Chabot College Fall, 2007 16 - Business Mathematics 3 units

advertisement

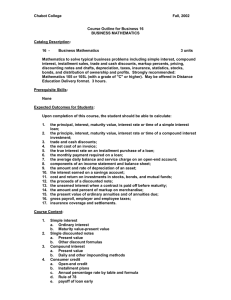

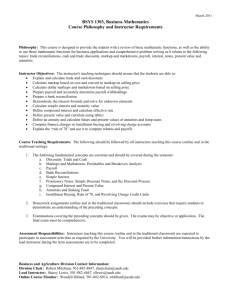

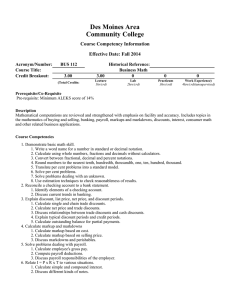

Chabot College Fall, 2007 Course Outline for Business 16 BUSINESS MATHEMATICS Catalog Description: 16 - Business Mathematics 3 units Mathematics to solve typical business problems including banking, simple interest, compound interest, installment sales, trade and cash discounts, markup percents, pricing, discounting notes and drafts, payroll, insurance, statistics, stocks, bonds, and mutual funds. Strongly recommended: Mathematics 105 or 105L (completed with a grade of "C" or higher). 3 hours. [Typical contact hours: 52.5] Prerequisite Skills: None Expected Outcomes for Students: Upon completion of this course, the student should be able to calculate: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. the principal, interest, maturity value, interest rate or time of a simple interest loan; the principal, interest, maturity value, interest rate or time of a compound interest investment; trade and cash discounts; the net cost of an invoice; the true interest rate on an installment loan; the monthly payment required on a loan; the average daily balance and service charge on an open-end account; basic financial statement ratios; the interest earned on a savings account; cost and return on investments in stocks, bonds, and mutual funds; the proceeds of a discounted note; the unearned interest when a contract is paid off before maturity; the amount and percent of markup on merchandise; the present value of ordinary annuities and of annuities due; gross payroll, employer and employee taxes; insurance coverage and settlements; the mean, median, and mode of a series of numbers. Course Content: 1. 2. 3. 4. Simple interest a. Ordinary interest b. Maturity value-present value Single discounted notes a. Present value b. Other discount formulas Compound interest a. Present value b. Daily and other impounding methods Consumer credit a. Open-end credit b. Installment plans c. Annual percentage rate by table and formula d. Rule of 78 e. payoff of loan early Chabot College Course Outline for Business 16, Page 2 Fall 2007 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Purchase discounts and markup a. Trade discounts b. Cash discounts c. Markup based on cost or selling price d. Markdowns Financial statements a. Income statements b. Balance sheet c. Basic financial ratios Annuities a. Ordinary annuities b. Annuities due Cost of real property ownership Stocks, bonds, and mutual fund investments Life, fire, and auto insurance Sinking funds Basic business statistics Payroll and payroll taxes Auto/Home purchases and financing Methods of Presentation: 1. 2. 3. 4. Lecture Discussion Problem solving Group work Assignments and Methods of Evaluating Student Progress: 1. 2. Typical Assignments: a. Visit the autobytel.com website to find your dream car. Then visit bankrate.com and select a new car loan to finance your car with a 20% down payment for 4 years. Calculate your monthly payment and total interest cost of the loan. b. Visit a local Safeway store. Find 5 items that are on sale. Determine the markdown for each item, and the average markdown for your basket of 5 items. c. Determine how much you’d like to save for your retirement and the number of years until you retire. Assuming the historical growth rate of stock market investments of 8%, calculate how much will you need to save each year to achieve your retirement goal. Methods of Evaluating Student Progress: a. Graded problems b. Examinations c. Projects d. Final examination Textbook(s) Typical: PRACTICAL BUSINESS MATH PROCEDURES, Jeffrey Slater, Irwin, 2006 CONTEMPORARY MATHEMATICS FOR BUSINESS AND CONSUMERS, Robert Brechner, Thomson South-western, 2006 BUSINESS MATH, Cheryl Cleaves and Margie Hobbs, 2005 Special Student Materials: Calculator Jn 09/07/06 (revised 10/17/06) COBUS16