Strategies for the Future of Lighting Ryan C Williamson

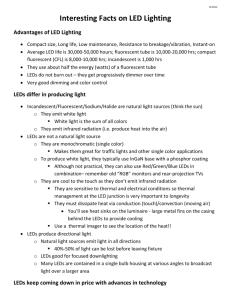

advertisement