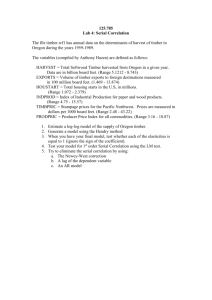

Wyoming’s Forest Products Industry and Timber Harvest, 2010

advertisement