L U W B

advertisement

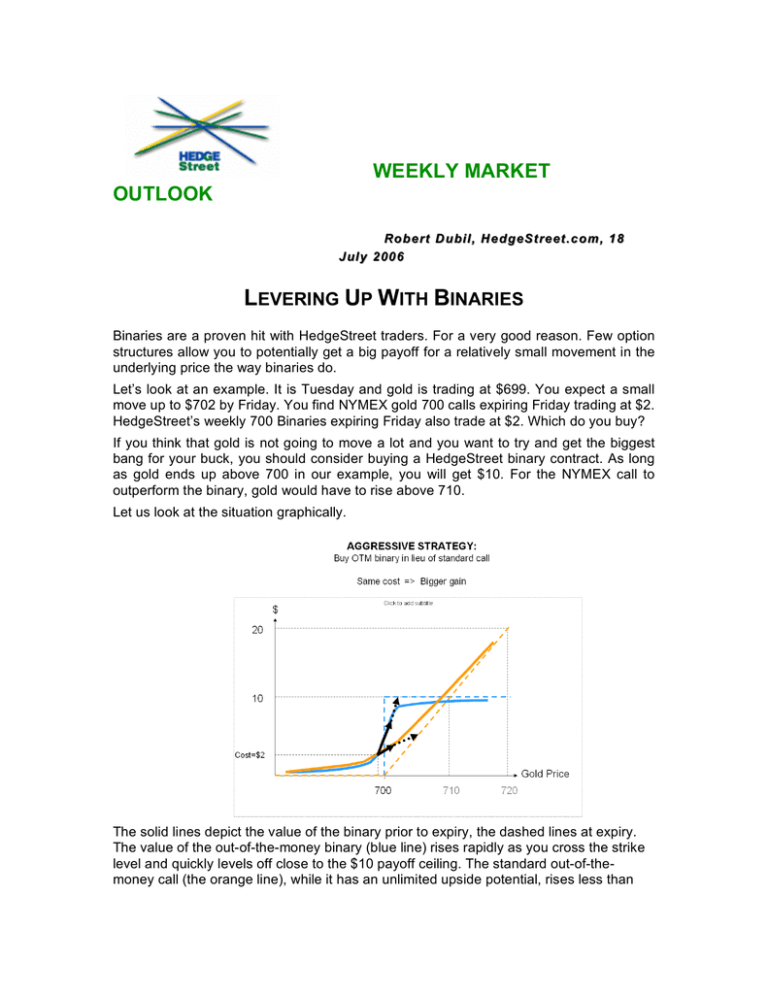

WEEKLY MARKET OUTLOOK Robe rt D ubil, H e dgeSt re et .c om , 1 8 J uly 2 00 6 LEVERING UP WITH BINARIES Binaries are a proven hit with HedgeStreet traders. For a very good reason. Few option structures allow you to potentially get a big payoff for a relatively small movement in the underlying price the way binaries do. Let’s look at an example. It is Tuesday and gold is trading at $699. You expect a small move up to $702 by Friday. You find NYMEX gold 700 calls expiring Friday trading at $2. HedgeStreet’s weekly 700 Binaries expiring Friday also trade at $2. Which do you buy? If you think that gold is not going to move a lot and you want to try and get the biggest bang for your buck, you should consider buying a HedgeStreet binary contract. As long as gold ends up above 700 in our example, you will get $10. For the NYMEX call to outperform the binary, gold would have to rise above 710. Let us look at the situation graphically. The solid lines depict the value of the binary prior to expiry, the dashed lines at expiry. The value of the out-of-the-money binary (blue line) rises rapidly as you cross the strike level and quickly levels off close to the $10 payoff ceiling. The standard out-of-themoney call (the orange line), while it has an unlimited upside potential, rises less than dollar-for-dollar as you cross the strike. Gold has to get to 702 before you break even on the call, yet the binary will pay $10 at any level above 700. Binaries: a big payoff for a small move. Dr. Robert Dubil, HedgeStreet’s Chief Economist, has had successful careers both in the financial industry and in academia. In the former, Dr. Dubil’s positions have included director of risk analytics technology and senior strategy consultant for Merrill Lynch; director of U.S. fixed income options trading and quantitative analysis for Union Bank of Switzerland; head of U.S. dollar exotic options for Chase Manhattan Bank; and VP, derivatives trader for Merrill Lynch and for Nomura Securities. The author of An Arbitrage Guide to Financial Markets as well as numerous scholarly papers, Dr. Dubil is currently Associate Professor of Finance at the University of Utah. He holds a Certificate in EEC Law & Economics from Tilburg University, Netherlands; an MA (ABD) in finance from the University of Pennsylvania, Wharton School; and an MBA in finance/ statistics and a PhD in finance from the University of Connecticut. This outlook report contains statements of fact relating to economic conditions and trading on HedgeStreet generally. Although these statements of fact have been obtained from and are based on sources that HedgeStreet believes to be reliable, we do not guarantee their accuracy and any such information might be incomplete or condensed. All opinions and estimates included in this report constitute HedgeStreet's judgment as of the date of this report and are subject to change without notice. This report is for information purposes only. It is not intended as an offer or a solicitation with respect to the purchase or sale of a futures or options contract, and it should not be interpreted as such. HedgeStreet Inc. maintains a wholly owned subsidiary that may be acting as market maker for the products mentioned in this outlook report and therefore may be effecting volume and pricing levels as described herein.