China’s Rare Earth Elements Industry: What Can the West Learn? March 2010

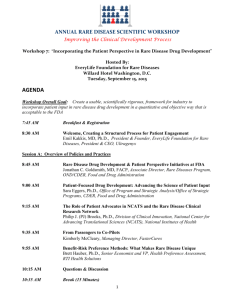

advertisement