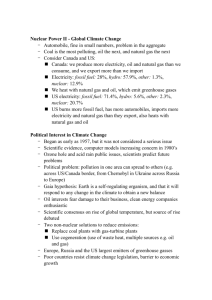

DISCUSSION PAPER How Do Natural Gas Prices Affect

advertisement