Assessment of Achievable Potential from Energy (2010–2030)

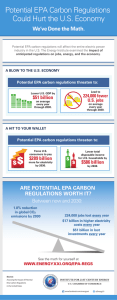

advertisement