 3. Clean float with i-targeting (e.g. inflation targeting with i as instrument) Note: The central bank can set reserves wihtout any effect on the exchange rate. Fixed rate regime: i and M endogenous. Floating rate regime: i and E endogenous. What is money? Next time: Fixed income assets (bonds) and the term structure of interest rates Several possible definitions. i) Stock of base money, M0: Notes and coins issued by the central bank ii) Through private banks’ money creation process: Reason as if M in the economic model corresponds to a broader definition of money, M1, M2 or M3. Builds on the money (and credit) multiplier: Each time a bank issues a loan, reserve requirements also creates a deposit. In the portfolio model: "Money" is a non-interest bearing asset (like M 0). "Kroner bonds" are not actually bonds but an interest bearing bank deposit (included in M2). −P κ ∂E = ∂i (1 − fW )Fp0 EP EP − P e0eκ −κ = 1 γ E − e0eκ −1 = γ 0 κE − ee The slope of the Ei-curve Calculation of the partial derivative ∂E/∂i from (3.14): " ½ ¾# P f (r, Wp) ∂E P Fp0 ∂E 0 ∂E ∂i fr (1 − ee ) + fW + 0=− E2 E ∂i P ∂i Simplify by using Fp = P f (r, WP )/E. Set Fp = Fp0 (since both Fg and F∗ are constant). Solve for ∂E/∂i: P fr ∂E < 0. = ∂i (1 − fW )Fp0 + P e0efr Interpretation in terms of a coefficient of capital mobility and a portfolio rebalance effect: γ = (1 − fW ) EFp0 , P κ = −fr , The effect of selling bonds under a fixed exchange rate • The market equilibrium glides down along the B d-curve in Figure 3.2 in OEM. The money supply is not controlled (M is endogenous). Assume that the initial increase in M was 1billion (if dB = −1bill). In the The central banks buys bonds from the public (“open market operation”) new equilibrium: hence increasing money supply (monetary expansion). dM mi 1 = P mi = <1 dB P (fr + mi) (f r + mi) since Fg is reduced to restore equilibrium in the market for foreign exchange. Corresponds to regime II. The effect on i is found from (3.13) di 1 − = <0 dB P (fr + mi) • “minus”, since dM = −dB, from the money demand function (3.10), dM > 0 =⇒ dB < 0. − dFg dM fr = −[ + 1] = −[ ] < 0. dB dB (fr + mi) (Supply of foreign currency is reduced by i &. In order to keep E constant, − Fg must fall by the same amount). In the analysis of Regime III, full sterilization, we saw that monetary policy had no effect on the interest rate if capital mobility is perfect. How is the regime with no attempt to sterilise affected? From (3.17) − dM mi = dB (fr + mi) → −fr →∞ 0. since −fr → ∞ means that Fg falls by the same amount as Bs. From (3.18): −E dFg fr 1 = −[ ] = −[ ] → −1. dB (fr + mi) (1 + mi/fr ) −fr →∞ Hence, again as a result of the link between foreign currency reserves and the money supply, perfect capital mobility makes monetary policy ineffective also in Regime II. Formally: − di 1 = dB P (fr + mi) → −fr →∞ 0