Investment strategy for the Petroleum Fund Lecture at

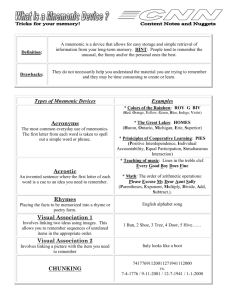

advertisement

Investment strategy for the Petroleum Fund www.norges-bank.no BiV/October 2002 om te e ns io Pe ity tri c Te le c s IT P/ Al e ni ct ve a ns rs iti Se es rv Su ic es pe ra nn ua t.. AT . P (D H am en bu m a rg rk ) M an nh ei m er IPE U Source: Source: IPES El ec Birger Vikøren Governor’s Staff Norges Bank Tr us si on C oa lP en nd Fu um ro le Pe t PG G M AB P Lecture at UiO November 13, 2002 Br iti sh Bn euro Top 10 European Funds 160 140 120 100 80 60 40 20 0 The Norwegian Government Petroleum Fund has within a few years become one of the largest funds in Europe The inflow to the fund over the last 3 years has been appr.EUR 60 bn BiV/October 2002 Outline • • • • • • Background of the Fund Portfolio models Regional allocation Equity portion Active management Ethical investments BiV/October 2002 The petroleum sector and the Norwegian economy (in 2001) • Share of Norwegian export: 43,1 per cent • Share of government revenue: 35,3 per cent • Share of GDP: 21,6 per cent • Share of employees: 1 per cent BiV/October 2002 Background of the Fund BiV/October 2002 The Petroleum Fund: • The Norwegian Government Petroleum Fund was established by law in 1990 • The inflow to the Fund is the the central government budget surplus each year • The first transfer occurred in May 1996 • The fund is invested in financial assets outside Norway BiV/October 2002 1 Transfers from the Government Petroleum Revenue The main purposes of the Petroleum Fund: State net cash flow from Petroleum • A buffer for the government budget to shelter the domestic economy from volatility in petroleum revenue 250.0 Transfers to the Petroleum Fund Billion 2002 NOK 200.0 • An instrument for meeting the long-term challenges of a combination of an expected decline in petroleum resource revenue and an increase in government pension expenditures Financing budget defisits 150.0 100.0 50.0 0.0 1991 BiV/October 2002 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 BiV/October 2002 Net cash flow from the petroleum sector and pension expenditures (per cent of GDP) Pension expenditures Growth of the Petroleum Fund 18 120 15 15 100 12 12 80 18 9 Net cash flow from the petroleum sector 6 3 0 1970 1992 1980 1990 2000 2010 2020 2030 2040 9 6 60 3 40 0 20 2050 0 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 The Government Long Term Programme 2002-2005 The present value of future state pension expenses is USD 450 bn (by year end 2003) Capital (Bill. USD) Net budget surplus The increase this year is USD 16 bn (in real terms) BiV/October 2002 BiV/October 2002 Why is the Fund invested abroad? Norway’s national wealth Percentage distribution • Budget concern • The Petroleum Fund should not be a second budget 70 • The Fund does not affect international rates of return - better returns abroad 60 50 • Monetary policy concern 40 • The petroleum activity yields substantial currency incomes • Accumulation of foreign reserves in the Fund counteracts appreciation of the currency 1997 2030 30 20 10 • The Fund as a buffer 0 • Drawing on a domestic fund could destabilize the economy when activity is low BiV/October 2002 79.676.6 80 • Investment concern 6.5 1.2 Oil and gas 0.6 6.6 13.315.6 Financial Fixed assets assets Human capital BiV/October 2002 2 The investment strategy could be divided into: • Long-term (passive) investment strategy – Strategic Asset Allocation (SAA) – reflected in the benchmark • Short-term (active) investment strategy – deviation from the benchmark – increase returns – reduce costs BiV/October 2002 Petroleum Fund - Division of responsibilities • Owner: Ministry of Finance • Manager: Norges Bank – Active investment strategy – Achieve higher return than benchmark given investment mandate and restrictions – Risk control – Reports to MOF – Give advice to MOF on Strategic Asset Allocation – Passive investment strategy – Strategic asset allocation and investment universe – Benchmarks – Risk limits – Evaluates manager (uses consultant) – Reports to the Parliament BiV/October 2002 Strategic asset allocation depends on: Strategic Asset Allocation in benchmark • Purpose of the Fund • “In terms of the Petroleum Fund, it is natural to apply a long investment horizon and to recognize the importance of preserving the Fund's international purchasing power". (Revised National Budget 1997) Equities 40 % Europe 50 % • Owner’s risk tolerance Developed markets + Brazil, Mexico, Tyrkey Korea, Taiwan • The expected return and risk of the various assets classes BiV/October 2002 America 42 % Fixed income 60 % Asia 8% Europe 55 % America 35 % Asia 10 % investment grade bonds in developed markets incl. emerging market domiciled issuers BiV/October 2002 Portfolio models BiV/October 2002 BiV/October 2002 3 Market cap weighted bonds and equity portfolios are time-varying! 70 70 60 50 US 40 30 Europe 30 Japan 20 jan.01 jan.99 jan.97 jan.95 jan.02 jan.99 jan.00 jan.01 jan.98 jan.93 jan.94 jan.95 jan.96 jan.97 jan.92 jan.88 jan.89 jan.90 jan.91 jan.86 jan.87 BiV/October 2002 Japan 0 0 bonds Europe 10 10 Government US 20 jan.91 bonds 50 40 jan.89 Non - govt. jan.87 Equities 60 jan.85 estate Government bonds Stocks Real jan.93 A global market cap portfolio BiV/October 2002 Portfolio models Efficient front Minimize: • The portfolio choice is based on expected return, variance (risk) and risk tolerance n n σ p2 = ∑∑ wi w j ρ ijσ iσ j i =1 j =1 Given: • The efficient front and indifference curves are based on subjective assessments n E ( R p ) = ∑ wi E ( Ri ) , i =1 n ∑w • Portfolio choice is sensitive to changes in input i =1 i = 1, Short-sale constraint: • Investment horizon and availability of data 0 ≤ wi ≤ 1 , for all i BiV/October 2002 BiV/October 2002 Risk preferences II Return Risk preferences I Efficient frontier It follows from this model that the degree of risk aversion determines the allocation between risk free rate and market portfolio (which has a fixed allocation between bonds and stocks) Asset allocation puzzle: The degree of risk aversion should determine the allocation between bonds and stocks Return Risk Risk BiV/October 2002 BiV/October 2002 4 Efficie nt frontie r int'l stocks and bonds (local curr.), with short sale s constraints. Blue square s: e fficie nt frontie r 1986-2000. Re d square s: indiv idual asse ts. Ye llow triangle : Pe trofund. Ye llow cirle : FX re se rv e s. Ye llow cross: FX re s. 20% stocks Efficient frontier 18 0.18 16 0.16 100% stocks 14 0.14 Annual expected return 1993-1997 1998-2002 15.46 -0.63 8.63 5.70 9.83 17.84 3.38 3.09 0.42 -0.38 Return stocks Return bonds Risk stocks Risk bonds Correlation 12 0.12 10 0.1 8 0.08 6 0.06 4 0.04 2 100% bonds 100% stocks 0 -2 0 0.02 0 0 0.05 0.1 0.15 0.2 2 4 6 8 10 12 14 16 18 20 0.25 1998-2002 Annual volatility BiV/October 2002 1993-1997 BiV/October 2002 Relationship between return differentials and exchange rate changes in bond markets in the US, Japan and Europe Regional allocation US and Japanese bonds US and European bonds Exchange rate changesand return on American and Japanese bonds Exchange rate changes and return on American and European bonds 200 250 200 150 150 100 100 BiV/October 2002 Exchange rate index (USD/EUR) Relative return index (USD/JPY) jan.02 jan.01 jan.00 jan.99 jan.98 jan.97 jan.96 jan.95 jan.94 jan.93 jan.92 jan.91 jan.90 jan.89 jan.88 jan.87 jan.02 jan.01 jan.00 jan.99 jan.98 jan.97 jan.96 jan.95 jan.94 jan.93 jan.92 jan.91 jan.90 jan.89 jan.88 jan.87 jan.86 Exchange rate index (USD/JPY) jan.86 50 50 Relative return index (USD/EUR) BiV/October 2002 Correlation coefficients for selected countries in the Fund's bond portfolio (in local currency) in the period 1994-2001. The colour code for the correlation coefficients is: Red: 0.75-1, Pink: 0.50-0.74, Green: 0.25-0.49, Blue: < 0.24 Relationship between return differentials and exchange rate changes in equity markets in the US, Japan and Europe US and Japanese equities US and European equities Exchange rate changes and return on American and Japanese stocks Exchange rate changes and return on American and European stocks US Canada 1 0.77 0.77 1 0.23 0.68 0.22 0.77 0.65 0.65 0.77 0.79 0.77 0.69 0.70 0.69 0.78 0.69 0.70 0.69 Japan Australia NewZealand 0.23 0.22 0.68 0.77 0.65 0.65 1 0.26 0.26 1 0.31 0.72 0.31 0.72 1 0.14 0.11 0.14 0.58 0.57 0.58 0.71 0.70 0.71 0.15 -0.13 0.60 0.54 0.72 0.60 Netherlands Italy France Germany UK 0.77 0.79 0.77 0.78 0.69 0.14 0.11 0.14 0.15 0.71 0.70 0.71 0.72 0.60 1 0.99 1.00 1.00 0.81 1.00 0.99 1.00 1 0.81 200 800 700 600 150 500 400 300 100 200 100 Relative return index (USD/JPY) Exchange rate index (USD/EUR) Relative return index (USD/EUR) jan.02 jan.01 jan.00 jan.99 jan.98 jan.97 jan.96 jan.95 jan.94 jan.93 jan.92 jan.91 jan.90 jan.89 jan.88 jan.87 jan.02 jan.01 jan.00 jan.99 jan.98 jan.97 jan.96 jan.95 jan.94 jan.93 jan.92 jan.91 jan.90 jan.89 jan.88 jan.87 jan.86 Exchange rate index (USD/JPY) jan.86 50 0 0.69 0.70 0.69 0.70 0.69 US Can BiV/October 2002 0.58 0.57 0.58 0.60 -0.13 0.54 Jap Aust NewZ 0.99 1 0.99 0.99 0.81 1.00 0.99 1 1.00 0.81 Neth Ital Fran Germ 0.81 0.81 0.81 0.81 1 UK BiV/October 2002 5 Correlation coefficients for selected countries in the Fund's equity portfolio (in local currency) in the period 1994-2001. The colour code for the correlation coefficients is: Red: 0.75-1, Pink: 0.50-0.74, Green: 0.25-0.49, Blue: < 0.24. US Canada Mexico Brasil 1 0.77 0.54 0.56 0.77 1 0.61 0.58 0.54 0.61 1 0.57 0.56 0.58 0.57 1 0.49 0.40 0.39 0.54 0.37 0.37 0.41 0.32 0.48 0.40 0.36 0.30 0.62 0.62 0.54 0.45 0.62 0.62 0.55 0.51 0.57 0.52 0.51 0.60 0.57 0.55 0.40 0.51 0.73 0.67 0.50 0.55 0.52 0.52 0.34 0.50 0.71 0.71 0.49 0.62 0.73 0.68 0.44 0.60 0.79 0.70 0.56 0.59 Japan Taiwan Korea HongKong Singapore Australia NewZealand 0.49 0.37 0.48 0.62 0.62 0.57 0.57 0.40 0.37 0.40 0.62 0.62 0.52 0.55 0.39 0.41 0.36 0.54 0.55 0.51 0.40 0.54 0.32 0.30 0.45 0.51 0.60 0.51 1 0.32 0.40 0.33 0.38 0.44 0.31 0.32 1 0.46 0.38 0.38 0.31 0.33 0.40 0.46 1 0.52 0.50 0.41 0.45 0.33 0.38 0.52 1 0.81 0.63 0.48 0.38 0.38 0.50 0.81 1 0.58 0.55 0.44 0.31 0.41 0.63 0.58 1 0.57 0.31 0.33 0.45 0.48 0.55 0.57 1 0.50 0.33 0.36 0.50 0.55 0.59 0.55 0.35 0.32 0.29 0.22 0.33 0.44 0.44 0.47 0.34 0.39 0.43 0.51 0.48 0.52 0.48 0.40 0.35 0.49 0.51 0.55 0.53 0.44 0.34 0.56 0.58 0.59 0.66 0.62 Netherlands Italy France Germany UK 0.73 0.52 0.71 0.73 0.79 0.67 0.52 0.71 0.68 0.70 0.50 0.34 0.49 0.44 0.56 0.55 0.50 0.62 0.60 0.59 0.50 0.35 0.47 0.48 0.44 0.33 0.32 0.34 0.40 0.34 0.36 0.29 0.39 0.35 0.56 0.50 0.22 0.43 0.49 0.58 0.55 0.33 0.51 0.51 0.59 0.59 0.44 0.48 0.55 0.66 0.55 0.44 0.52 0.53 0.62 1 0.68 0.84 0.84 0.80 0.68 1 0.75 0.70 0.59 0.84 0.75 1 0.84 0.76 0.84 0.70 0.84 1 0.71 0.80 0.59 0.76 0.71 1 US Can Mex Bra Jap Taiw Kor HK Sing Aust NewZ Neth Ital Decomposition of the variance of the return on equity and bond investments in the US, Japan and Europe. Monthly data for the period 1986-2001 70 Correlation between exchange rate changes and return on stocks and bonds respec tively 60 50 40 30 Variance of exchange rate changes 20 10 0 Variance of return on stocks and bonds respec tively -10 -20 US Japan Europe US Japan Europe Fran Germ UK BiV/October 2002 BiV/October 2002 Regional portfolio weights Correlation between regions Market capitalisation weights are attractive Correlations between bond markets (measured in local currency, 60 month window) Correlations between stock markets (measured in local currency, 60 month window) 0.8 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 • • • • exposed against “bubbles” in market pricing are not related to our trading pattern (import weights) is affected by difference in structure of capital markets between countries implies growing weight of bond investments in countries facing a rising debt burden (in relative terms) • does not take other parts of our national wealth into consideration jan.01 jan.00 jan.99 BiV/October 2002 consistent with theory (CAPM) an indicator of production capacity simplifies benchmarking vs. index and peer’s no rebalancing is needed connections to liquidity - important for a large fund with capital flows but should be modified: Japan,Europe jan.91 jan.01 jan.00 jan.99 jan.98 jan.97 jan.96 jan.95 jan.94 jan.93 jan.92 0 US,Europe jan.98 0.1 US,Japan jan.97 Japan,Europe 0.2 jan.96 US,Europe 0.3 jan.95 US,Japan 0.4 jan.94 0.5 jan.93 0.6 jan.92 0.7 jan.91 • • • • • BiV/October 2002 What is most important for the performance - sector or region X SL = α + β 1 X GS + β 2 X L + ε Japan US 6 12 5 10 3 sector country 2 6 sector country 4 2 1 0 0 1994-1 997 1994-1997 1998 -2001 Euro-block 1998-2001 UK 7 6 6 5 5 4 4 sector 3 country 2 3 sec tor country 2 1 1 0 0 1994-1997 BiV/October 2002 Equity portion 8 4 1998-2001 1994-1997 1998-2001 BiV/October 2002 6 CAPM Determinig the equity portion • What is the return on equity investment (the equity premium puzzle) • How should we assess the risk associated with equity investment • Is the optimal equity portion independent of the investment horizon? E(Ri ) = RF + βi ⋅ [E(Rm ) − RF ] where: RF - riskfree rate E(Rm ) - expected return on market portfolio βi = BiV/October 2002 cov(Ri , Rm ) σ im = 2 - systematic risk on asset ”i” var(Rm ) σm BiV/October 2002 How should we calculate average return? Consumption - CAPM (an example using US data for the period 1926-2000) E ( Rm ) − R f = γσ (∆c)σ ( Rm ) ρ (∆c, Rm ), γ - degree of risk aversion ρ - correlation coefficient (between consumption growth and asset return R f - riskfree rate Arithmetic Geometric Continuesly compounding Aksjer Obligasjoner Aksjepremie 12.97 5.46 7.51 11.03 5.31 5.72 10.46 5.18 5.28 RA = RG + 1/2 σA2 ∆c - consumption growth BiV/October 2002 BiV/October 2002 Rolling fixed window (10 years) Return on US bonds and stocks, 1926-2002 25 60 20 40 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 1950 1945 1940 1935 -5 2001 1996 1991 1986 1981 1976 1971 1966 1961 1956 1951 -40 -60 -10 BiV/October 2002 1946 Kontinuerlig (ln) snitt 0 0 -20 1941 Realavkastning 5 20 1936 Arit gj snitt 1931 Geo gj snitt 10 1926 15 Obligasjoner Aksjer BiV/October 2002 7 Rolling fixed window (3, 5 and 10 years) 40 30 Equity premium in 9 countries 1900 - 2002 (average annual return) 30 % 20 20 % 10 10 % 2000 0% -30 -20 % -40 -30 % 10 år 5 år 3 år Japan Sveits Frankrike Nederl. Italia UK Tyskland -20 1900-2000 Canada -10 % USA 1995 1990 1985 1980 1975 1970 1965 1960 1955 1950 1945 1940 1935 -10 1930 0 1995-1999 2000-2002 -40 % BiV/October 2002 BiV/October 2002 Standard deviation Correlation between bonds and equities Rolling fixed window (10 years) rolling fixed window (5 and 10 years) 40 Standardavviket til aksjer Standardavviket til obligasjoner Gj snitt (1926-2002) Gj snitt (1926-2002) BiV/October 2002 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 2000 1995 1990 1985 1980 1975 1970 1965 -0.4 1950 0 1945 -0.2 1940 0 5 1960 0.2 10 1955 0.4 15 1950 0.6 20 1945 25 1940 0.8 1935 Prosent 30 1935 1 35 10 år 5 år -0.6 -0.8 -1 BiV/October 2002 Dividend discount model (DDM): CFt B0 = ∑ t t =1 (1 + y ) How to use the DDM T ~ ∞ CFt , P0 = E ∑ t =1 (1 + y + rp) t Assume constant growth rate (g) in dividend (D): ∞ P0 = ∑ t =1 D0 (1 + g ) t D0 = . y + rp − g (1 + y + rp ) t y + rp = BiV/October 2002 • Y, D and P is observable • rp, g and Pfair are unobservable • Q1: What should dividend (and earnings) growth be to justify current pricing? • Q2: For given g, what rp is implied in current pricing? • Q3: For given g and rp, what is fair price? D +g P g = y + rp − rp = P fair D P D +g− y P D = y + rp − g BiV/October 2002 8 Dividend/Price ratios in USA, Japan, Europe and UK, 1973 - 2002 USA Japan 3.50 10 01 /0 0 8 1 /7 -2 3 0 4 6- 7 -1 4 9 12 - 76 /1 06 2 /7 / 7 0 3 08 /7 -3 9 1 1 0- 8 -2 1 0 7 2-8 -1 2 10 6-8 /0 4 02 3 /8 /1 6 06 1/ -2 8 7 02 6-8 -1 9 12 8- 9 /1 1 06 0 /9 /0 2 0 1 6 /9 -2 4 0 9 9- 9 -2 6 0 5 2- 9 -1 7 08 7-9 /0 9 1 /0 1 -2 st avvik +2 st avvik dy +2 st avvik BiV/October 2002 2000 dy 1998 0.00 -2 st avvik 1996 2.00 0.00 1995 1.00 01/01/73 05/04/76 09/07/79 11/10/82 03/12/90 07/03/94 09/06/97 11/09/00 08-19-74 11-21-77 02-23-81 05-28-84 01-13-86 08-31-87 04-17-89 07-20-92 10-23-95 01-25-99 04-29-02 100 1993 2.00 4.00 1991 6.00 198 9 8.00 1987 3.00 1985 dy 4.00 1984 10.00 5.00 1982 12.00 6.00 1980 14.00 7.00 1978 8.00 1000 1976 +2 st avvik 1974 dy UK 197 3 -2 st avvik 1971 01 /0 09 1 /7 -1 3 05 6-7 -3 4 02 1- 7 -1 6 10 3- 7 -2 8 07 9-1 79 03 3-8 -2 1 10 8-8 / 3 08 12/ -2 84 09 5-8 /0 6 01 5/ -2 88 07 2-9 /1 0 06 0/ -2 91 06 1-9 /0 3 11 3 /9 -1 5 03 8-9 /0 6 04 8 /9 -1 8 12 7-0 -3 0 101 +2 st avvik 1969 dy Europe 1951 -2 st avvik 1967 -0.50 1965 0.00 Vekst i no minelt GDP og nom inelt EPS i SP500 1 0000 1963 0.00 1962 1.00 – Current D/P ratios in the different regions are on of several indicators supporting a positive, but low equity premium going forward 1960 0.50 1958 1.00 2.00 195 6 1.50 3.00 1954 2.00 4.00 1952 3.00 2.50 5.00 dy 7.00 6.00 08 /0 0 2 1 /7 /0 3 04 9 /7 -2 4 12 6- 7 -1 6 08 9- 7 -1 7 0 6 3 -7 /0 9 11 4/ 8 -2 1 07 9 -8 -2 2 03 3-8 -1 4 0 9 7-8 /1 6 0 3 1 /8 /0 7 02 7 /8 -2 9 10 5- 9 -1 1 06 9- 9 -1 2 3 0 5 -9 / 4 09 0 2/ -2 96 05 9 -9 -2 7 01 4 -9 -1 9 501 dy 8.00 dy Relationship between earnings growth and GDP-growth (log scale) BiV/October 2002 Three reasons for falling equity prices: • Increased interest rates (y) • Increased risk premium (rp) • Lower dividend (and earnings) growth (g) D P = y + rp − g Return stocks Return bonds Risk stocks Risk bonds Correlation Efficient frontier 1988-1997 1993-2002 12.71 7.69 8.47 7.21 11.70 14.40 3.30 3.26 0.50 -0.04 14 13 100% stocks 12 11 10 9 100% bonds 100% bonds 8 100% stocks 7 • Could also be that a bubble has burst 6 0 2 4 6 8 1988-1997 BiV/October 2002 1993-1997 1998-2002 15.46 -0.63 8.63 5.70 9.83 17.84 3.38 3.09 0.42 -0.38 Return stocks Return bonds Risk stocks Risk bonds Correlation 18 16 100% stocks 14 12 10 6 100% bonds 4 2 0 -2 0 100% stocks 2 4 6 8 10 1998-2002 BiV/October 2002 12 14 16 1993-2002 BiV/October 2002 Efficient frontier 8 10 12 14 16 18 Equity portion and investment horizon • Merton/Samuelsen • Random walk • Constant relative risk aversion • Mean reversion • Long horizon - more flexibility in labour supply • Shortfall preferences • Equity portion independent of investment horizon • Equity portion depends on investment horizon 20 1993-1997 BiV/October 2002 9 Portfolio risk Siegel (1998): US data from 1802 to 1997 USA 1926 - 2000 • Mean reverting equity returns implies that equity investments are less risky at long investments horizons 25 50 45 40 35 30 25 20 15 10 5 0 20 15 10 5 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1 year (left axe) Investment 1 år 5 år 10 år 30 år horizon Equity portion 7% 25% 40.6% 71.3% that minimize risk 5 year (right axe) BiV/October 2002 BiV/October 2002 Equities and long-term risk Time-varying equity allocation (market timing)? • “We have a sample of 24 markets for which we have data in 1931. Out of these, only seven experienced no interruption (the US, Canada, the UK, Australia, New Zealand, Sweden and Switzerland). Seven experienced a temporary suspension of trading, less than a year. The ten remaining markets suffered a long-term closure.” 13 12 11 10 9 8 7 • Jorion and Goetzmann (1998) 6 5 2002 1998 1994 1990 1986 1982 1978 1974 1970 1966 1962 1958 1954 1950 1946 1942 1938 1934 1930 1926 4 Return index for US equity (ln) Linear (Return index for US equity (ln)) BiV/October 2002 BiV/October 2002 The benchmark is the starting point for the operative management Active management • The benchmark is defined by the Ministry of Finance • Norges Bank has ambition to outperform the benchmark within the risk limits set by MoF • To main alternatives: • index management • active management BiV/October 2002 BiV/October 2002 10 Index management 135 130 Benchmark Index management 125 • Low cost and low risk 120 115 110 105 100 1.k va rta l1 99 2.k 7 va rta l1 99 3.k 7 va rta l1 99 4.k 7 va rta l1 99 1.k 7 va rta l1 99 2.k 8 va rta l1 99 3.k 8 va rta l1 99 4.k 8 va rta l1 99 1.k 8 va rta l1 99 2.k 9 va rta l1 99 3.k 9 va rta l1 99 4.k 9 va rta l1 9 1.k 99 va rta l2 00 2.k 0 va rta l2 00 0 • Among large international pension funds there is a tendency towards using index management for a large share of the equity portfolio • Index management is a “standard product” • Competitive gains seem to be achieved with an increase in the volume under management (economies of scale) • Management costs are very low Index management BiV/October 2002 BiV/October 2002 Active management can be carried out in four different ways: BiV/October 2002 140 Benchmark 135 Index management 130 Active management 125 120 115 110 105 100 • Not many managers beat the benchmarks consistently over time • Risk must be controlled 1.k va r ta l1 99 2.k 7 va r ta l1 99 3.k 7 va r ta l1 99 4.k 7 va r ta l1 99 1.k 7 va r ta l1 99 2.k 8 va r ta l1 99 3.k 8 va r ta l1 99 4.k 8 va r ta l1 99 1.k 8 va r ta l1 99 2.k 9 va r ta l1 99 3.k 9 va r ta l1 99 4.k 9 va r ta l1 99 1.k 9 va r ta l2 00 2.k 0 va r ta l2 00 0 • by changing the country allocation • by changing the equity portion • within the equity portfolio: by increasing investments in sectors or companies that are expected to perform better than others • within the bond portfolio: by changing interestrate risk or credit risk. Active management BiV/October 2002 Example: Large US pension funds Risk-adjusted return: • Fama and French (1993) three-factor model: – broad stock index – excess return on a portfolio of small stocks over a portfolio of large stocks – excess return on a portfolio of high book-to-market stocks over a portfolio of low book-to-markets stocks • Carhart (1997) augmented this model to include: – a portfolio of stocks with high return over the past months BiV/October 2002 BiV/October 2002 11 Considerable debate about the interpretation of this results • Entirely spurious and the result of data-snooping • Inability of the the broad stock index to proxy for the market portfolio return • Genuine evidence against CAPM, but not against a broader model in which there are multiple risk factors • Mistakes that disappear once market participants become aware of them • Enduring psychological biases that lead investors to make irrational forecasts Ethical investments BiV/October 2002 BiV/October 2002 What are ethical guidelines? Three options for the Petroleum Fund • “The reason we have the phenomenon of social investing is that people are concerned about such issues as human rights abuses, environmental degradation and exploitation of workers - and they have taken the fight against these social ills into the business arena.” (The Journal of Investing, Winter 1997) • Option 1: Screening • “Social investors may be individuals, businesses, universities, hospitals, pension funds, religious institutions and other non-profit organisations.” (Social Investment Forum, 1997 Report) • Option 2: Invest in ethical equity fund • A broad set of criteria are currently used to define ethical guidelines: In the US, the most important criteria are: tobacco (84%), gambling (72%), firearms (69%), alcohol (68%), birth control (50%), environment (37%), workers’ rights (25%), human rights (23%), animal rights (7%). • Option 3: Influence enterprises through use of voting rights • positive screening ("best-in-class" approach) • negative screening (black-listing of enterprises/industries) BiV/October 2002 BiV/October 2002 Ulike paradigmer når det gjelder SRI: Resultatene for miljøporteføljen så langt: • Lavere avkastning i miljøporteføljen enn i Petroleumsfondets aksjeportefølje Det er SRI-effekter i aksjemarkedene: SRI-selskaper gir høyere avkastning og lavere risiko enn andre selskaper SRItilhengere 110 100 90 80 BiV/October 2002 70 Effisiente markeder 60 50 jul.02 sep.02 mai.02 jan.02 mar.02 nov.01 jul.01 Miljøporteføljen sep.01 mai.01 jan.01 40 mar.01 • Lite sannsynlig at dette skyldes miljøkriteriene fordi miljøporteføljen har en klar land- og sektorskjevhet i forhold fondets aksjeportefølje SRI-avkastning mist like god, sannsynligvis bedre Det er ingen SRI-effekter i aksjemarkedene: SRI-screening reduserer diversifikasjonsmulighetene SRImotstandere Ineffisiente markeder (feilprisinger er mulig) Petroleumsfondets aksjeportefølje SRI-avkastning: kanskje like god, sannsynligvis dårligere Det er feilprisinger i aksjemarkedene, men det er bare aktiv forvaltning ut fra finansielle vurderinger som lønner seg BiV/October 2002 12 Hva bestemmer bedriftenes inntjening? Ansattes motivasjon Offentlige reguleringer Bedriftens kostnader Bedriftens strategi Bedriftens inntekter Kundene Website: www.norges-bank.no Investorer Bedriftens finansieringskostnader Bedriftens inntjening og aksjekurs BiV/October 2002 BiV/October 2002 13