THE PHILADELPHIA METROPOLITAN CASE STUDY

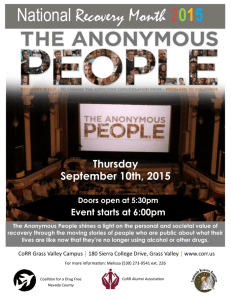

advertisement