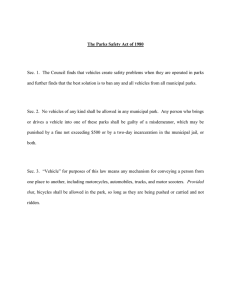

Paying for State Parks Evaluating Alternative Approaches for the 21st Century Margaret Walls

advertisement