STATIC OLIGOPOLY MODELS SØK/ECON 535 Imperfect Competition and Strategic Interaction (

advertisement

SØK/ECON 535 Imperfect Competition and Strategic Interaction

STATIC OLIGOPOLY MODELS

Lecture notes 10.09.02

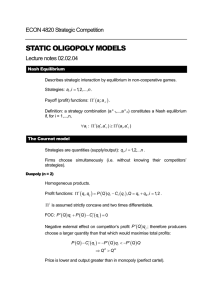

Nash Equilibrium

Describes strategic interaction by equilibrium in non-cooperative games.

Strategies: ai , i = 1,2,..., n .

i

Payoff (profit) functions: Π ( ai ; a− i ) .

Definition: a strategy combination (a * 1,...,a * n) constitutes a Nash equilibrium

if, for i = 1,...,n,

∀ai : Π i (ai∗ , a−∗ i ) ≥ Π i (ai , a−∗ i )

The Cournot model (1838)

Strategies are quantities (supply/output): qi , i = 1,2,...n .

Firms choose simultaneously (i.e. without knowing their competitors’

strategies).

Duopoly (n = 2)

Homogeneous products.

i

Profit functions: Π ( qi , q j ) = P (Q ) qi − Ci ( qi ) ,Q = q1 + q2 , i = 1,2 .

Π i is assumed strictly concave and two times differentiable.

FOC: P ′ (Q ) qi + P (Q ) − Ci′ ( qi ) = 0

Negative external effect on competitor’s profit P ′ (Q ) q j ; therefore producers

choose a larger quantity than that which would maximise total profits:

P (Q ) − Ci′ ( qi ) = −P ′ (Q ) qi < −P ′ (Q ) [q1 + q2 ]

⇒ Qd > Qm

Price is lower and output greater than in monopoly (perfect cartel).

At equilibrium, marginal costs are equal only if firms are symmetric; therefore,

for given aggregate output, total costs are generally not minimised.

From the FOC we obtain the Lerner index:

Li ≡

P − Ci′ α i

=

P

ε

where α i = qi Q is i’s market share and ε = −P ′ (Q ) Q P is the price elasticity

of demand.

i

Reaction functions (from FOC): Π i (Ri (q j ),qj ) = 0. 1

Ri′ = −

Π iij

Π iii

<0

if marginal profits decrease as a function of the competitor’s supply (because

Π iij = P ′′qi + P ′ , a sufficient condition for this result is that the inverse demand

function is convex, i.e. P ′′ < 0 ).

If so, quantities are strategic substitutes.

Figure (equilibrium described by reaction functions)

Example: Linear demand and cost functions: Ci ( qi ) = ci qi and P (Q ) = 1 − Q

Ri ( q j ) =

1 − q j − ci

2

Note: a reduction in ci shifts the reaction curve outwards and increases i’s

profit-maximising supply.

Oligopoly (n ≥ 2)

i

Profit functions: Π ( qi ;Q− i ) = P (Q ) qi − Ci ( qi ) ,Q− i = ∑ j ≠ì q j

Same FOC as above, and same formula for Lerner-indices.

From the individual Lerner-indices:

L≡

1

We define

P − C′ H

=

P

ε

Π ii = ∂Π i ∂qi , Π iii = ∂ 2 Π i ∂qi

2

and so on.

2

2

where H = ∑ i =1[α i ] is the Hirschmann-Herfindahl concentration index and

n

C ′ = ∑ i =1α i Ci′ the (weighted) average marginal cost.

n

Example: linear demand and cost functions

Symmetric model: ci = c, i = 1,2,..., n :

1

n

1

q=

[1 − c ]

n +1

n

Q=

[1 − c ]

n +1

1

p=c+

[1 − c ] → c as n → ∞

n +1

H=

Concentration indices

Summary statistics for market ‘concentration’, i.e. distribution of market

shares.

Ideally, an index should

treat firms symmetrically;

not decrease in value if part of a firm’s market share is transferred to a

larger firm; and

decrease in value if, in a symmetric industry, the number of firms increase.

Order firms such that α1 ≥ α 2 ≥ ... ≥ α n :

m

m-firm concentration ratio: K = ∑ i =1α i

m

2

Hirschmann-Herfindahl index: H = ∑ i =1[α i ]

n

These indices satisfy the above conditions:

take on values between 0 and 1;

maximised (=1) at monopoly;

for a given number of firms n, the index reaches its lowest value when

firms are equally large.

Hirschmann-Herfindahl index puts more weight on smaller firms.

3

Concentration indices may be useful if there is a relationship between market

concentration and competition, or, more specifically, performance/welfare.

This is the case in the Cournot model (under certain conditions, see above).

I other cases, this may not necessarily be true (cf. the Bertrand model).

The Bertrand model (1883)

Strategies: prices pi , i = 1,2,..., n .

Firms choose strategies simultaneously.

Homogenous duopoly (n = 2)

Buyers will shop where the price is lowest (if firms charge same prices we

assume they share the market equally).

Demand:

D ( pi ) if pi < p j

Di ( pi , p j ) = 21 D ( pi ) if pi = p j

0

if pi > p j

where D ( p ) is market demand.

Assume marginal costs are constant and identical (= c).

Nash equilibrium: p1 = p2 = c .

( pi > p j cannot be an equilibrium because j can increase profits by raising

price; pi = p j > c cannot be an equilibrium because either firm would want to

undercut; pi = p j < c cannot be an equilibrium because either firm would

want to raise its price.)

Conclusion: duopoly equals perfect competition!

In the case of asymmetric costs ( ci > c j ), the only equilibrium involves j

obtaining a monopoly at price equal to the cost of i; that is, p j = pi (technical

assumptions to guarantee existence.

The "Bertrand Paradox"

Solutions to the paradox:

product differentiation.

4

capacity constraints (Edgeworth);

inter-temporal (dynamic) competition (threat of price wars);

Product differentiation

Demand does not necessarily disappear even if price exceeds those of the

competitors.

(

)

i

Profit functions: π ( pi , p j ) = pi Di ( pi , p j ) − Ci Di ( pi , p j ) , i = 1,2.

π i assumed strictly concave and twice differentiable.

(

)

i

Reaction functions (from first-order conditions): π i ri ( p j ) , p j = 0 .

ri′ = −

π iji

>0

π iii

if marginal profit is increasing in competitor’s price.

If so, prices are strategic complements.

Figure (equilibrium described by reaction functions)

Price competition with capacity constraints

Example (costly capacity):

Demand: D ( p ) = 1 − p

Unit capacity costs: c ∈ 34 ,1

Variable costs are constant and normalised to 0

Capacity constraints: qi ≤ qi , i = 1, 2 .

Rationing

Assume p1 < p2 and D ( p1 ) > q1 : Who gets to buy from Firm 1?

Efficient rationing: residual demand equals D ( p2 ) − q1 if D ( p1 ) > q1 , 0

otherwise.

Two stage game

1)

Firms choose capacities simultaneously.

5

2)

Firms choose prices simultaneously. Trade takes place and profits are

realised.

We are looking for a Subgame Perfect Equilibrium, in which, from each stage

of the game, the strategies constitute a Nash equilibrium of the continuation

game.

Solves the game by backward induction.

STAGE 2:

Gross monopoly profits equal 1/4. Therefore, no firm will ever choose q >

because that would lead to negative profits.

1

3

Given q ≤ 31 , i = 1, 2 , there exists a unique Nash equilibrium in which

p1 = p2 = p* = 1 − q1 − q2 .

Proof of existence:

There is no point in reducing prices because capacity constraints bind.

Profits for firm 1 when p1 > p2 = p * equals p1 [1 − p1 − q2 ] . The marginal

profits is

1 − 2 p1 − q2 < 1 − 2 [1 − q1 − q2 ] − q2 = 2q1 + q2 − 1 ≤ 0.

STAGE 1:

Reduced-form profit functions, given equilibrium play at Stage 2, are

[

]

Π i (q i , q j ) = 1 − q i − q j q i , i = 12

, .

In other words, Cournot profits.

Conclusion: The two-stage game leads to the same equilibrium outcome as

in the Cournot model. The difference is that here prices are set by firms

rather than by some Walrasian auctioneer or other equilibrating ‘mechanism’.

Caveats:

For larger capacities ( qi > 31 ), an equilibrium in pure strategies generally

does not exist and one may have to consider mixed strategies (KrepsSheinkman, 1983).

The equivalence with the Cournot model does not necessarily hold for

other rationing rules (for example, proportional rationing, such that

everyone with willingness to pay above the lowest price has equal

probability of getting to buy at this price).

6

Institutional detail – pricing rules and capacity constraints

Market outcomes may depend on the finer details of market institutions; in

particular, how firms are remunerated.

Assume demand D is perfectly inelastic.

There are two (symmetric) firms with capacities k and unit costs c.

Firms set prices simultaneously: pi ∈ c, P .

A market price is set equal to the price of the marginal supplier; that is,

min { p1, p2 } if D ≤ k

P=

max { p1, p2 } if D > k

Low-demand periods ( D ≤ k )

There is a unique (Bertrand like) equilibrium in pure strategies in which

p1 = p2 = c .

High-demand periods ( D > k )

There are many equilibria, all having outcomes with one firm pricing at P and

the other pricing so low as to avoid undercutting; that is, pi = P and

p j = b ≥ c, bk ≤ P [D − k ] .

Ref: N-H von der Fehr and D Harbord (1993): Spot market competition in the

UK electricity industry, The Economic Journal, 103, 531-46.

Under the Bertrand assumption (i.e. each firm being paid its own price) we

would have the same equilibrium in low-demand periods, but in high-demand

periods equilibria would be different; in particular, only mixed-strategy

equilibria exists.

7