– Personal Annual Questionnaire

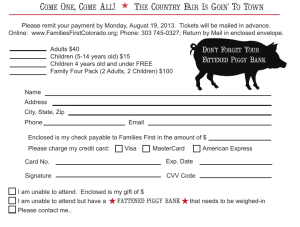

advertisement

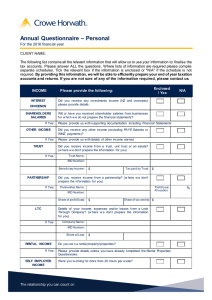

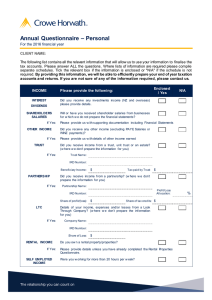

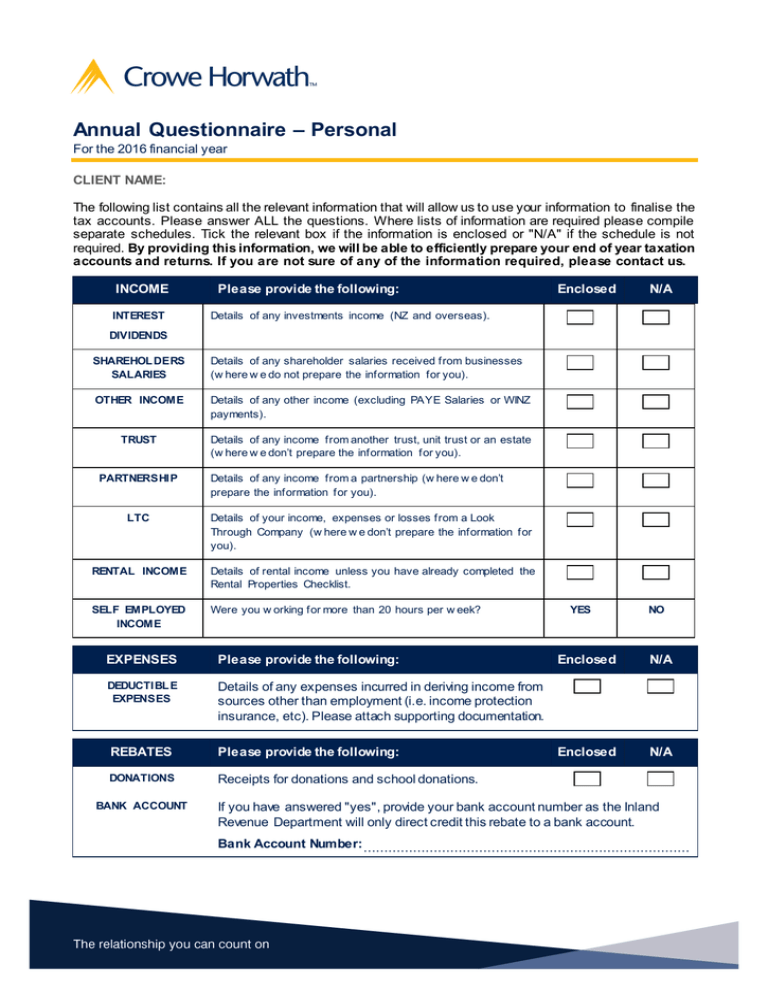

Annual Questionnaire – Personal For the 2016 financial year CLIENT NAME: The following list contains all the relevant information that will allow us to use your information to finalise the tax accounts. Please answer ALL the questions. Where lists of information are required please compile separate schedules. Tick the relevant box if the information is enclosed or "N/A" if the schedule is not required. By providing this information, we will be able to efficiently prepare your end of year taxation accounts and returns. If you are not sure of any of the information required, please contact us. INCOME INTEREST Please provide the following: Enclosed N/A Details of any investments income (NZ and overseas). DIVIDENDS SHAREHOL DERS SALARIES Details of any shareholder salaries received from businesses (w here w e do not prepare the information for you). OTHER INCOME Details of any other income (excluding PAYE Salaries or WINZ payments). TRUST Details of any income from another trust, unit trust or an estate (w here w e don’t prepare the information for you). PARTNERSHIP Details of any income from a partnership (w here w e don’t prepare the information for you). LTC Details of your income, expenses or losses from a Look Through Company (w here w e don’t prepare the information for you). RENTAL INCOME Details of rental income unless you have already completed the Rental Properties Checklist. SELF EMPLOYED INCOME Were you w orking for more than 20 hours per w eek? EXPENSES Please provide the following: DEDUCTIBL E EXPENSES Details of any expenses incurred in deriving income from sources other than employment (i.e. income protection insurance, etc). Please attach supporting documentation. REBATES Please provide the following: DONATIONS Receipts for donations and school donations. BANK ACCOUNT YES NO Enclosed N/A Enclosed N/A If you have answered "yes", provide your bank account number as the Inland Revenue Department will only direct credit this rebate to a bank account. Bank Account Number: ............................................................................... WORKING FOR FAMILIES Please provide the following: Enclosed Details of children under 18 years of age and still at school for whom you may be entitled to family assistance. CHILDREN Name Date of birth IRD Number If you received Working for Families payments during the period please supply us with the certificate issued by Work & Income New Zealand OTHER INCOME Please provide details of any other income received by the household: A profit (or loss) from unrelated businesses Income for the year from a Trust that hasn’t been distributed as beneficiary income including income from trading and investment activities in which the trustees or their associates hold 50% or more of the voting interests. The value of any attributable fringe benefit for shareholder-employees if they or their associates hold voting interests of 50% or more in the company. This includes: o Motor vehicles for private use o Low/nil-interest employee loans o Subsidised transport in excess of $1000 (where employer is in business of transporting the public o Contributions to insurance schemes in excess of $1,000 o Any other benefit received in excess of $2,000 Pension or annuity payments from life insurance policies or a superannuation fund (excluding NZ Super) Passive income of Children, if over $500 per year per child. includes interest, rents or beneficiary income. Income of non residence spouse or partner. Any income attributed from a PIE that allows you to access your investment (such as cash PIE, on-call PIE or a PIE term deposit). The exception is where the PIE is a superannuation fund or retirement savings scheme (e.g. Kiwi Saver). Dividends from listed PIEs also need to be included. Income equalisation scheme deposits made by you, your trust or a company controlled by you or your trust. Tax exempt income and overseas pensions. Depreciation recovery on sale of buildings used in business Income equalisation refunds received by you, your trust or a company controlled by you or your trust. Income spread to this income year N/A This WORKING FOR FAMILIES Please provide the following: Other payments received used for day to day living expenses if more than $5,000 per year. A payment is considered to be used to meet day to day living expenses if it is: o Replacing lost or reduced income (e.g. insurance policy for loss of earnings or employment) o Used to pay regular liabilities such as car payments or mortgage o Used to meet the families usual living expenses (e.g. phone or power bill) Payments can be used to meet day to day living expenses if it is paid directly by another person on your (or spouse/partner’s) behalf. Payments can include loans made on favourable terms e.g. low/nilinterest terms or, not set repayment date. Retirement savings scheme contributions – Te Rununga o Ngai Tahu Allocated income from a portfolio investment entity (PIE) Shareholdings in a company including details of: o Net income of the company for the year 1 April to 31 March o Percentage of shares you hold o Dividends you received for the year 1 April to 31 March Enclosed N/A If you are not sure about any of the above please discuss with your advisor. CHANGE OF CIRCUMSTANCES If Yes: Have any of your circumstances changed during the year. For example, shared custody arrangements, change in marital or relationship status etc. Please provide full details: OTHER INFORMATION Enclosed STUDENT ALLOWANCES/LOANS Details of any children receiving loans or allowances. CHILD MAINTENANCE Details of any child maintenance you paid: $ Details of any child maintenance you received: $ TRUSTS N/A Are there any Trusts which you have an interest in that we have not been advised of? If so, do they own any residential property? DISCLOSURES RESIDENCY Enclosed Were you a non-resident at any time during the income tax year? N/A OWNERSHIP INTERESTS GENERAL COMMENTS Did you have any interest in a foreign company, unit trust, life insurance policy or super scheme?