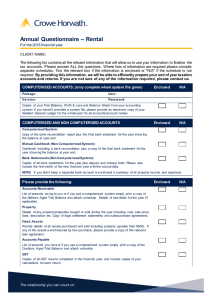

– Rental Annual Questionnaire

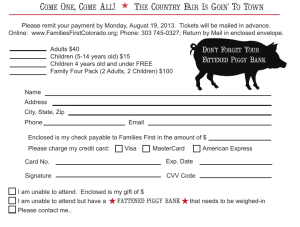

advertisement

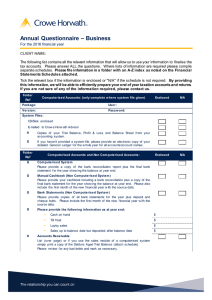

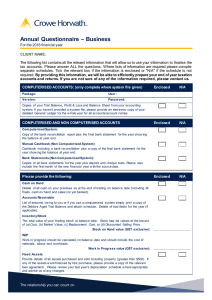

Annual Questionnaire – Rental For the 2016 financial year CLIENT NAME: The following list contains all the relevant information that will allow us to use your information to finalise the tax accounts. Please answer ALL the questions. Where lists of information are required please compile separate schedules. Please file information in a folder with an A-Z index as noted on the Financial Statements Schedules attached. Tick the relevant box if the information is enclosed or "N/A" if the schedule is not required. By providing this information, we will be able to efficiently prepare your end of year taxation accounts and returns. If you are not sure of any of the information required, please contact us. Folder Ref Com puterised Accounts: (only com plete w here system file given) Package: User: Version: Passw ord: Enclosed / Yes N/A Enclosed / Yes N/A System Files: CD/Disk enclosed E-mailed to Crow e Horw ath Advisor A Copies of your Trial Balance, Profit & Loss and Balance Sheet from your accounting system. E If you haven't provided a system file, please provide an electronic copy of your detailed General Ledger for the w hole year for all accounts/account names. Folder Ref Com puterised Accounts and Non Com puterised Accounts: G Com puterised System Please provide a copy of the bank reconciliation report plus the final bank statement for the year show ing the balance at year end. G Manual Cashbook (Non Com puterised System ) Please provide your cashbook including a bank reconciliation plus a copy of the final bank statement for the year show ing the balance at year end. Please also include the first month of the new financial year w ith the source data. G Bank Statem ents (Non Com puterised System ) Please provide copies of all bank statements for the year plus deposit and cheque butts. Please include the first month of the new financial year w ith the source data. NOTE: If you didn’t keep a separate bank account w e w ill need a summary of all property income and expenses. H Accounts Receivable Was there any unpaid rent or reimbursement costs ow ing to you at year end? If Yes: Amount outstanding: J $ Property Did you purchase or sell a property/properties during the year? If Yes: Please provide a list of all movements including cost, sale price, date, description and amount. Please provide a copy of legal settlement statements and sale/purchase agreements. Folder Ref J Com puterised Accounts and Non Com puterised Accounts: Enclosed / Yes N/A Fixed Assets Details of cost, selling price and trade-in value of plant, vehicles, property etc bought, sold or traded in for the period w ith copies of invoices. Purchased (greater than $500): New / Used Date Price (inc GST) Description Asset traded (if any) Value (inc GST) Sold (excluding trade -ins included above): Date M Scrapped? Accounts Payable List (below ) w here not included in company file provided or please print a copy of your Accounts Payable ledger and attach. Nam e N Price (inc GST) Description Particulars Am ount (inc GST) Copies of GST w orkpapers and GST returns. Did you process prior year GST adjustments as provided by your Crow e Horw ath advisor? Q Loans List below details of bank loans, including closing loan balances, interest rate and details of securities in place (w here applicable). Interest Rate Loan Q Security Balance % $ % $ % $ Hire Purchase Agreem ents List below details of Hire Purchase Agreements, including closing loan balances, interest rate and details of securities in place (w here applicable). Hire Purchase Interest Rate Security Balance % $ % $ % $ Folder Ref R Enclosed / Yes INCOME AND EXPENSES N/A Property Manager – Did you use a property manager to manage the rental property? If Yes: Please provide copies of the property manager statements for the year. R Rental Income – Was any rent banked in to a private bank account? If Yes: Amount: $ R Details of other documentation). S Details of any expenses paid personally, ie. paid out of a non-property bank account or from a personal credit card (please provide invoices). S Details of motor vehicle expenses i.e. business related versus personal. Please provide log book or mileage details, including date, distance and purpose. income/interest received Vehicle during the period (attach Business use % S Repairs & Maintenance – Details of significant repairs and maintenance, alterations and modifications over $500. S Home Office Expenses - If part of your home is used for business purposes, please advise expenses below . This includes a home off ice, w orkshop or storage area. Area of home for office Total area of home Expense Date of last log book sq m sq m Private use % Am ount (inc GST) Insurance (house & contents) Mortgage interest Rates Repairs (provide details) Pow er Gas Other: Folder Ref OTHER OTHER Details of any other major transactions or changes undertaken during the period. OTHER Tenancy – Was there any extended period of vacancy during the year? If Yes: Please advise the reason why: Enclosed / Yes N/A Folder Ref OTHER OTHER Enclosed / Yes Relative – Was the property/properties occupied by either yourself or a relative during the year? If Yes: We suggest you discuss this w ith us so w e can inform you of the implications. OTHER Properties – Please list the address(es) of the property/properties OTHER If this is a Trust, please fill in the “Annual Questionnaire – Trust” OTHER Do you require a copy of the accounts to be forw arded to a third party? If Yes, please provide details: GENERAL COMMENTS N/A