A Neglected Interdependency in Liability Theory Dhammika Dharmapala, Sandy Hoffmann, Warren Schwartz

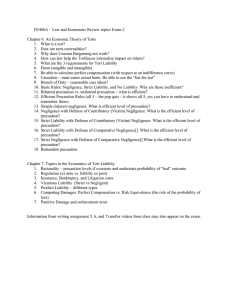

advertisement