Outputs of innovation systems: accounting what comes out of the system

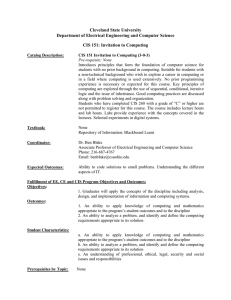

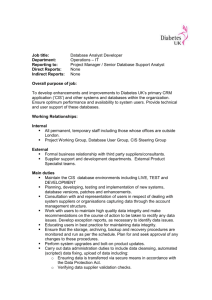

advertisement