Haavelmo’s macroeconomics: endogenous cycles Andr´ University of Oslo

advertisement

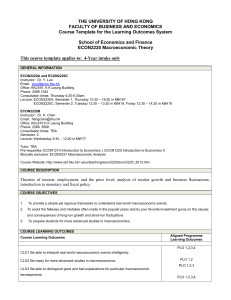

Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Haavelmo’s macroeconomics: endogenous cycles André Anundsen, Tord Krogh, Ragnar Nymoen and Jon Vislie University of Oslo Haavelmo Centennial Symposium 14 December 2011 1 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Haavelmo’s themes Titles of all published works and lectures 2 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Career lasting Contributions to macroeconomics His books in English on growth and evolution and investment theory became well known, Haavelmo (1954,1960) But Haavelmo took an even broader interest in macroeconomics. His written work include: Studies in the joint determination of the price level, inflation and the interest rate (Wicksell heritage) Monetary policy analysis with deregulated credit markets A model with an inflation target, from 1951! 1970s: A theory of inflation, interpretable as a model with bargaining and monopolistic competition, which can be specified as an error-correction form not unlike Sargan (1964), see Bårdsen et al. (1998) A macroeconomic model with regimes and switching between growths period and intermittent depressions—his “business cycle theory” 3 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Career lasting Capital markets and macroeconomic cycles In this talk we concentrate on the business cycle model, from Studies in Macroeconomics, Haavelmo (1969), in Norwegian. It brings together several of his main themes: Role of financial markets for investments and for macroeconomic performance: stability vs crisis and depression Role of monetary policy in a model with liberalized credit markets—at a time when monetary policy (in Norway) was all about regulations Investment as a system property, not an autonomous equation, so link to “Investment” from 1960 4 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Why haven’t you heard? 5 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Model Building Blocks The model Haavelmo discusses in his 1960s-lectures has standard elements Aggregate production function A given supply of labour Consumption determined by a consumption function In addition he discussed how the private sector would allocate its wealth and how the implied required rate of return plays a role for the determination of the activity level 6 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion The law of indifference on capital markets Financial market equilibrium Consider a closed economy with a private sector that can invest its wealth in: Capital, yielding a return rK (from renting it to firms) Deposits, yielding a return i Since the private sector is free to choose an optimal portfolio, we get an equilibrium condition between the two rates of return: rK∗ = G (i ) This is the law of indifference in the capital market Given a money market interest rate, i, it defines the capital owners’ required rate of return to capital to retain the existing stock 7 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion The law of indifference on capital markets Actual rate of return Haavelmo’s thesis was that the economy’s investment response depends on the relationship between the required rate of return and of the marginal productivity of capital The marginal product is defined in the classical way: rK = FK0 (K , N ) − δ FK0 (K , N ) is the derivative of the production function in capital (K ) and labour (N), and δ is the depreciation rate 8 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Equilibrium and disequilibrium I Haavelmo found it most realistic to consider the case where price rigidity prevented market clearing from being a necessity For simplicity: Take the price level as fixed In this setting there is no guarantee that the marginal product of capital is equal to the required rate at each point in time The idea: Differences between rK∗ and rK will have consequences for investment activity 9 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Equilibrium and disequilibrium II There are three cases to consider: a: rK > rK∗ = G (i ), “very high investments” b: rK < rK∗ = G (i ) “no investments” c: rK = rK∗ = G (i ) “stable investments” Case c, with equality rK = G (i ), and endogenous interest rate i is the “classical equilibrium” If the government fixes i autonomously: c can only hold by coincidence and the idea of a stable classical equilibrium cannot be maintained 10 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Over-determinedness and regimes The model is over-determined, if i is given from outside the capital markets. In the light of this, a and b are disequilibria, where the laws of classical economic theory tells us little about the outcome. Haavelmo hypothesized disequilibrium behaviour, which then drives his business cycle model. a: rK > G (i ), GDP is supply determined: full employment,and full capacity utilization b: rK < G (i ), GDP is demand determined: gross investment is zero, and there is unemployment We get two regimes—with persistence in each of them. Anundsen et al. (2011) gives the full account of the models equations, here we focus on the interpretation of the model with the aid of graphs. 11 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Investment response and macroeconomic regimes Regimes and switching 12 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Business cycles Business cycles I Assume that the initial situation is in a and that the interest rate and the labour stock are constant over the period of consideration The economy is pushed to full employment, and stays there for several periods since rK > G (i ) As the flow of investment is added to the capital stock, the marginal product of capital will gradually fall and once we reach a point such that the actual return to capital, rK , is slightly less than rK∗ , investment activity drops to zero But then employment will fall as well. This implies a further drop in the marginal product of capital 13 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Business cycles Figure: Evolution of marginal product of capital 14 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Business cycles Business cycles II Depreciation of the stock of capital will imply that the marginal product of capital, at some point, starts growing again When we are back at the case where rK = rK∗ , employment will pick up, due to higher investment activity, and we jump back to the full employment regime And so it goes 15 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Business cycles Figure: Regime switching business cycles 16 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Business cycles Financial crisis The law of indifference equation that determined the required rate rK∗ = G (i ) is more generally a complex relationship. For example: the required rate depends on transactions costs and liquidity In a situation with low liquidity and with little trust: rK∗ is higher for a given i Experience shows that there is no guarantee that a reduction of i gives the same reduction in the required rate as before liquidity disappeared A financial crises can become a job and income crisis in this model 17 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion Characterization Haavelmo’s theory is more like a model of intermittent depressions, than of ordinary business cycle model The downward switching point he called the “point of catastrophe” With grim realism he stated that, while we enjoy full employment and stability (and, in an extension, rapid growth), a catastrophe may be just around the corner 18 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion What about prices? I Only making the model over-determined is not impressive. It is the way Haavelmo deals with the issue that deserves a second look How prices will adjust is a matter Haavelmo gave a good deal of thought If price adjustments are always local equilibrium paths, the model economy will never move far away from the classical equilibrium—but real life economies do In the full employment regime: Inflation. Enough to make that regime? In depression regime: Deflation. Increases the “drag” of depressions 19 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion What about prices? II In a model with consumer goods and capital goods producing sectors, Haavelmo (1960) showed that investments was determined by the price of the predetermined capital stock and cost. Investment is determined by the producers of capital goods. Overdeterminancy could remain in this type of model as well. This characteristic feature [overdeterminancy] is a far more general feature than our particular model may suggest. It has little to do with the level of aggregation or disaggregation we use. It applies even if capital is perfectly mobile and all prices are perfectly flexible. Haavelmo (1960, p 200) 20 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion What about prices? III Has Wicksell left the building? Not at all. Assume that the inflation-process is proportional to rk − rk∗ Now, even if the authorities are unable to observe G (i ), one policy prescription could be to target inflation! But Haavelmo has added a twist: Even if inflation targeting will move the economy towards ’classical equilibrium’ locally, the adjustment process has the risk of over-shooting, thus rapidly causing a new downturn 21 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion What about prices? IV What is the relation to New Keynesian macro? In NK models, inflation is an equililbrium phenomenon Prices are sticky, but it does not prevent market clearing since agents are adjusting their behavior to the institutional framework (which includes in what way prices are sticky) Business cycles are thus deviations from the long-run steady state, but the economy is nevertheless always in equilibrium Sharp contrast to Haavelmo’s model, where price rigidity must be interpreted as a breakdown of the universal auctioneer who, in a classical model, serves as the market clearing mechanism 22 / 23 Introduction Macroeconomic research Why haven’t you heard? Business-cycle model Discussion References References 1 Anundsen, A. K., Krogh, T. S., Nymoen, R. and Vislie, J. (2011): Overdeterminacy and endogenous cycles: Trygve Haavelmo’s business cycle model and its implications for monetary policy, Memorandum fra Økonomisk institutt, Universitetet i Oslo, 03/2011. 2 Bårdsen, Fisher, P. G. and Nymoen, R. (1998): Business Cycles: Real Facts or Fallacies? Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium, Cambridge University Press, 3 Haavelmo, T (1954): A Study in the Theory of Economic Evolution. Contributions to Economic Analysis III, North Holland Publishing Company, Amsterdam, 1954 (second edition 1956, third edition 1964), 114 4 Haavelmo, T (1960): A Study in the Theory of Investment. The University of Chicago Press. 5 Haavelmo, T (1969): Orientering i Makrokønomisk Teori. [Studies in Macroeconomic Theory]. Universitetsforlaget, Oslo. 6 Moene, K. O. and A. Rødseth (1991): Nobel laureate: Trygve Haavelmo, The Journal of Economic Perspectives, 5(3), 175-192. 7 Sargan, J. D. (1964): Wages and prices in the United Kingdom: a study in econometric methodology, in P.E. Hart, G. Mills og J.K. Whitaker: Econometric analysis for national economic planning. Butterworths, London. 23 / 23