Station Travel Plans: Research Toolkit Station Travel Plans: Research Toolkit

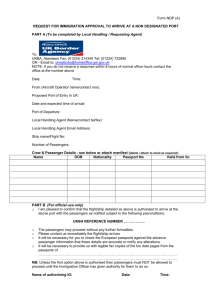

advertisement