Legacy City Revitalization: The Role of Federal Historic Tax Credit Projects

advertisement

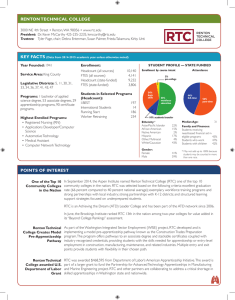

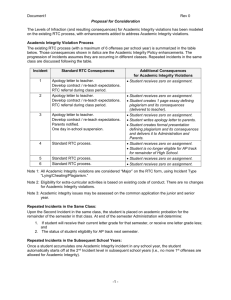

Legacy City Revitalization: The Role of Federal Historic Tax Credit Projects Kelly L. Kinahan, AICP Doctoral Candidate Levin College Research Conference August 20, 2015 Research Questions (1) What is the distribution of RTC activity across legacy city neighborhood types? (2) What is the relationship between historic tax credit activity and changes neighborhood racial, socioeconomic, and housing characteristics? 2 Legacy cities: shrinking, post-industrial, right-sizing, etc. Long-term population loss Economic restructuring Vacancy, abandonment, foreclosures Baltimore, Cleveland, Philadelphia, Richmond, & St. Louis Federal historic rehabilitation tax credits (RTCs): 20% federal income tax credit National Register of Historic Places Income-producing (not owner-occupied) “the largest federal program specifically supporting historic preservation” (NPS, 2015, p.1) $73 billion of investment for more than 40,000 preservation projects 3 Literature Framework: Legacy Cities Demolition: Blight remediation and neighborhood stabilization Not a question of if, but where and to what extent Unknowns: effect on surrounding property values, balance protection of cultural and historic resources, long-term impacts Historic buildings: Core assets for neighborhood revitalization and stabilization Preservation is largely absent from both broader policy discussions and the implemented approaches Recent revitalization trends, particularly downtowns Unknowns: how is preservation activity contributing to revitalization? 4 Literature Framework: Urban Preservation Analysis of program effects: standard economic impact analyses at state and federal levels Historic preservation and gentrification “preservation efforts are more prone to cause displacement than redevelopment projects involving new construction” because “property values and rents begin to increase even before the real estate experiences much improvement” (Werwath, 1998, p. 489) Limited empirical evidence All types of neighborhood investment? Weak market context of legacy cities? 5 Data Historic Tax Credit data: Technical Preservation Services Division of the National Parks Service Federal RTC projects from 1998-2007 Geolytics’ Neighborhood Change Database: Normalized census tract data to 2010 boundaries Pre-intervention: Census 2000 Post-intervention: American Community Survey 2006-2010 (5year estimates) 6 Dependent Variables Race/Ethnicity Expected Sign Share of Non-Hispanic White +/- Share of Non-Hispanic Black +/- Share of Hispanics +/- References Bures, (2001); Deng, (2012); Mallach (2015); Podagrosi & Vojnovic, (2008); Swanstrom & Webber, (2014) Bures, (2001); Hollander (2010); Mallach (2015); Podagrosi & Vojnovic, (2008); Swanstrom & Webber, (2014) Bures, (2001); Swanstrom & Webber, (2014) Socio-economic Bachelor's Degree or greater + Professional/Technical workers + Median Household Income + Share of low-, middle-, and upper income persons +/- Poverty Rate - Households + Allison, (2005); Coulson & Leichenko, (2004); Deng, (2012); Mallach (2015); Montgomery, (2004) Allison, (2005); Blakely, (2001); Coulson & Leichenko, (2004); Filion, (2010); Florida, (2002); Swanstrom & Webber, (2014) Allison, (2005); Coulson & Leichenko, (2004); Smith, (1998); Mallach (2015); Swanstrom & Webber, (2014); Werwath, (1998) Allison, (2005); Coulson & Leichenko, (2004); Smith, (1998); Mallach (2015); Swanstrom & Webber, (2014); Werwath, (1998) Allison, (2005); Coulson & Leichenko, (2004); Deng (2012); Hollander (2010); Smith, (1998); Swanstrom & Webber, (2014); Werwath, (1998) Birch, (2005); NPS, (2014); Stern & Seifert, (2010); Ryberg-Webster, (2014a, 2014b) Housing Median Housing Value + Median Rent + Allison, (2005); Bures, (2001); Coulson & Leichenko, (2004); Deng (2012); Smith, (1998); Swanstrom & Webber, (2014); Werwath, (1998) Allison, (2005); Bures, (2001); Coulson & Leichenko, (2004); Deng (2012); Smith, (1998); Swanstrom & Webber, (2014); Werwath, (1998) 7 Methods (1) what is the distribution of RTC activity across legacy city neighborhood types and transition patterns? Descriptive statistics, maps 8 Neigbborhood Neigbborhood Type Category Black, Stressed, & Disadvantaged Highly Distressed Collapsed Urban Core Highly Distressed Competitive & Educated some Distress Stable Declining & Black Highly Distressed Educated Newcomers Stable Established & Stable Homeowners Stable Highly Bifurcated: Success & Distress Stable White Immigrants Highly Distressed Description low-value housing;low-income families with little educational attainment; residents are primarily black, unemployed, and living below the poverty line long-term renters, high rates of poverty and public assistance among renters; high vacancy rates, weak housing values, and low educational attainment; large share of the population is under 18, black, and unemployed; higher-than average rents; some white residents high-value housing, well-educated singles, and higher-than-average income; white residents, rents higher than city and MSA averages; high rates of poverty and public assistance among renters weak housing values, paired with low educational attainment, high rates of public assistance, among low-income black families high housing values with well-educated, highincome singles high levels of homeownership, low levels of poverty and public assistance, people that have lived in their homes and the neighborhood for an extended period of time, low vacancy, and little multifamily housing high rates of poverty and public assistance, transient renters; high-value housing occupied by well-educated singles; lowincome renters very old housing stock; primarily white residents; some foreign born and Hispanic residents Share of Distribution Highest Neighborhood Concentration Ratio City Census Year Gaining/Losing Share, 1970-2010* Most Common Transition Pattern 19% STL (1.20) 2010 (1.21) +7.7% Collapsed Urban Core; Declining & Black (all years) 7% BAL (1.24) 1990 (1.10) -0.1% Black, Stressed & Disadvantaged Bifurcated: Success & Distress; Educated Newcomers (all years) 8% PHI (1.32) 2010 (1.11) +1.4% 19% RVA (1.19) 2000 (1.21) +4.1% Black, Stressed, & Disadvantaged -8.1% Established & Stable Homeowners (19702010); Declining & Black (1970-2000) 13% RVA (1.49) 1970 (1.30) 16% STL (1.30) 1970 (1.14) -2.9% Educated Newcomers(1970-80); White Immigrant (1980-2010) 7% RVA (2.11) 2000 (1.21) +2.1% Competitive & Educated some Distress 11% PHI (1.28) 1970 (1.20) -4.2% Black, Stressed & Disadvantaged *Based on the share of all 1970 neighborhoods in the neighborhood type compared to the share of 2010 neighborhood in the type. 9 Tracts Highly Distressed Black, Distressed, & Disadvantaged Collapsed Urban Core Declining and Black White Immigrants Subtotal Stable Competitive & Educated, some Distress Educated Newcomers Established and Stable Homeowners Highly Bifurcated Subtotal Total Tracts with RTC Activity Total Tracts Total RTC Projects Total RTC Investment Baltimore RTC Projects RTC Tracts 28% 8% 18% 5% 59% 29% 5% 7% 0% 41% 11% 10% 14% 6% 41% 37% 2% 2% 17% 59% RTC Investment Tracts Cleveland RTC Projects RTC Tracts 17% 2% 3% 0% 22% $ 50,306,545 27% $ 13,313,764 8% $ 32,476,179 19% $ 10% 15% 64% 32% 12% 16% 4% 64% 43% 1% 1% 34% 78% 21% 198 194 $620,770,963 $ 305,166,688 5% $ 2,636,555 5% $ 6,483,810 18% $ 210,387,420 9% 85% 36% 12% 0% 0% 24% 36% Richmond RTC Projects RTC Tracts Tracts Highly Distressed Black, Distressed, & Disadvantaged Collapsed Urban Core Declining and Black White Immigrants Subtotal Stable Competitive & Educated, some Distress Educated Newcomers Established and Stable Homeowners Highly Bifurcated Subtotal Total Tracts with RTC Activity Total Tracts Total RTC Projects Total RTC Investment 27% 3% 21% 2% 53% 36% 4% 11% 0% 50% 0% 14% 15% 18% 47% 0% 14% 0% 36% 50% RTC Investment Tracts RTC Tracts Philadelphia RTC Projects 10% 6% 4% 1% 21% $ 55,023,634 $ 20,383,484 $ 6,599,639 $ 34,201 13% 18% 5% 23% 13% 59% 8% 2% 22% 0% 31% 48% 0% 0% 31% 79% 15% 172 90 $625,580,807 $ 480,377,334 $ $ $ 63,162,515 87% 13% 9% 13% 6% 41% 43% 8% 2% 16% 69% RTC Investment RTC Tracts Tracts 38% 0% 1% 0% 39% $ 179,310,603 $ 4,196,399 $ 4,778,212 $ 30% 26% 15% 9% 15% 17% 12% 7% 9% 59% 50% 0% 5% 0% 56% 61% 42% 66 369 $624,961,613 $ $ 40,854,688 $ $ 395,821,709 70% 8% 24% 5% 0% 18% 3% 9% 24% 41% 50% St. Louis RTC Projects 3% 23% 18% 4% 48% RTC Investment 2% 2% 16% 0% 20% $ 13,028,492 $ 882,086 $ 112,600,212 $ 10% 64% 3% 1% 13% 80% 14% 375 188 $1,299,874,545 $ 677,656,517 $ 35,045,262 $ 6,688,452 $ 453,973,524 90% RTC Investment $ $ $ $ 20,650,408 148,329,832 26,205,470 11,902,295 16% 26% $ 782,145,803 0% $ 0% $ 391,795 26% $ 316,499,079 52% 84% 32% 106 388 $1,306,124,683 10 Methods (1) what is the distribution of RTC activity across legacy city neighborhood types and transition patterns? Descriptive statistics, maps (2) what is the relationship between historic tax credit activity and neighborhood racial, socioeconomic, and housing characteristics? Difference-in-difference regression model understand whether rehabilitation activity accelerated neighborhood changes or if they continued at the same rate baseline differences between RTC and non-RTC tracts are accounted for 12 Non-Hispanic Whites Non-Hispanic Blacks Hispanic Households Bachelor's Degree or Greater Professional/Technical Workers Poverty Median Household Income Very low-income (30% of city MHI or less) Low-income (31-50% of city MHI) Moderate income (51-80% of city MHI) Middle income (81-120% of city MHI) Upper income (120% of city MHI or greater) Share of Housing Units 50 years or older Median Rent Median Housing Value RTC Non-RTC RTC Non-RTC Tracts Tracts Tracts Tracts 2000 2010 43.4% 37.8% 44.1% 33.3% 46.1% 52.2% 42.2% 54.0% 4.3% 5.6% 5.9% 7.6% 1,341 1,386 1329 1308 27.0% 15.9% 36.9% 19.2% 24.2% 17.8% 28.0% 19.0% 28.4% 23.8% 28.7% 25.7% $36,009 $39,507 $38,319 $36,322 23.5% 19.4% 17.9% 15.8% 9.2% 8.8% 12.6% 13.9% 12.9% 13.7% 11.0% 12.4% 13.9% 14.5% 15.2% 16.4% 40.8% 43.6% 43.3% 41.2% 63.8% 57.6% 73.5% 74.5% $680 $656 $847 $774 $121,406 $88,471 $211,250 $137,811 13 Statistical Model Yit=α+β1(RTCi)+β2(Postt)+β3(RTC ⋅ Post)it+ β4(City)+ϵit where: α = intercept β = coefficient RTC = dummy variable for neighborhoods with historic tax credit investment between 1998 and 2007 Post = dummy variable for the post treatment period of 2010 City= Citywide fixed effects Y = Value (in log form) for revitalization indicators in census tract i in year t ϵ = a random error term with the usual assumed statistical properties 14 Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 All RTC tracts Above median RTC tracts Below median RTC tracts Stable (2000) RTC tracts All RTC tracts Above median RTC tracts 178 89 89 95 178 89 All non-RTC tracts All non-RTC tracts and below median RTC tracts All non-RTC tracts and above median RTC tracts All non-RTC tracts and all non-Stable RTC tracts Matched comparison tracts Matched comparison tracts and below median RTC tracts n 742 831 831 835 152 241 Total observations 920 920 920 920 330 330 Treatment Group n Comparison Group 15 Model 1 Dependent Variables Model 6 Above RTC and Median Above Below Stable RTC Matched RTC and Full Model Median Median RTC Tracts Comp. Matched RTC Tracts Tracts (2000) Model Comparison Group Race/Ethnicity Percent Hispanic -0.050 Percent Non-Hispanic Black -0.069 ** Percent Non-Hispanic White -0.001 Socio-economic Income Groups Very-low income -0.001 Low-income -0.065 ** Moderate-income -0.056 * Middle-income 0.002 Upper-income 0.060 * Median Houshold Income 0.078 ** Percent Bachelor's or more 0.040 Percent Professional/Technical workers 0.059 * Poverty Rate -0.052 Housing Households 0.038 Median Housing Value 0.086 *** Median Rent 0.024 Observations 920 All Dependent variables are in natural log form. ***p<0.01, **p<0.05, *p<0.1 Model 2 Model 3 Model 4 Model 5 -0.053 -0.060 * 0.011 -0.012 -0.030 -0.013 -0.056 * -0.062 * -0.017 0.280 -0.078 0.317 -0.066 0.292 0.063 0.033 -0.046 -0.020 0.065 ** 0.019 0.066 ** 0.029 0.034 -0.030 -0.034 -0.038 -0.052 * -0.062 * 0.058 * 0.036 0.023 0.043 -0.038 0.013 -0.087 *** -0.072 ** 0.012 0.024 0.083 *** 0.012 0.001 -0.031 0.414 0.269 0.602 0.826 0.631 0.331 0.292 0.181 0.781 0.066 ** 0.060 ** 0.026 920 -0.017 0.052 * 0.005 920 0.051 0.092 *** 0.037 920 0.088 -0.044 0.012 0.127 ** -0.024 0.060 0.038 0.033 -0.001 0.304 0.117 ** 0.117 0.053 0.367 0.047 330 330 20 Key Findings & Policy Implications RTC incentivizes investment in weak market conditions RTC projects are contributing to important LC neighborhood revitalization goals- attracting more upper-income earners and professional/technical workers as well as increased median household income and median housing values Negative change effects- loss of non-Hispanic black and lowand moderate-income residents. Most evident in Stable neighborhoods These differences vary, however, based on the scale of RTC investment, the status of the neighborhood prior to RTC activity, and the composition group of comparison tracts 21 Key Findings & Policy Implications Legacy city policy: Including RTCs in strategic targeting frameworks for neighborhood stabilization Federal/state policy: Requiring greater coordination with local planning efforts; training for real estate developers on program use Evidence that RTC activity does play a significant role in the complex neighborhood change processes of legacy cities 22 Legacy City Revitalization: The Role of Federal Historic Tax Credit Projects Kelly L. Kinahan, AICP Doctoral Candidate Levin College Research Conference August 20, 2015