Document 11579495

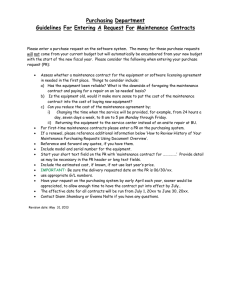

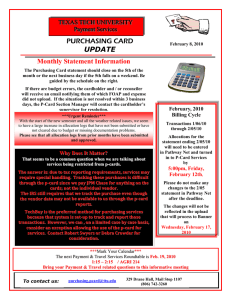

advertisement