Document 11370257

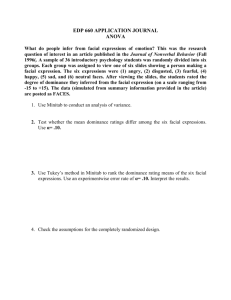

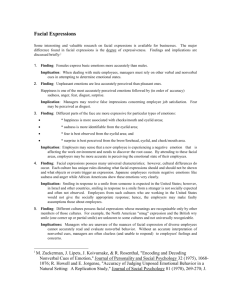

advertisement