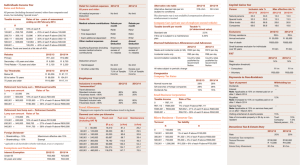

Budget 2014 InSide: South African Budget Newsletter

advertisement