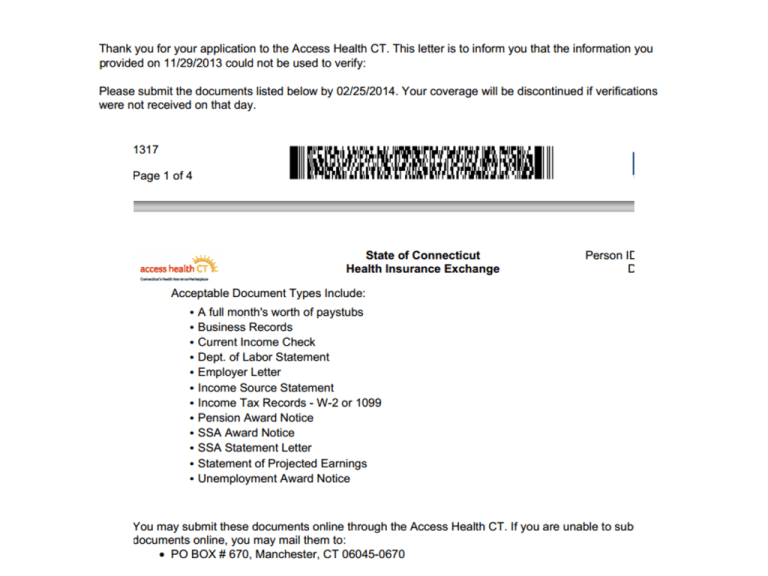

Verification of Income

advertisement

Income Verification Documents – What is Acceptable? • For employees who report earned income from an employer, 4 weekly paystubs or 2 bi-weekly paystubs are acceptable. Paystubs should be dated within the last 60 days and should contain a full month’s worth of income. Tax returns for individuals are not acceptable proof of income. • If income varies or an individual receives commission income this should be documented in a separate letter describing how income fluctuates month to month. Please send the last 3 month’s worth of paystubs. • For self-employed businesses, the most recent quarterly profit and loss statement is an acceptable income verification document. Please be sure the applicant’s name is on the statement, not just the business name. Call in: 866-919-3870 - Mute *6 2 Documents Verifying Income Acceptable Documents for Verifiable Items Verifiable Items Annual Income Acceptable Documents • • • • • • • • • • • • • • • • • A month’s worth of current paystubs Business records showing income after allowable expenses Dept. of Labor Statement Employer Letter Income Source Statement Pension Award Notice SSA Award Notice SSA Benefit verification letter SSA Benefits Letter SSA Budget Letter SSA Earning Record SSA Payment History SSA Statement Letter Social Security Income Letter Statement of Projected Earnings Tax return, W-2 or 1099s for most recent tax year Unemployment Award Notice