GAO SPACE ACQUISITIONS Development and

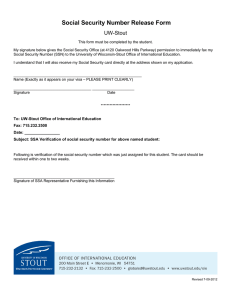

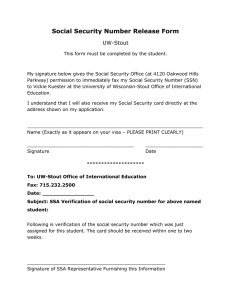

advertisement