GAO DEPARTMENT OF ENERGY Advanced Technology

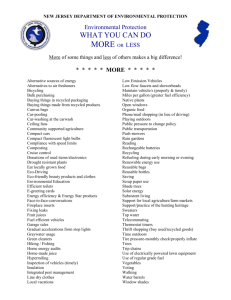

advertisement