SYSTEMS USING MARIA de las NIEVES RINCON

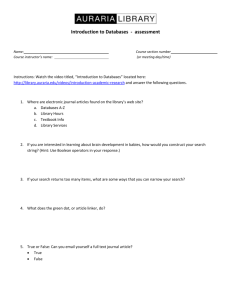

advertisement