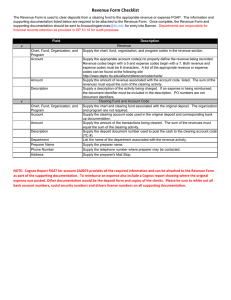

TEXAS TECH UNIVERSITY Revenue Form

TEXAS TECH UNIVERSITY

Revenue Form

Accounting Use Only

Transaction Date Document ID

CHART

Revenue

FUND

Accounting Approval

ORGANIZATION PROGRAM ACCOUNT AMOUNT DESCRIPTION

Clearing Fund and Account code

Department Preparer Name Phone Number Mail Stop

The Revenue form may be used to clear deposits from the clearing fund and account code to the appropriate revenue or expense FOAP.

Please attach any documentation assoicated with the deposit and forward to Financial Services & Tax for entry. Departments shall provide any necessary documentation to Financial Accounting & Reporting, Sponsored Programs Accounting & Reporting, and auditors upon request.

Field Description

Revenue

Chart, Fund, Organization, and

Program

Supply the chart, fund, organization, and program codes in the revenue section.

Account

Supply the appropriate account code(s) to properly define the revenue being recorded. Revenue codes begin with a 5 and expense codes begin with a 7. A list of the appropriate revenue or expense codes can be found at the following site http://www.depts.ttu.edu/afism/reference/codecharts/

Amount

Supply the amount of revenue associated with the account code listed. The sum of the revenues must equal the sum of the clearing activity.

Description

Supply a description of the activity being charged.

Clearing Fund and Account Code

Chart, Fund, Organization, and

Program

Supply the chart and clearing fund associated with the original deposit. The organization and program are not required.

Account

Supply the clearing account code used in the orginal deposit.

Amount

Description

Department

Preparer Name

Supply the amount of the transactions being cleared. The sum of the revenues must equal the sum of the clearing activity.

Supply the deposit document number used to post the cash to the clearing account code.

List the name of the department associated with the revenue activity.

Supply the preparer name.

Phone Number

Supply the telephone number where preparer may be contacted.

Address

Supply the preparer's Mail Stop.

After the form has been completed, please deliver to Drane Hall, Room 221, via mail to Mail Stop 1091 or email the form to

Accountingservices

@ttu.edu.

Upon receipt of the Revenue Form, it will be reviewed by the accountants for completion, timeliness, and appropriateness based on the fund class.

Special considerations:

To research revenues allowed on certain fund class please visit the following site

http://www.depts.ttu.edu/afism/training/documents/codeSerchDemo.htm