OECD Guidelines for OECD Guidelines for Multinational Enterprises

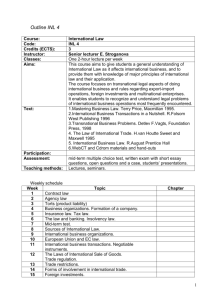

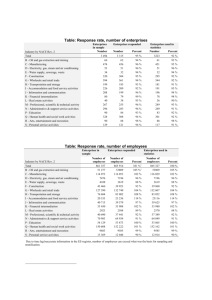

advertisement