Using risk analysis to assess trust An on-line banking scenario Overview

advertisement

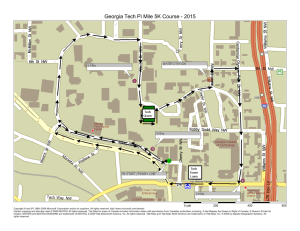

Using risk analysis to assess trust An on-line banking scenario Based on iTrust’2004 paper by Gyrd Brændeland and Ketil Stølen iTrust’2004 30 March 2004 Tele og data Overview Contribution: Investigate the use of risk analysis as a means to analyse trust. Method: Application of methods from risk analysis on a simple on-line banking scenario, targeting user trust. Hypothesis: User trust can be identified as an asset. Risk analysis targeting user-trust can be based on the same overall process as risk analysis in the security domain. Trust risk analysis includes aspects that are not present in conventional security risk analysis. Tele og data 1 Elements in a security risk analysis Frequency Unwanted Incident Context Target Consequence Asset Vulnerability Treatment Threat Tele og data Scenario: on-line banking on-line bank Internet Bank net-bank user Tele og data 2 Trust risk analysis How can model based risk analysis be used to identify threats, vulnerabilities and unwanted incidents that may reduce user trust. Focus: Those aspects where a risk analysis targeting trust differs from an ordinary security risk analysis. Trust is a more general issue than security. Tele og data Trust versus security Trust: Perceived security Lack of information => worse than actual security. Appealing interface => better than actual security. Includes security, but also; Security: Actual security legal, sociological and psychological issues Tele og data 3 Establish the context Egger – model of trust on-line bank Internet Reputation Trust propensity Attitude Transference Bank Pre-interaction filters net-bank user Tele og data Establish the context Interface properties Informational content Usability Overview Appeal Products & services Company Security Privacy Communication on-line bank Internet Reputation Pre-interaction filters Relationship management Bank net-bank user Tele og data 4 Identify assets Questions: What is the significance of user trust from the perspective of the service provider? How do we measure user trust from the perspective of the service provider? The bank is interested in the number of users and their money. User trust affects customer behaviour. Therefore trust is an asset for the bank. Tele og data Hierarchy of trust related assets Market share Database confidentiality Pre-interaction filters Net-bank technology confidentiality User trust Interface properties Informational content Reputation Usability Overview Appeal Products/ services Communication Company Perceived Perceived policy security privacy Tele og data 5 Risk evaluation criteria What may be tolerated with respect to risk. Risks that do not satisfy these criteria must be treated. Example: if risk impact < 0.15 decrease in user trust within a week then accept risk else assign priority and treatment. if risk impact < loss of 500 customers within a week then accept risk else assign priority and treatment. Tele og data Identify risks << Unwanted Incident >> security incident published locally <<Initiate>> <<Unwanted Incident>> security incident published in the National News <<Initiate>> <<Unwanted Incident >> information about security incident leaked <<Asset>> perceived security <<include>> E <<Eavesdropper >> eavesdropper <<Asset>> customer data <<Threat Scenario >> illegal access to customer data over network Tele og data 6 Negative press coverage on security leakage Analyse risks OR Determine consequence and frequency Customer alerts press Hacker reveals weakness and alerts press The customer’s personal data were acquired by another user The data were accessed crafting the specific URL for the page that provides user’s personal data OR The access achieved acquiring the user’s authentication account The access achieved by web traffic eavesdropping 0.25 0.08 0.03 URL for the page that provides user’s personal data unprotected, due to programming error Tele og data Evaluate risks Frequency Consequence Rare Unlikely Possible Likely Almost certain Minor Moderate Major Negative exposure Major risk Tele og data 7 Treatment Treatment: A way of reducing the risk value of a risk. << Treatment >> public relations<< Reduce Consequence >> work << Asset >> perceived security << Treatment >> authentication << Reduce Likelihood >> E << Unwanted Incident >> information about security incident leaked <<include>> <<Asset>> customer data << Eavesdropper >> eavesdropper << Threat Scenario >> illegal access to customer data Tele og data Conclusions Risk analysis is well suited to defend existing user trust. User trust in an online banking system is an asset for the service provider. Risk analysis targeting user-trust can be based on the same overall process as risk analysis in the security domain. Trust risk analysis includes aspects that are not present in conventional security risk analysis. These techniques can also be used to build new and increase existing user trust. Tele og data 8