Optional term paper, SØK460/ECON460 Finance The- ory, fall 2002

advertisement

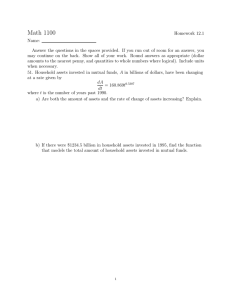

Department of Economics University of Oslo 24 September 2002 Optional term paper, SØK460/ECON460 Finance Theory, fall 2002 (“Semesteroppgave.”) Your answers should be handed in (room 1240) before 11:00 hrs. on 14 October. I shall give my suggested answers in a lecture on Monday, 18 November at 12:15–14:00 in Auditorium 3 (ES) and you will get your answers back at that time with some comments. You may write in English or Norwegian. The purpose of this is to give the students an opportunity to write an exam-like paper, and receive written comments to it, as a preparation for the exam. The evaluation of the paper does not affect your course grade in any way, but the paper is a strongly recommended exercise. Please write legibly on one side of the paper, and leave a margin for notes. Please restrict yourself to less than 24 hand written pages, or less than 15 typed pages. The questions are previously given as exam questions, but make up about two six-hour exams. (Two of these question would make one six-hour exam.) As you will notice in this and other connections, the notation changes slightly from text to text. For instance, the risk free interest rate may be Rf (or even r − 1 in Cox and Rubinstein) instead of rf . Electronic calculators are not permitted for the final exam, and hopefully, you can do OK without them for this exercise as well. (In fact, calculators were permitted when Question 1 was given as an exam question.) It is better to hand in incomplete answers than nothing. It is a good idea to work on your own as much as possible. It is also a good idea to try to solve the other exercise problems available on the course web site. Good luck! Question 1 Consider an economy in which the Capital Asset Pricing Model holds. The economy has only two types of shares with risky future values. Share i has a rate of return of R̃i , for i = 1, 2. In addition the agents may save or borrow at a risk free interest rate Rf . It is not necessary to derive the model results. 1 (a) Find the market portfolio’s expected rate of return, and the variance of this rate of return, when the following information is given: E(R̃1 ) = 0.1, E(R̃2 ) = 0.2, var(R̃1 ) = 0.062 = 0.0036, var(R̃2 ) = 0.182 = 0.0324, cov(R̃1 , R̃2 ) = 0.002, the total market value of all shares of type 1 is equal to the total market value of all shares of type 2. (b) Show that the given information is sufficient to determine the magnitude of Rf , and try to find this magnitude. (c) Find the minimum-variance portfolio within the set of portfolios composed from the two shares. Determine the composition of this portfolio, its expected rate of return, and the variance of this rate of return. Question 2 (a) Consider a risk averse person wishing to invest today to have money available for consumption one period from now. There are only two investment opportunities, X and Y . Both have normally distributed rates of return, R̃X and R̃Y , with expected values E(R̃X ) = 0.18 and E(R̃Y ) = 0.15, and variances var(R̃X ) = 0.42 = 0.16 and var(R̃Y ) = 0.32 = 0.09, and covariance cov(R̃X , R̃Y ) = 0.11. From this information, can you narrow down what kind of investment the person will make? (b) Consider a risk averse person wishing to invest today to have money available for consumption one period from now. There are only two investment opportunities, V and W . Both have normally distributed rates of return, R̃V and R̃W , with expected values E(R̃V ) = 0.08 and E(R̃W ) = 0.11, and variances var(R̃V ) = 0.42 = 0.16 and var(R̃W ) = 0.32 = 0.09, and covariance cov(R̃V , R̃W ) = 0.11. From this information (and what you found under part (a)), can you narrow down what kind of investment the person will make? Question 3 As a point of departure consider the formula P0 = E(P̃e ) − λ cov(P̃e , R̃m ) . 1 + Rf (a) Explain what the symbols in the formula mean. (b) Show how the formula can be derived from the standard version of the Capital Asset Pricing Model (CAPM). You are not asked to derive the CAPM. 2 (c) Give a verbal interpretation of what the formula expresses. You may well discuss why one or more variables, which an uninformed person could have expected to see, does not appear in the formula. Consider a corporation (joint-stock, limited company) which shall invest in a production process which only needs input in the form of investment now, and which produces only one period from now. If the invested money amount is I, then the produced quantity will be f (I) with certainty. Here f is an increasing, concave function. The produced quantity can be sold at a price per unit, P̃ , which is normally distributed. You can disregard the possibility that this price becomes negative, since we assume that the probability for this is very small. (d) Show how the formula above can be used to find the value today of the production which will take place one period from now. (e) Find the first order condition for a maximum net value of the corporation, i.e., the value you found under (d) minus the invested amount. How will the uncertainty affect the amount to be invested? (f) Do the same analysis as under (d) and (e), but this time under the assumption that the corporation is subject to a cash flow tax at a rate t. The corporation will be refunded a fraction t of the invested amount in the same period as the investment. It must pay the same fraction of the production value as a tax in the next period. How will the tax affect the amount to be invested? Interpret the result. (g) Do the same analysis as under (f), but this time under the assumption that the corporation instead is subject to a profits tax. Nothing is refunded in the period of investment. But the invested amount may be deducted in the production value in the next period, and a tax at a rate t is paid out of the difference. If the difference is negative, the state will refund a fraction t. How will the tax affect the amount to be invested? Interpret the result. How could one have adjusted the deduction for the invested amount in order to obtain the same effect on the investment of the profits tax as of the cash flow tax? Question 4 (a) Within a standard CAPM, explain what is meant by the Capital Market Line. Illustrate the line in a suitable diagram. Give a formula for the line. Explain in mathematical and practical terms what kind of objects are located on the line. Explain what kind of objects are located above the line and below the line, if any. Explain what characterizes those objects located far to the right on the line and far to the left on the line. (b) Within a standard CAPM, explain what is meant by the Security Market Line. Illustrate the line in a suitable diagram. Give a formula for the line. Explain in 3 mathematical and practical terms what kind of objects are located on the line. Explain what kind of objects are located above the line and below the line, if any. Explain what characterizes those objects located far to the right on the line and far to the left on the line. (c) Discuss the following statement: “Those, and only those, who live in an economy where the Capital Market Line is steep, are higly rewarded for taking risks.” (d) Discuss the following statement: “Those, and only those, who live in an economy where the Security Market Line is steep, are higly rewarded for taking risks.” (e) Explain briefly what is meant by the zero-beta CAPM (without proofs or derivations). Discuss to what extent the two lines mentioned in parts (a) and (b) are meaningful concepts when the zero-beta CAPM holds, but not the standard CAPM. Diderik Lund 4