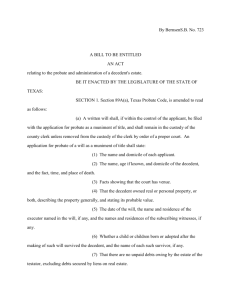

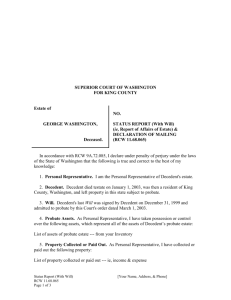

Texas Probate Passport

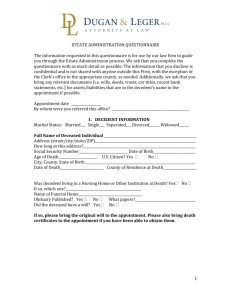

advertisement