Interpretation of • − p pC

advertisement

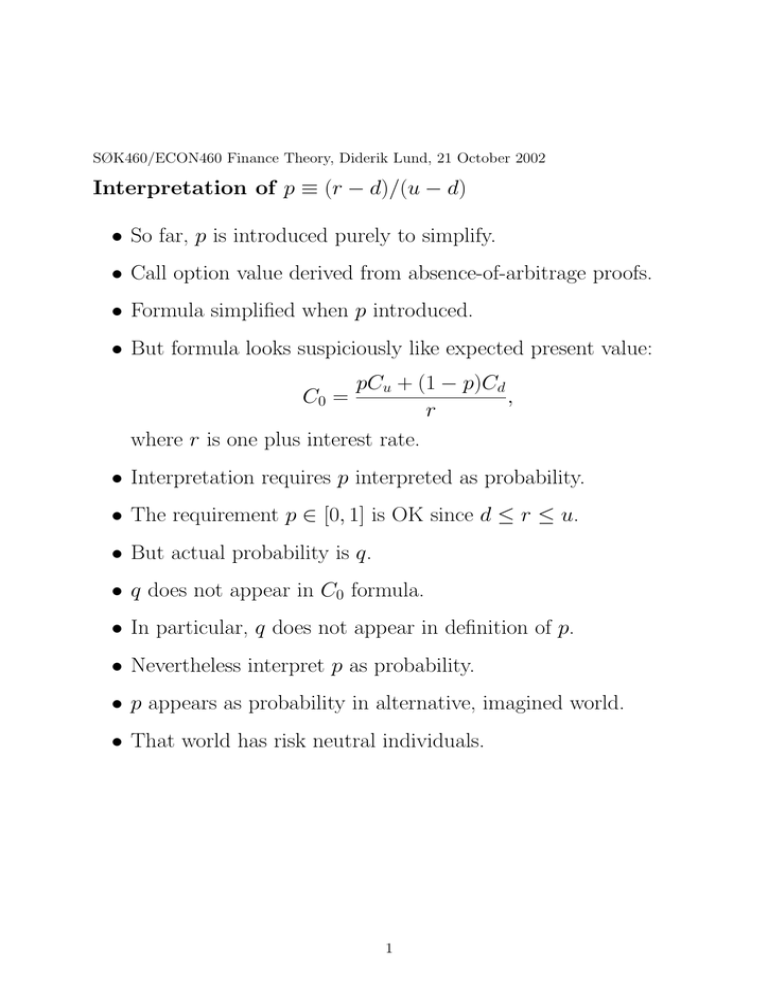

SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Interpretation of p ≡ (r − d)/(u − d) • So far, p is introduced purely to simplify. • Call option value derived from absence-of-arbitrage proofs. • Formula simplified when p introduced. • But formula looks suspiciously like expected present value: pCu + (1 − p)Cd , r where r is one plus interest rate. C0 = • Interpretation requires p interpreted as probability. • The requirement p ∈ [0, 1] is OK since d ≤ r ≤ u. • But actual probability is q. • q does not appear in C0 formula. • In particular, q does not appear in definition of p. • Nevertheless interpret p as probability. • p appears as probability in alternative, imagined world. • That world has risk neutral individuals. 1 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 p as probability in risk neutral world • Risk neutral individuals care only about expectations. • In equilibrium in “risk neutral world,” all assets must have same expected rates of return. • No one would hold those with smaller expected rates of return. • Consider thought experiment: • Keep specification of our binomial model, except for q. • In particular, keep u, d, r, S0 unchanged. • What probability would we need to make E(S1/S0) = r? • Call answer px: px · u · S0 + (1 − px) · d · S0 = r · S0 has solution px = (r − d)/(u − d) ≡ p. • Conclude: p is the value needed for the probability in our binomial model of the share price, in order for bonds and shares to have the same expected rate of return. • p is thus “probability in risk neutral world” for u. 2 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Risk neutral interpretation, contd. • p obviously not = q for most shares (except with β = 0). • When going to the risk neutral world: • Nothing in a-o-arbitrage option value is changed. • Option value did not rely on the value of q. • Composition of replicating portfolio unchanged. • Thus option value still C0 = 1r [pCu + (1 − p)Cd]. • But can also be seen from requirement E(C1/C0) = r: pCu + (1 − p)Cd = rC0 has solution C0 = 1r [pCu + (1 − p)Cd]. • Thus: Could derive C0 as expected present value. • But then: Need to use “artificial” probability p. • Sometimes called “risk-neutral” expected present value. When is this insight useful? • For call options no need for “risk-neutral” valuation. • But the principle has more widespread application. • Sometimes difficult to find formulae for replicating pf. • May nevertheless know replication possible in principle. • Expected (using p) present values may be easier to calculate. 3 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Call options: Extension to n periods Define (as before) r−d , u−d and let Ct1t2 denote the value of a call option at time t1 when expiration is at time t2. p≡ Have found the following values: With one period left until expiration: pCu + (1 − p)Cd . r With two periods left until expiration: C01 = p2Cuu + 2p(1 − p)Cdu + (1 − p)2Cdd . C02 = r2 This can be generalized to the case with n periods left: C0n n 1 n! j n−j j n−j p (1 − p) = n max[0, u d S − K] , 0 r j=0 j!(n − j)! where the max expressions are reintroduced, since the Cdu notation becomes cumbersome. Observe that the two first formulae are special cases of the third. Proof of the n-period equation is by induction, and given in a handout. 4 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Rewriting n-period formula using binomial distn. fn. C0n n 1 n! j n−j j n−j p (1 − p) = n max[0, u d S − K] 0 r j=0 j!(n − j)! can be rewritten. For any given K, only those terms with S ∗ > K have strictly positive values. Drop the remaining terms (= 0) from formula: What is least number of u outcomes needed in order for S ∗ ≥ K? K u x u K x n−x ≥ ⇐⇒ x ln ≥ ln , u d S0 ≥ K ⇐⇒ d S0dn d S0dn but we need an integer, thus let a ≡ min x ∈ N; x ≥ ln S0Kdn ln ud . Can then rewrite C0n n 1 n! j n−j j n−j p (1 − p) = n [u d S − K] . 0 r j=a j!(n − j)! This can be rewritten in terms of the complementary binomial distribution function as C0n = S0Φ(a; n, p) − Kr−nΦ(a; n, p). where p ≡ pu/r, and Φ(a; n, p) ≡ Pr(X̃n ≥ a) when X̃n is binomially distributed with probability p. 5 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Option values and the CAPM • What is relation between option values and CAPM? • Is our option value theory consistent with CAPM? • Or inconsistent? Or completely unrelated? • First: What about theoretical assumptions? • Consider only options with one period to expiration. • (Exists also multi-period CAPM. Have not considered.) • Could then imagine options are priced as in CAPM. • Option theory assumes binomial or lognormal St. • CAPM prefers normally distributed St. Problem. • CAPM also works when U functions are quadratic. • Theoretical consistency OK with quadratic U . • Next: Option value formula neglects RM . • Instead: Considers option, share, bond in isolation. • In particular: Considers share’s total risk. • In binomial (discrete-time) model: Measured as u − d. • In continuous-time model even clearer: Measured as σ. • Is this inconsistent with CAPM? Will show answer is no. 6 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Option values and CAPM, contd. • Our theory: Option equal to replicating portfolio. • When shares and bonds satisfy CAPM, so do options. • Option’s β linear combination of share’s and bond’s β’s. • Bond’s β is zero. Option’s β is linear function of share’s. • Introduce equations for expected rates of return. Starting point, three equations: C0 = ∆0S0 + B0, (1) Cu = ∆0uS0 + B0r, (2) Cd = ∆0dS0 + B0r, (3) Combining these: q(uS0∆0 − Cu) + (1 − q)(dS0∆0 − Cd) = r(S0∆0 − C0). C&R: Define one plus expected rate of return for share as mS ≡ qu + (1 − q)d ≡ 1 + µS . (µS = expected rate of return, our previous notation). Option: mC ≡ qCu + (1 − q)Cd . C0 7 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Expected rates of return, option and share Equation from the previous page, q(uS0∆0 − Cu) + (1 − q)(dS0∆0 − Cd) = r(S0∆0 − C0), gives qCu + (1 − q)Cd −r C0 q∆0uS0 + qB0r + (1 − q)∆0dS0 + (1 − q)B0r −r = C0 ∆0S0(qu + (1 − q)d) + rB0 − rC0 ∆0S0mS − r∆0S0 = = C0 C0 ∆0 S 0 = (mS − r) ≡ Ω(mS − r), C0 where Ω ≡ ∆C0S0 0 is called the option’s elasticity. Since B0 ≤ 0, must have Ω ≥ 1. CAPM equations: mC − r = mS − r = βS (mM − r), mC − r = βC (mM − r), βC = ΩβS . Conclusion: • Call option has higher beta risk than share. • If CAPM assumptions hold, then option fits into CAPM equations. • When option value expressed as function of share price, no beta needed in formula: The beta risk of the option is “hidden” in today’s share value, which is in formula. 8 SØK460/ECON460 Finance Theory, Diderik Lund, 21 October 2002 Neutral hedge ratio For call with 1 period until expiration, Cox and Rubinstein call ∆0 = Cu − Cd (u − d)S0 the “neutral hedge ratio” of the option. Related to the concept “option’s elasticity.” Both answer the following question: If one wants a positive number of shares and a negative number of options (buying shares, issuing options) such that the combination has a risk free rate of return: What is, in absolute value terms, the ratio of number of shares to number options one needs? Neutral hedge ratio. What is the ratio of value invested in shares to value invested in options? Option’s elasticity. Proof: Then one has ∆0S0 placed in shares, −C0 in options, and get ∆0uS0 − Cu if u happens, ∆0dS0 − Cd if d happens, both are equal to |B0|r. 9