MATTHEW D. WHITLEDGE

advertisement

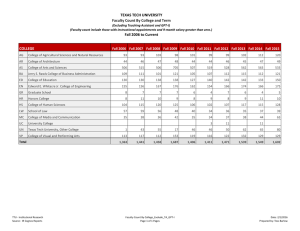

MATTHEW D. WHITLEDGE Texas Tech University Rawls College of Business Administration Lubbock, TX 79409-2101 Office: (806) 834-2446 matthew.whitledge@ttu.edu www.myweb.ttu.edu/mwhitled EDUCATION Texas Tech University Ph.D. Candidate-Finance Expected Graduation: May 2016 Southeast Missouri State University MBA 2011 BSBA, Finance 2008 TEACHING EXPERIENCE Texas Tech University Instructor BA 3303 Foundations of Finance Fall 2014 4.80/5.00 Spring 2015 4.49/5.00 Fall 2015 4.57/5.00 Spring 2016 In progress Spring 2016 (Online) In progress (21 students) (65 students) (52 students) (20 students) (33 students) PUBLICATION Whitledge, M. D., & Winters, D. B. (2015). The price of liquidity: CD rates charged by money market funds. Journal of Banking & Finance, 54, 104-114. We examine the cost of liquidity in rates on CDs purchased by money market funds (MMFs). We find no evidence that rates vary directly with the size of CDs. However, we do find that large MMFs receive higher rates on large CDs than small MMFs. This suggests banks pay for (potential) liquidity. RESEARCH PAPERS The Cost of Liquidity: Certificate of Deposit Rates Before, During, and After the Financial Crisis (Job Market Paper) I examine the cost of liquidity that Money Markets Funds (MMFs) are able to charge on Certificates of Deposit (CDs) issued by global banks from 2006 through 2013. I examine both bank liquidity needs in the form of undrawn loan commitments and customer deposits and also potential liquidity that MMFs can provide. During and after the crisis, I find that larger MMFs are able to charge higher rates relative to smaller MMFs for offering higher amounts of liquidity in this market. The result is not present prior the crisis supporting the notion that the price of liquidity is not constant. This result is present after controlling for interest rates, the size and term of the CD, bank risk, the length of the relationship between banks and funds, and other bank characteristics. Allen, K. D., Hein, S. E., & Whitledge, M. D. (2015). The Evolution of the Federal Reserve's Term Auction Facility and Community Bank Utilization. SSRN: 2551021. The Term Auction Facility (TAF) was designed by the Federal Reserve during the financial crisis to inject emergency short-term funds into banks as a supplement to the lender of last resort discount window offerings. We document both community and non-community FDICinsured banks’ usage of the facility over its existence. Community banks, the vast majority of banks in the U.S., were far less likely to use the facility than larger, non-community banks during the financial crisis. Those community banks that used the facility, especially in latter stages, seemed to do so to mitigate concerns stemming from commercial real estate exposure but were also attracted by the funds being a cheap source of funds. WORKS IN PROGRESS Examining Dodd-Frank’s Reform on FDIC Insurance (with Kyle Allen and Scott Hein) Foreign Bank Participation in US Crisis Programs (with Will Armstrong and Scott Hein) HONORS AND AWARDS Community Banking Research Conference Emerging Scholar Recipient Rawls College of Business Admin. Doctoral Student Research Award Rawls College of Business Admin. PhD Student Research Grant Rawls College of Business Admin. Scholarship 2015 2014-2015 2014 2012-2016 PROFESSIONAL EXPERIENCE The Bank of Missouri Financial Adviser 2008-2010 Previous Licenses: Series 7, 63, Missouri Life and Health REFERENCES Drew Winters (Chair) Lucille & Raymond Pickering Chair Rawls College of Business Texas Tech University Lubbock, TX 79409-2101 Phone: 806-834-3350 drew.winters@ttu.edu Scott Hein Robert C. Brown Chair in Finance Rawls College of Business Texas Tech University Lubbock, TX 79409-2101 Phone: 806-834-3433 scott.hein@ttu.edu Jack Cooney Benninger Family and Rawls Professor of Finance Chair in Finance Rawls College of Business Texas Tech University Lubbock, TX 79409-2101 Phone: 806-834-1536 jack.cooney@ttu.edu