COURT FILE NO.: ) CITATION:

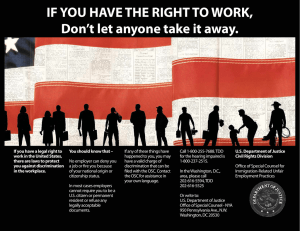

advertisement