_LBRARIES

Academic Entrepreneurial Ecosystem Strategy in the

New York State Capital Region

by

Daniel Mark Adsit

B.S., Information Science, Systems and Technology

Cornell University, 2006

Submitted to the System Design & Management Program

In Partial Fulfillment of the Requirements for the Degree of

Master of Science in Engineering and Management

MASSACHUET

OF

INSII E

JUN 2 6 2014

_LBRARIES

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

February 2014

© 2014 Daniel Mark Adsit. All Rights Reserved.

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created.

Signature redacted

Signature of A uthor...........................................................................................................................

Daniel Mark Adsit

Signature redacted

System Design & Management Program

January 14, 2014

Certified by .....

Accepted by ...................

..................................................................

Signa

Michael A M Davies r)

S~~e turg MIT S oan chool of Management

ture redacted

Thesis Supervisor

IV

Patrick Hale

Director, System Design & Management Program

1

This page intentionally left blank.

2

Academic Entrepreneurial Ecosystem Strategy in the New York

State Capital Region

by Daniel Mark Adsit

Submitted to the System Design & Management Program on

January 14, 2014 in Partial Fulfillment of the Requirements for the

Degree of Master of Science in Engineering and Management

ABSTRACT

The upstate New York regions are historically significant, but experienced economic decline throughout the later twentieth century. The New York State capital region, located approximately 150 miles north of New York City and west of Boston, has developed government, academic, and industrial institutions that influence economic performance and relationships.

Academic theories about cluster and agglomeration development indicate that complex productivity and network dependencies significantly impact economic sustainability and resilience, while entrepreneurial activity is a critical development factor in cluster dependencies.

Applied concepts from the MIT Regional Entrepreneurial Acceleration Laboratory (REAL) highlight innovative and entrepreneurial capacities linkages in the capital region, and opportunities for stakeholders to facilitate entrepreneurship.

Annually, over twenty capital region academic institutions dispatch thousands of graduates into the regional, national, and global economies with skills and experiences.

However, professional social network data indicates that significant fractions of regional graduates that demonstrate innovative and entrepreneurial capacities have departed in the past twenty-three years. Therefore, challenges exist to provide regional economic opportunities to these graduates.

Academic entrepreneurial ecosystems present economic opportunities for regional graduates, entrepreneurial ventures, and future jobs. A system engineering analysis reveals networked accelerator potential to enhance existing academic programs, improve venture success, and reduce student entrepreneurial risk.

Thesis Supervisor: Michael A M Davies

Senior Lecturer, MIT Sloan School of Management

3

This page intentionally left blank.

4

ACKNOWLEDGEMENTS

Thank you to all who have contributed to the success of this project. It has been a long but worthwhile process, and I am sincerely thankful for each of you.

To God, for new opportunities and challenges.

To my family, Dr. Mark Adsit, Sylvia Adsit, Laura Adsit, and Jonathan Adsit for all your support through the years.

To Michael Davies, Senior Lecturer at the MIT Sloan School of Management, for your guidance, feedback, good cups of coffee, and always making time for this project.

From the MIT Regional Entrepreneurial Acceleration Laboratory (REAL): e

To Fiona Murray, Associate Dean of Innovation, Alvin J. Siteman (1948) Professor of

Entrepreneurship, and Faculty Director at Martin Trust Center for MIT Entrepreneurship, for your guidance, source recommendations, and project feedback.

e

To Dr. Phil Budden, Senior Lecturer at the MIT Sloan School of Management and former

British Consul in Boston, for your perspectives on government initiatives.

From the MIT System Design and Management (SDM) Program: e e

To Pat Hale, Director of the MIT SDM program, for input and data collection support.

To Bill Foley for organizing our deliverables.

To all the other SDM staff who make our program and projects possible.

From MIT Engineering Systems Division:

* To Dr. Qi Van Eikema Hommes, MIT Research Scientist, for systems engineering techniques presented in MIT ESD.33. e

To the Fresh.Local.Food. team members Ryan Jackson, Alhely Almazan Morales, Brian

Hendrix, and Raymond Uros for a challenging opportunity to apply systems engineering techniques together.

* To Tom Allen, Howard W. Johnson Professor of Management, Emeritus for feedback on collaborative data collection.

From the New York State capital region: To the academic, government, entrepreneurial, industry, risk capital, and community stakeholders who provided essential context and input during this investigation.

5

This page intentionally left blank.

6

TABLE OF CONTENTS

M otivation...........................................................................................

10

Introduction.........................................................................................

12

Chapter 1: Regional Cluster and Agglomeration Analysis in the New

York State Capital Region ................................................................. 14

1.1 New York State capital region context ...................................................

1.1.1 A cadem ic context.................................................................................................

15

. 15

1.1.2 Commercial and industrial context ......................................................................

16

1.1.3 Regional economic stakeholder linkage ..............................................................

18

1.2 Comparative perspectives on clusters and agglomerations...................... 22

1.2.1 Productivity perspective........................................................................................

23

1.2.2 N etw ork perspective ............................................................................................

25

1.2.3 Entrepreneurial development perspective.............................................................

27

1.3 Regional clusters in the New York State capital region .........................

30

Chapter 2: Innovative and Entrepreneurial Capacities in the New York

State Capital Region ..........................................................................

31

2.1 Regional entrepreneurial development policies ......................................

32

2.1.1 Regional policies that develop "cluster" dependencies ........................................

32

2.1.2 Regional policies that facilitate entrepreneurship.................................................

33

2.1.3 MIT Regional Entrepreneurial Acceleration framework......................................

34

2.2 Innovative and entrepreneurial capacities...............................................

35

2.2.1 Innovative capacity ..............................................................................................

35

2.2.2 Entrepreneurial capacity .......................................................................................

40

2.2.3 Innovative and entrepreneurial capacities linkage................................................

46

Chapter 3: Innovative and Entrepreneurial Graduates in the New York

State Capital Region..........................................................................

48

3.1 Exploring graduate retention with social networking .............................

49

3.2 .1 H ypothesis ................................................................................................................

49

3 .2 .2 M eth od ......................................................................................................................

50

3.2.2 Potential lim itations and risks.............................................................................

51

3.2 Innovative and entrepreneurial graduate retention...................................

54

3.2.1 Graduates with innovative and entrepreneurial capacities....................................

54

3.2.2 Graduates with innovative and entrepreneurial capacities within the region .....

56

3.2.3 Implications of regional preference and economic opportunities......................... 58

Chapter 4: Academic Entrepreneurial Ecosystem Analysis in the New

York State Capital Region .................................................................

60

4.1 Academic entrepreneurial theory ............................................................

61

4.2 Academic entrepreneurial ecosystem boundary and controls.......... 62

7

4.2.1 System stakeholders.............................................................................................

4.2.2 System boundary..................................................................................................

4.2.3 System controls...................................................................................................

66

. 69

4.3 Academic entrepreneurial ecosystem needs and system requirements....... 72

4.3.1 Primary stakeholder needs ..................................................................................

4.3.2 System requirements mapping ..............................................................................

62

72

76

Chapter 5: Academic Entrepreneurial Ecosystem Concept Analysis .... 85

5.1 Academic entrepreneurial system concepts ................................................

86

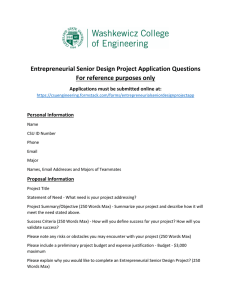

5.1.1 Academic incubators and educational programs .................................................. 86

5.1.2 Entrepreneurial communities and networks.......................................................... 87

5.1.3 Entrepreneurial accelerators................................................................................ 89

5.2 Academic entrepreneurial ecosystem concept selection .............

91

5.2.1 Initial system concept selection ........................................................................... 92

5.2.2 Emerging system concept selection...................................................................... 96

Chapter 6: Conclusion..........................................................................

100

6.1 Recommendations for regional policymakers........................................... 102

6.2 Recommendations for academic leadership.............................................. 103

6.3 Recommendations for business leadership ............................................... 104

6.4 Recommendations for student entrepreneurs ............................................

105

Appendix.............................................................................................. 106

References............................................................................................ 117

8

6

7

LIST OF FIGURES

1

2

3

4

5

Academic publication subject areas within New York State capital region cities betw een 1990 and 2013 ................................................................................................

Currently operating innovative enterprises by founding year with primary locations in New York State capital region counties...................................................

Patents issued by year for enterprises founded within New York State capital region counties ...................................................................................................

38

44

47

Innovative and entrepreneurial graduates from four New York State capital region institutions between 1990 and 2012........................................................55

Fraction of innovative and entrepreneurial graduates currently within the N ew York State capital region................................................................................. action and feedback controls..........................................................................................

57

New York State capital region academic entrepreneurial ecosystem boundary............67

New York State capital region academic entrepreneurial ecosystem

70

LIST OF TABLES

1

2

3

Top fifteen employers in the New York State capital region ........................................ 17

Top fifteen patent assignees in the New York State capital region betw een 1990 and 2013 ...............................................................................................

39

Identified academic entrepreneurial initiatives at four institutions within the New York State capital region......................................................................42

4

5

6

7

8

Academic entrepreneurial ecosystem education requirements mapped to stakeholder needs......................................................................................................

78

Academic entrepreneurial ecosystem innovation requirements mapped to stakeholder needs......................................................................................................

80

Academic entrepreneurial ecosystem funding requirements mapped to stakeholder needs ....................................................................................................

82

Academic entrepreneurial ecosystem networking requirements mapped to stakeholder needs......................................................................................................

Summary of ranked academic entrepreneurial ecosystem requirements......................93

84

9 Initial academic entrepreneurial ecosystem concept selection analysis by ranked requirem ent .....................................................................................

10 Emerging academic entrepreneurial ecosystem combination concept selection analysis by ranked requirem ent .....................................................................................

94

97

9

MOTIVATION

As a Fellow in the System Design and Management (SDM) program at the Massachusetts

Institute of Technology (MIT), I focused on leveraging systems solutions to solve complex challenges in broad business contexts. Prior to MIT, I spent almost seven years designing manufacturing and supply chain systems in over fifteen countries around the world. These experiences provided me with a global perspective, a capability to interact in different system stakeholder contexts, and a renewed respect for the rich culture and people that shaped the first twenty-two years of my life in upstate New York.

The regions of upstate New York, positioned between New York City, New England,

Canada, and the Great Lakes, were historically significant in the early development of the United

States. Albany is strategically located on the Hudson River, and eventually became the state capital. The cities of Syracuse, Rochester and Buffalo rose to prominence around agriculture, manufacturing, and milling industries following the development of the Erie Canal that linked the Hudson River with the Great Lakes. Around Rochester, an imaging empire with academic linkage emerged from firms such as Eastman Kodak and Xerox. George Eastman, who founded

Kodak, contributed significantly to the University of Rochester, and also to MIT.

Gradually over the twentieth century, upstate New York fell from prominence as the national and global economies became more complex. Agriculture and manufacturing became

highly competitive puzzles. Large and seemingly unstoppable institutions including Kodak and

Xerox gradually fell from grace, taking entire communities with them. Today, as one parallels the Erie Canal along the New York State Thruway, shadows of former industrial towns lie dormant along the roadside. Despite these economic struggles, I believe that upstate New York regions, with rich history, natural beauty, and determined people, can rise again in the national and global economies. As a graduate of the College of Engineering at Cornell University, I am a

10

product of New York's legacy and future. This is my home, and I feel compelled to dedicate my perspective and experience to realize its potential.

This investigation has convinced me that the New York State capital region has an exceptional legacy of innovation, hard work, educational opportunity, and resources. With such an evolved history, I am curious how we will engage nationally and globally. Our institutional and resource configurations will impact our integration into more complex economic systems than ever before. Whether we like it or not, the world will continue to change around us, and the way that we deploy, leverage, and network regionally will determine our continued position. In this investigation, I focus on economic sustainability in the capital region around Albany,

Schenectady, Troy and Saratoga Springs.

As we have seen powerful institutions crumble, we must develop natural dependencies, open infrastructure, and talent networks embedded in a strong, dynamic, and distributed regional foundation. We cannot afford monoculture, oligopolies, or institutionalism. New innovative entrepreneurial ventures are absolutely essential to develop this regional resilience, and a regional strategy must simultaneously engage our unique government, academic, industry, community, and entrepreneurial stakeholders to rapidly develop and retain innovative and entrepreneurial capacities. New acceleration concepts provide potential to rapidly develop innovative and entrepreneurial ventures and minimize the underlying risks.

I hope that this investigation facilitates future discussion about the types of institutions, networks, capabilities, and initiatives that are necessary for long-term regional competitiveness within national and global economies. While this certainly does not provide all the answers, it may serve as an opportunity to discuss different implementable concepts.

11

INTRODUCTION

This project has two main components. The regional analysis discovers underlying unique innovative and entrepreneurial elements in the New York State capital region economy, while a system engineering analysis reconstructs these elements to produce a desired emergent property: innovative and entrepreneurial students who form integrated regional ventures that produce sustainable growth and jobs.

First, historical and recent dynamics in the capital region imply that it is necessary to understand what is happening, and what it means. This investigation analyzes this landscape in the context of modem academic theories about regional economic competitiveness to understand where we are as a region.

Second, having analyzed the region in the context of academic theories about competitiveness, it is still not clear what to do, or who should do it. To explore this, we turn to authorities that have studied emerging regions around the world, and identified policies and processes that make a difference. The key lesson is not to copy other regions, but discover our own regional strengths.

Third, based on the investigation of our region, it is necessary to measure one of the key factors of regional economic development: do our innovative and entrepreneurial graduates from our world class academic institutions stay in the region? Based on this, we can discuss the options to provide opportunities.

Fourth, we follow a systems engineering analysis to determine how academic entrepreneurial ecosystems can develop long-term sustainable opportunities for our innovative and entrepreneurial graduates. This emphasizes underlying stakeholder needs for system requirement generation.

12

Fifth, we leverage the system engineering analysis to select entrepreneurial ecosystem concepts for the region from existing and new concept models. This selection is based on the identified underlying system requirements.

Sixth, we provide recommendations to policymakers, academic leadership, industry leadership, and student entrepreneurs about how to best engage and benefit from innovative entrepreneurship in the capital region.

This process is a challenge, but leverages fundamental principles and methods to discover regional options. While there will always be debates about inputs and parameters, the system engineering process is the most important implication, and can be applied by anyone in any region.

13

CHAPTER

1:

REGIONAL CLUSTER AND AGGLOMERATION

ANALYSIS IN THE NEW YORK STATE CAPITAL REGION

Towards the end of the twentieth century, upstate New York experienced significant economic downturn as national and global economic competitive factors changed. The New

York State capital region is located in the eastern upstate New York, and has an established collection of academic institutions, established industry, and successful entrepreneurial ventures.

Formal relationships have developed between these economic stakeholders, especially in semiconductor manufacturing and energy focus areas.

Academic theories and frameworks about cluster and agglomeration development from sources such as Porter (1998), Saxenian (1996), and Bathelt et al. (2004) explain that sustainable productivity and networks inherent in underlying location and culture result from complex regional economies, while Feldman (2005) directly attributes complex dependencies to entrepreneurial institution and resource development. In the capital region, it is important to analyze the regional relationships from these framework perspectives, while exploring opportunities to support entrepreneurship.

While formal relationships have been established between capital region economic stakeholders, the underlying dependencies implied through these academic frameworks do not appear based on the analyzed evidence. From the framework perspectives, it is essential for the capital region to pursue opportunities to expand participants, develop regional infrastructure that benefits all participants, foster underlying networks, and continue to support entrepreneurship beyond formal institutional boundaries and partnerships. Future discussions focus on how existing policies and stakeholders can contribute to these developments.

14

1.1 New York State capital region context

Upstate New York originally emerged as a prosperous group of agricultural, manufacturing, and milling regions oriented around the Erie Canal. As the national and global economies shifted towards the end of the twentieth century, upstate New York regions experienced economic decline.

The New York State capital region is located in eastern upstate New York, approximately

150 miles north of New York City, 160 miles west of Boston, and 230 miles south of Montreal.

According to the U.S. Census Bureau, in 2012 a total population of approximately 850,000 people was distributed across 2,300 square miles in Albany, Rensselaer, Schenectady, and

Saratoga counties. In comparison to nearby major metropolitan areas, these populations and densities are small.

Within this geographic and demographic region, the cities of Albany, Troy, Schenectady, and Saratoga Springs are the primary urban centers of economic significance, and range between ten to thirty-five miles apart separated by suburban communities. Albany is the state capital, with government influence over regional academic, commercial, and industrial activities. Alongside smaller towns, Schenectady and Troy are both historically vibrant industrial cities that have experienced recent economic stress, while Saratoga Springs hosts a popular raceway, casino, and state park, and is commonly considered a gateway to the Adirondack Mountains.

1.1.1 Academic context

From an academic perspective, over twenty universities, colleges, trade schools, and other academic institutions are located within the capital region, including the State University of

New York (SUNY) at Albany, the SUNY College of Nanoscale Science and Engineering

(CNSE), Rensselaer Polytechnic Institute (RPI) in Troy, Union College in Schenectady, and

Skidmore College in Saratoga Springs. Additional institutions are listed in the Appendix by municipality.

According to the New York State Education Department, academic institutions in the capital region encompass a broad variety of academic programs, including basic sciences, engineering, nanotechnology, and business, that attract students from the local region, across

15

New York State, the domestic United States and international locations. This landscape, which in

2012 included over 64,000 "full-time equivalent" post-secondary level students enrolled in degree programs, emphasizes a rich academic legacy. The degree credit enrollment reflects an approximately twenty percent increase since 2010, which highlights increased regional academic influence.

The capital region academic institutions also actively contribute to published research. A query of the Scopus bibliographic database, containing 21,000 academic titles across 5,000 publishers, identifies over 50,000 academic publications between 1990 and 2013 with at least one author in Albany, Schenectady, Troy, and Saratoga Springs.

1.1.2 Commercial and industrial context

The New York State Department of Labor indicates that total non-farm employment in the capital region was approximately 450,000 in November 2013, with ninety percent of employees in "service providing" roles. Furthermore, approximately twenty-three percent of employees work in government, fifteen percent work in healthcare, and seven percent work in education. This distribution demonstrates historical dominance by specific sectors in the regional economy.

To provide further employment detail, Table 1 highlights the top fifteen organizations by number of employees as of November 2013 across Albany, Rensselaer, Schenectady, and

Saratoga counties, according to Dun & Bradstreet.

16

Organization

St. Peter's Health

Sector

Medical

NYS Department of Health

Government

Comptroller Office of the State of New York Government

United States Department of the Navy Military

Saratoga Hospital

Medical

KAPL, Inc.

Military

The Golub Corporation

Retail

Employees

15,188

5,800

4,000

2,800

2,500

2,200

1,936

Table 1. Top fifteen employers in the New York State (NYS) capital region, according to Dun & Bradstreet data.

There are a few key observations based on these top employers. First, the figures from the New York State Departments of Taxation and Finance, Environmental Conservation, Health,

Transportation, Motor Vehicles, and Education reflect the large percentage of workers employed through government agencies. This suggests that the state government exerts strong institutional influence over the capital region economy and culture.

Second, the capital region has a strong legacy of dominant national and global industrial enterprises, with government connections. For example, General Electric (GE), founded in

Schenectady in 1892, is the largest industrial employer in the region and maintains its global research headquarters in the region. The Knolls Atomic Power Laboratory (KAPL) is a United

States Department of Energy contract laboratory currently operated by Bechtel Marine

Propulsion Corporation, but historically operated by other firms including Lockheed Martin and

GE. KAPL also maintains a United States Navy training facility near Saratoga Springs.

Third, other large commercial and industrial participants are based in the region. The

Golub Corporation is a privately owned supermarket operator based in Schenectady, Albany

Molecular Research (AMRI) is a contract pharmaceutical research and development laboratory based in Albany, and Mohawk Paper is a privately owned specialty paper manufacturer based in

17

Cohoes. While manufacturing and milling represent a historical upstate legacy, published New

York State Department of Labor statistics indicate that manufacturing employment in the capital region declined by thirty percent in the decade between 2000 and 2010. However, recently global semiconductor manufacturing firms have entered the region. GlobalFoundries is currently completing three semiconductor fabrication facilities near Saratoga Springs at a cumulative investment of $7 billion, as reported in the Albany Times Union. Other semiconductor manufacturing firms with a physical presence in the region include Tokyo Electron and IBM.

Fourth, despite the tumultuous economic patterns, smaller entrepreneurial participants have emerged and grown in the capital region. For example, GlobalSpec was founded in 1996 as a search engine for engineering parts, and is now a subsidiary of IHS, Inc. Crystal IS was founded in 1997 by Rensselaer Polytechnic Institute (RPI) faculty to develop semiconductor technology, and was acquired by Asahi Kasei in 2011. Vicarious Visions was founded in 1990

by RPI graduates as a video game producer, and acquired by Activision in 2005. MapInfo

Corporation developed locational technology solutions and was purchased by Pitney Bowes

Corporation in 2007. RPI students, leveraging technology to develop "rigid materials" out of fungi, founded Ecovative Design in 2007. Besstech was founded in 2010 by SUNY College of

Nanoscale Science and Engineering graduates, has developed an enhanced anode production process for batteries, and received over $200,000 in research grants in 2013, according to the

Albany Business Review.

1.1.3 Regional economic stakeholder linkage

Within the capital region, there are also examples of regional stakeholder linkage between academia, government and industry. Activities suggest this trend focuses particularly in manufacturing technologies and energy applications that reflect transitioning government, academic, industry and entrepreneurial regional economic stakeholder roles.

New York State has recently increased economic development and recovery activities. In

2002 the State of New York contributed $210 million to a "semiconductor research center" at the

Center for Environmental Studies and Technology Management (CESTM) at the University at

Albany, as reported in the Albany Times Union. This has become a facility at the SUNY College of Nanoscale Science and Engineering.

18

In 2011, the state government launched the Regional Economic Development Councils

(EDC) to develop "strategic plans" and allocate development funds to statewide regions.

According to the 2013 EDC award report, Albany, Rensselaer, Saratoga, and Schenectady counties received over $31 million of EDC fund awards for development projects. The highest capital region EDC funded projects including $5 million to develop "apartments, supermarket, hotel, and banquet house" and $3 million to "provide heating and cooling to seven historic buildings" in Schenectady, and $2.5 million to "relocate" utilities for "medical office building, housing units, and parking garage" and $1.5 million for "interior fit up costs" for a regional high school in Albany. These investments significantly emphasize infrastructure projects, particularly around existing institutions.

Besides infrastructure projects, government initiatives support technology development.

According to the 2013 annual report, the New York State Energy Research and Development

Authority (NYSERDA) provided support and grants for energy-related economic growth and allocated $15 million to "Technology and Market Development," $16 million to "Energy

Research and Development," and $900,000 to the Saratoga Technology Energy Park (STEP) in

2012. These expenditures reflect particular industries and technologies, and are mostly statewide.

Finally, the state has also acknowledged entrepreneurs. Beginning in 2014, the START-

UP NY initiative provides ten years of "tax free" benefits to new businesses that locate within designated zones at statewide academic institutions and "certified" incubators. According to the

2013 EDC fund award report, Albany, Rensselaer, Saratoga, and Schenectady counties will also receive almost $900,000 from the Regional Development Councils for projects directly related to entrepreneurship, including $250,000 to establish two "Certified Business Incubators" at local academic institutions, and $550,000 to enhance a "maker" space in Troy.

From the academic perspective, Rensselaer Polytechnic Institute (RPI) established the

Center for Automation Technologies and Systems (CATS) in 1988 to conduct manufacturing process design with industrial partners, and includes regional partners including General Electric,

IBM, Pitney Bowes, Paper Battery, GlobalFoundries, KAPL, Crystal IS, Philips, Ecovative, and

Albany International. RPI also hosts the National Science Foundation (NSF) Smart Lighting

Engineering Research Center (ERC), which conducts research to improve lighting technologies efficiency and cost with over twenty global partners, including General Electric and Crystal IS.

According to the ERC website, the program was designed to encourage "collaboration" between

19

academic researchers and industry, and "transform" these industries through an

"interdisciplinary" innovation environment. The ERC program also provides practical experiences for students, and serves as an opportunity for innovative skill development within the capital region.

At the State University of New York (SUNY), academic and industrial linkage has emerged in semiconductor manufacturing. Since the initial $400 million public and private investment in 2002, the SUNY College of Nanoscale Science and Engineering (CNSE) has partnered with global semiconductor industry manufacturers to provide shared equipment and fabrication space access, as reported in the Albany Times Union. As of 2013, CNSE claims a cumulative public and private investment of over $17 billion, 300 industry partners, and 140,000 square feet of "Class 1 cleanroom" laboratory space. CNSE also provides "workforce training," high school programs, seminars, presentations, museums, and other local outreach initiatives.

In addition to supporting established industry and community, the capital region academic institutions have developed programs and organizations to support entrepreneurship.

Rensselaer Polytechnic Institute (RPI) hosts the Severino Center for Technological

Entrepreneurship and the Emerging Ventures Ecosystem (EVE) to provide entrepreneurial educational support resources for entrepreneurs. At the SUNY College of Nanoscale Science and

Engineering (CNSE), the Energy and Environmental Technologies Applications Center

(E2TAC) includes six programs in collaboration with the National Science Foundation (NSF), including the iCLEAN virtual incubator program. Additionally, Siena College hosts the Stack

Center for Innovation and Entrepreneurship to provide learning and entrepreneurial incubation, while Russell Sage College in Troy hosts the Incubator for New Ventures in Emerging Science and Technologies (INVEST) that provides physical resources and services. Finally, CNSE established the New York State Business Plan Competition in 2009 as an annual statewide prize competition for innovative student entrepreneurs.

Beyond academia, industry consortiums and groups have formed within the capital region. In 2011 the SEMATECH consortium for semiconductor manufacturing relocated from

Austin, Texas to Albany, as reported in the Albany Times Union. The New York Battery and

Energy Storage Technology (NY-BEST) consortium was created in 2010 to "position New York

State as a global leader in energy storage technology, including applications in transportation, grid storage, and power electronics" and has hundreds of members, including regional energy

20

entrepreneurial ventures. These initiatives highlight efforts to develop institutional integrations and relationships in specific focus areas.

From a regional development perspective, the Center for Economic Growth (CEG) is an industry organization in the capital region that seeks to expand economic opportunities. As part of its activities, the CEG supports multiple regional programs intended to expand "industry networks," including Bioconnex for biotechnology development, the Chief Executives Network,

"NY Loves Clean Tech," "NY Loves Nanotech," and Techconnex for information technology development. These formal program examples reflect regional linkage and development efforts.

Finally, there are eight chambers of commerce distributed throughout Albany, Rensselaer,

Saratoga, and Schenectady counties, as summarized in the Appendix.

21

1.2 Comparative perspectives on clusters and agglomerations

The New York State capital region is geographically distinct, with multi-hour travel times to major metropolitan areas, and a commuter culture between local cities and towns.

Furthermore, the linkage between academic institutions, government, and industry stakeholders is evident from the formal relationships within the region.

To effectively analyze the capital region within continually reconfiguring national and global economic landscapes, it is necessary to reflect on academic frameworks that describe competitive advantage within regional clusters and agglomerations of economic activity. These frameworks provide context to analyze the underlying regional structure, and were selected to highlight the related underlying dependency themes between authors with diverging views. The organizational implications for these themes are critical for regional economic resilience and sustainability.

First, Porter (1998) proposes that "location" facilitates "productivity" that results in regional competitive advantage. In the capital region, while there exist specific focus areas such as semiconductor manufacturing and energy, the underlying dependencies in observed linkages have not emerged beyond formal relationships. Based on the framework application, the region should continue to pursue opportunities to increase the number of regional participants, while facilitating productivity from "informal" relationships.

Second, Saxenian (1996) proposes that regional competitive advantage does not depend primarily on locational productivity, but on the ability to leverage "culturally" inherent

"networks." While there is clear relationship evidence within the capital region, the observed

"institutional" and formal "boundaries" may restrict natural "collaboration." Based on this perspective, the region should continue to foster a networking culture beyond institutions.

Third, Feldman et al. (2005) proposes that entrepreneurially developed "configurations" result in regional cluster architectures and advantages over time. While entrepreneurial ventures and development initiatives clearly exist within the capital region, the framework suggests that future effectiveness will depend on entrepreneurial influence over academic, industrial, and governmental " resources."

22

1.2.1 Productivity perspective

Porter (1998) proposes that "interconnected institutions" develop "locational" configurations over time that "enhance productivity" through "competition" and "cooperation."

Porter (2000) organizes these concepts into a framework that emphasizes four cluster productivity types: "input conditions," "context for firm strategy and rivalry," "related and supporting industries" and "demand conditions."

Porter (1998) specifically emphasizes the importance of location in clusters, but provides limited elaboration beyond "linked activities" within a "geographical" boundary. In the capital region, the areas surrounding the cities of Albany, Schenectady, Troy, and Saratoga Springs represent a geographically distinct area that includes linked government, academic, and industrial institutions and resources.

Institutions and resources

Porter (1998) suggests that "government, universities, standards-setting agencies, think tanks, vocational training providers, and trade associations" configurations and influences contribute to "location" based competitive advantage within a region. In the capital region, the most recognizable institutions include government, academia, and large industry. Porter also identifies employees, "suppliers," "knowledge," infrastructure, and "customers" as resources within regional clusters. Doloreux and Parto (2005) relates these to innovation, commenting that

"innovative activity of firms is based to a large degree on localized resources." Within the capital region, there are various examples of such resources.

From the government aspect, institutions such as the Regional Economic Development

Councils and the New York State Energy Research and Development Authority support economic and technology development with funding resources. However, these organizations are focused across the state, which is outside the geographical boundary.

From the academia aspect, Rensselaer Polytechnic Institute has established facilities for lighting, automated manufacturing, nanotechnology and entrepreneurship. The SUNY College of

Nanoscale Science and Engineering includes semiconductor manufacturing and technology facilities in Albany, a solar development center in Saratoga county, a computer chip center near

Utica, micro-electromechanical systems and photovoltaic centers near Rochester, and a medical technology center in Buffalo. The regional academic institutions in the capital region produce

23

thousands of graduates in technical disciplines each year, although these graduates may not necessarily remain in the capital region.

Academic institutions and industrial enterprises also employ skilled workers, and develop knowledge in technical applications supported by state-of-the-art laboratories and facilities constructed with both "public and private" funds. These facilities also contribute to industrial

"complementarities," as exhibited by over sixty SUNY College of Nanoscale Science and

Engineering partners with physical locations in Albany, Rensselaer, Schenectady, and Saratoga counties. These are listed in the Appendix.

Outside academia, local ventures develop supply chain relationships with larger established enterprises, tech parks, tax schemes, partnerships, consortiums, and technology incubators. For example, the Tech Valley Center of Gravity in Troy provides a "maker space" and other resources for experimentation and innovative development.

From the trade association perspective, both SEMATECH and NY-BEST respectively serve as consortiums in semiconductor manufacturing and stored energy industries, also with broader application beyond the region. For example, outside of the capital region, NY-BEST is developing a shared battery testing and commercialization center in Rochester to serve consortium members.

Productivity between participants

Porter describes how regional clusters facilitate productivity in the global economy, emphasizing implied rather than organized relationships.

Modern competition depends on productivity, not on access to inputs or the scale of individual enterprise... a cluster allows each member to benefit as if it had greater scale or as if it had joined with others formally. (Porter 1998, 80)

Based on this definition, regional clusters improve all regional participant capabilities.

Institutions and resources form foundations for productivity, but inherent interactions that are difficult to replicate outside the cluster are critical. This means that the productivity between regional institutions is as important as individual institutional productivity.

Furthermore, Porter suggests that cumulative institutional investment may result in influence, but does not contribute to complex dependencies. Instead, regional development should focus on facilitating "market" opportunities, rather than institutional dominance. Within

24

the capital region, the historical size of public and private government, academic, and industrial institutions has potential to dominate the region.

Despite the institutional size in the capital region, there is evidence of existing and developing formal relationships between important and influential institutions. The previously discussed partnerships and consortiums have created new opportunities. Furthermore, many of these institutions employ outreach initiatives to draw others into the institutional spheres.

However, cluster productivity does not necessarily emphasize formal relationships.

Over consolidation, mutual understandings, cartels and other restraints to competition may undermine local rivalry... if companies in a cluster are too inward looking, the whole cluster suffers from a collective inertia. (Porter 1998, 85)

Rather than increasing institutional control, relationships within clusters reinforce productive "cooperation" and "competition" between all participants beyond formal relationships. These dependencies are incorporated into the complex underlying regional architecture, and emphasize "rivalry" to strengthen regional economic sustainability. Formal relationships based on "subsidies," exclusivity, legislation, or other non-locational factors do not contribute to Porter's regional cluster productivity definition.

While linkage has developed in the capital region, Porter argues that clusters provide instant advantage to all regional participants, as opposed to formal relationships and agreements.

Furthermore, this concept may broadly extend to many types of organizations, including cities, towns, government departments, academic institutions, large enterprises, small enterprises, economic development organizations, and community organizations. To develop cluster productivity, the capital region should emphasize structure and strategies to enhance these dependencies.

1.2.2 Network perspective

In contrast to locational productivity perspectives, Saxenian (1996) argues "proximity reveals little about the ability of firms to respond to the fast-changing markets and technologies that now characterize international competition." While this does not imply that proximity is disadvantageous, it means that efficiencies inadequately explain "differential performance" between regions, and proposes that deeper regional "networks of relationships" produce natural

"collaboration."

25

Social and cultural networks

Saxenian remarks that regional participants inherit regional institution modes and behaviors.

By drawing a sharp distinction between what occurs inside and what occurs outside the firm, scholars overlook the complex and historically evolved relations among the internal organization offirms and their connections to one another and to the social structures and institutions of a particular locality. (Saxenian 1996, 42)

Therefore, the formal "boundaries" between enterprises, commercial associations, and academic institutions that embody underlying "social" functions indicate the natural behaviors within a region. These formal "boundaries" become inhibitors to "knowledge" transmission, and indicates that "historical evolution" provides information about types of "networks" that have developed. While Porter (1998) cites "personal relationships, face-to-face contact, a sense of common interest, and insider status" as important for productivity, Saxenian implies that monoculture from geographical, political, and institutional boundaries reduces network effects.

In the capital region, the short distances, short travel times between cities, and flowing suburban landscapes suggest a geographical structure that supports open networks. However, while there are clearly relationships within the region, independent municipalities, large industrial enterprises, dominant academic institutions, inner-city economic inequalities, eight separate chambers of commerce, and government divisions could restrict underlying networks based on formal boundaries.

Despite partnerships between government, academia, and industry organizations to exchange information across the capital region, institutional emphasis on formal interaction observed in economic stakeholder linkage examples could indicate over consolidation or oligopoly potential. Strategic initiatives should encourage open and dynamic interactions outside formal institutional boundaries.

Network collaboration

As the underlying purpose for networks, Saxenian (1996) argues, "competitive advantage derives as much from the way that skill and technology are organized as from their presence in a regional environment." This means that how knowledge and resources are deployed regionally is as important as whether they exist, and dynamic regional networks encourage natural

26

collaboration beyond formal institutional boundaries. While Saxenian does not necessarily emphasize the same productivity approach as Porter (1998), this implies the same underlying regional dependencies.

From a collaboration perspective, the Scopus bibliographic database reveals that between

2005 and 2013, there were thirty-five joint academic publications between two prominent research institutions in the capital region. During the same period the database revealed over

12,000 joint publications between researchers at two prominent research institutions near Boston.

While this comparison is by no means exhaustive and joint academic publications are not the main focus of this study, this is intended to highlight a regional detail that may have underlying implications. A future study could investigate the historical patterns of academic publications in different regions to measure the impact on networks.

To improve collaboration between institutional boundaries, the capital region should design government, academic, and industrial investments to encourage open regional networks.

This will reduce institutionalism, and develop stronger underlying connections.

1.2.3 Entrepreneurial development perspective

While sources such as Porter (1998), Saxenian (1996), and Bathelt et al. (2004) focus on existing cluster characteristics, Feldman (2005) et al. proposes a framework that directly maps regional "cluster development stages" with increasing sophistication based on entrepreneurial

"configurations." From this framework perspective, it is important to examine how entrepreneurs take advantage of "unique" regional elements such as government to shape the regional opportunities.

To exhibit this entrepreneurial cluster development effect, Feldman et al. (2005) follows a case study of Washington, D.C. that is directly relevant to the New York State capital region, as both share a government presence. In the capital region, which has experienced economic development activity, entrepreneurial cluster development concepts perhaps provide more relevant information than existing cluster descriptions.

27

Entrepreneurial cluster development

Feldman summarizes the triggers for entrepreneurial action and cluster development regional impact.

Some initial change whether a crisis, a discontinuity in industry or an opportunity drives latent entrepreneurs to start companies. This sets into motion interactions in the institutional, economic and policy environments that, in turn, influence the success of a region by maintaining start-ups and furthering the maturation of the cluster to create stickiness (Feldman et al., 2005, 132)

Through this description, Feldman et al. implies the productivity and networks discussed in previous sources, but attributes the "development" process directly to entrepreneurship that takes advantage of specific regional "conditions" to advance itself. The critical factor is how the unique regional landscape is impacted by entrepreneurial activities, and results in compounded entrepreneurial and economic opportunity.

By starting companies, entrepreneurs act as the agents of change, draw on existing resources in the local environment and, in turn, add new resources to the environment. (Feldman et al., 2005, 130)

The above explanation references regional "resource" and institution development that entrepreneurs "influence." In the capital region, opportunities for entrepreneurs to "shape" the environment may exist around established industry, students, university technology, innovation programs, strategic government projects, and local supply chains. The key point is that these regional assets should reveal entrepreneurial opportunity.

Regional benefits

Feldman et al. (2005) proposes that entrepreneurial self-interest positively impacts the region in specific ways: new enterprises, profits, jobs, expertise, facilities, academic institutions, and relationships. This means that regional clusters formed from entrepreneurship significantly improve the regional resilience to "economic downturns."

While economic decline may prompt cluster-like action, Feldman et al. (2005) implies that organized initiatives rarely result in "sustainable" configurations, which instead must be cultivated from entrepreneurial "opportunities" and webs of resources developed through

28

entrepreneurial activity. These factors also reflect the same underlying regional dependencies observed through Porter's productivity and Saxenian's network collaboration. Therefore, regional development strategies should focus on initiatives that reduce underlying entrepreneurial risks and burdens.

In the capital region, regional development investments have emphasized infrastructure and strategic projects associated with established institutions. However, this entrepreneurial development framework implies that entrepreneurial enterprises are more tightly integrated into the regional economic architecture. Therefore, it is important to ensure that regional entrepreneurs are equipped to develop resources that will convert into more resilient regional conditions over time.

29

1.3 Regional clusters in the New York State capital region

Despite the regional cluster characteristics and development perspective differences,

Porter (1998, 2000), Saxenian (1996), Bathelt (2004) and Feldman (2006) present remarkably related themes about regional competitiveness within the global and national economy.

Specifically, these sources emphasize natural interaction within regions: completing, collaborating, networking, and building between all regional participants and beyond formal institutional boundaries.

Based on the analyzed municipality, government, academic, industrial, and organizational linkage, leadership in the New York State capital region has made exceptional progress developing formal relationships and partnerships. However, academic themes suggest that cluster relationships are not actively managed. Clusters are highly complex regional systems where extraordinary dependencies naturally emerge from organic interactions. They simply happen.

In the capital region and beyond, collections of cities, towns, academic institutions, industrial enterprises, government agencies, bilateral relationships, consortiums, partners, and other formal organizations do extraordinary things, but not as a regional cluster. This is particularly clear because many of the relational advantages actually result from programs and initiatives with scope beyond the immediate region, such as the state. The distinction is subtle, but critical.

Finally, these sources suggest that institutional formality damages regional sustainability.

To move from collection to a regional cluster, the capital region strategy should allocate investments to support underlying productivity, connectivity, and entrepreneurship across the region. Even if responsibilities require broader engagement beyond the region, the region must facilitate opportunities for new enterprises to take advantage of unique underlying regional economic architecture distinct from other state, national, and global locations.

30

CHAPTER

2:

INNOVATIVE AND ENTREPRENEURIAL

CAPACITIES IN THE NEW YORK STATE CAPITAL REGION

Previously analyzed academic sources indicate that strong natural dependencies embedded in competition, collaboration, and networks result in resilient economies and prevent economic downturn in regional clusters and agglomerations. Furthermore, entrepreneurial activity is a significant factor in dependency development, and regional strategy should support entrepreneurship.

However, the policies and strategies to effectively develop regional dependencies and entrepreneurship are not obvious. Policymakers and stakeholders already develop economic linkage through partnerships and support entrepreneurial initiatives. Furthermore, it is not clear how existing economic stakeholders integrate with these policies and strategies.

Additional academic regional cluster and entrepreneurial development policy perspectives advocate for strong people, access, and entrepreneurial opportunities within the region. Meanwhile, the MIT Regional Entrepreneurial Acceleration Program (REAP) framework explains that innovative and entrepreneurial capacities linkage across regional stakeholders can leverage existing strengths for entrepreneurial development. This framework clarifies that both innovation and entrepreneurship are required for growth and development.

In the New York State capital region, applied concepts from the MIT REAP framework reveal innovative and entrepreneurial capacities patterns. These patterns highlight opportunities to improve regional capacities linkage.

31

2.1 Regional entrepreneurial development policies

To develop regional cluster dependencies, Bresnahan et al. (2001) argues that policies should encourage quality people, companies, and access across the region. To facilitate entrepreneurship, Feldman et al. (2005) suggests strategies and policies should provide regional

"opportunity" for entrepreneurs.

The MIT Regional Entrepreneurship Acceleration Program (REAP) proposes a framework that integrates policy perspectives, and describes regional development through innovative and entrepreneurial capacities linkage across regional stakeholders supported through cluster and acceleration mechanisms. This framework implies that New York State capital region development requires both innovative and entrepreneurial capacities, and should emphasize existing regional strengths.

2.1.1 Regional policies that develop "cluster" dependencies

Bresnahan et al. (2001) acknowledges regional cluster and agglomeration descriptions in existing academic sources, but remarks about deficiencies in "development" and associated policy recommendations. The study embarks on a "comparative" analysis of "emerging" regional clusters throughout the world, based on innovative "technology development" patterns similar to the entrepreneurial Silicon Valley origination.

Bresnahan et al. (2000) identifies specific common "factors" in early regional growth that includes quality "technical and managerial labor," enterprises, access, market integration, and a

highly "collaborative" approach. From a policy perspective, developing regions should

"position" themselves to benefit from growth "challenges" in established regions to leverage these growth factors.

Many of the policy implications are simple and classical: invest in education, have open market institutions, tolerate and even encourage multinationals, tolerate and even encourage a brain-drain. (Bresnahan et al., 2001, 856)

Based on this assessment, the New York State capital region could position distinguishing assets such as education, empty spaces, infrastructure, and investment into compelling offerings compared to nearby established regions such as Boston and New York

32

City. The underlying implication is whether the region takes full advantage of its capabilities, investment, and talent.

Even though these recommendations suggest policy roles, Bresnahan et al. (2001) highlights "the foolishness of directive public policy efforts to jump-start clusters or to make topdown or directive efforts to organize them" to demonstrate an underlying entrepreneurial role in cluster and agglomeration development. This means that effective policies establish the

"foundation" for development, but do not attempt to control the underlying organization of

"specific industries or technologies to be sponsored."

Porter (1998) agrees with this argument for neutral cluster development policies, remarking, "governments should not choose among clusters, because each one offers opportunities to improve productivity." From these perspectives, the capital region should examine incentives and policies to determine whether the underlying effects encourage development and growth.

2.1.2 Regional policies that facilitate entrepreneurship

The Feldman et al. (2005) observation that "looking at a successful region in its full maturity, however, may not provide prescriptive information about how such regions actually develop" suggests that regions often attempt to import growth. This agrees with the Bresnahan et al. (2001) argument against "jump-starting" clusters, but emphasizes that regional attempts to compete should not simply copy other regions.

In Washington, D.C., Feldman et al. highlights reductions in government jobs and a

"highly skilled" workforce as triggers for entrepreneurial activity and cluster development, although acknowledges a variety of possible triggers. In the New York State capital region, high levels of government and institutional influence could also harbor entrepreneurial triggers.

Feldman et al. acknowledges that policy "opportunities" exist to help entrepreneurs find opportunities.

Areas for public policy intervention to help create supportive and positive decisions of individuals to become entrepreneurs, and the ways in which an entrepreneurial culture develops and takes hold. (Feldman et al., 2005, 139)

33

However, this perspective emphasizes policy opportunity, not control. It suggests that the overall "environment" should be open and available for entrepreneurs to "leverage", and institutional activity should facilitate regional entrepreneurial venture formation in the region.

Feldman (2005) echoes previously analyzed sources that discourage attempts to promote single institutions, industries, or technologies that do not result in the underlying "sustainable" dependencies. When developing regional strategy for economic development investments, infrastructure, and programs, policymakers should focus on initiatives that support and facilitate regional connectivity and opportunity across all participants, and allow underlying cluster effects to "emerge".

In the capital region, regional development should reduce the inherent entrepreneurial risk, avoid pre-selecting winners, and support ventures that exploit existing challenges as opportunities.

2.1.3 MIT Regional Entrepreneurial Acceleration framework

As a participant in the MIT Regional Entrepreneurial Acceleration Laboratory (REAL) led by Professor Fiona Murray and Dr. Phillip Budden in 2013, I explored comparative worldwide entrepreneurial acceleration strategies. Through this laboratory experience, I was introduced to the MIT Regional Entrepreneurial Acceleration Program (REAP) framework that explains regional "innovation-driven enterprise" (IDE) development as integrated "innovative capacity" and "entrepreneurial capacity," supported by complex relationships between entrepreneurial, academic, governmental, established enterprise, and "risk capital" stakeholders.

Beyond this framework, the REAP program comprises a broader initiative that "brings together diverse regional teams from across the globe committed to accelerating their regions' innovation-driven entrepreneurial ecosystems as drivers of regional prosperity and job creation" in a format that supports regional framework application.

This experience molded my perspectives on integrated innovative and entrepreneurial capacities in the New York State capital region, and allowed me to envision the region from different stakeholder perspectives. In particular, the existence of influential government, academic, and industry stakeholders reflects a regional characteristic with potential to significantly influence innovative entrepreneurial activities.

34

2.2

Innovative and entrepreneurial capacities

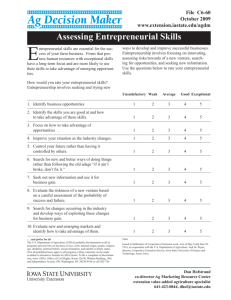

Aulet and Murray (2013) distinguishes "innovative" entrepreneurial ventures from traditional small business, which implies that both capacities are required for regional development and growth.

By innovation, we mean new-to-the- world ideas in the technical, market, or business model domain. The notion of being innovation driven is critical as it emphasizes the entrepreneur's awareness of the need to build competitive advantage, whichfor an entrepreneur can only be done by taking today's resources and doing something distinctive with them. (Aulet and Murray, 2013, 3)

From this perspective, innovation expands economic possibilities, while entrepreneurship transforms innovations into marketable products. Feldman et al. (2005) elaborates on this relationship: "entrepreneurship facilitates the realization of innovation, as firms are formed to commercialize and advance new ideas." Products develop from ideas that become innovations, while entrepreneurial ventures assume the risk to realize them. There will be many failures for each successful venture, and it is important to leverage the unique regional people, institutions, and mechanisms to minimize these underlying risks and capture benefit.

The underlying strength of the MIT Regional Entrepreneurial Acceleration framework is the regional system, with emergent properties that depend on unique regional stakeholder linkage that impacts innovative entrepreneurial development. It is important to analyze these underlying innovative and entrepreneurial capacities interactions in the New York State capital region to understand the regional system, and how it impacts new venture opportunity.

2.2.1 Innovative capacity

While innovation is applied in different contexts, Professor Murray defines "innovative capacity" in the MIT Regional Entrepreneurial Acceleration Laboratory as the "ability to develop new to the world innovations from inception through to the market," and highlights factors that influence innovative capacity across regional stakeholders, including people such as researchers and students, infrastructure such as academic institutions, research funding, intellectual property policies, networking, facilitation mechanisms such as innovation spaces, and aspects of regional

35

innovation "culture." This definition provides a basis to consider the innovative factors, activities, and opportunities that impact innovative capacity in the capital region.

Innovative capacity factors

From the academic stakeholder perspective, the presence of over twenty academic institutions is a significant contributing innovative factor in the capital region. Institutions vary widely in purpose, size, financial model, and focus, but host faculty, publish innovative research, develop students, maintain publicly and privately funded research laboratories, and collaborate around practical industrial processes relevant to national and global industry.

From the government stakeholder perspective, the state government presence provides potential that other regions do not have. Government is the largest employer in the region, which incorporates a highly skilled workforce that lives in the area and consumes its services. The government also maintains infrastructure, serves as a model for New York State, and is a gatekeeper for innovative research and development funding.

From the industry stakeholder perspective, the capital region contains established national and global enterprises, including General Electric, Knolls Atomic Power Laboratory,

Pitney Bowes, and GlobalFoundries. These enterprises employ thousands of engineering and technical workers, collaborate with academia, contribute to infrastructure and facilities, and encourage government to develop public and private assets.

From the entrepreneurial stakeholder perspective, the academic and industry presence facilitates opportunities for innovative students, faculty, and employees with intimate regional knowledge to develop complementary innovations. Innovation facilities, such as the Tech Valley

Center of Gravity "maker space" in Troy and the developing NY-BEST battery development center in Rochester, provide opportunities for experimentation and exploration.

Innovative activity

Academic publications are an important measure of innovative activity because they provide a foundation for new ideas and technologies. Based on academic publication data from the Scopus database, the over 50,000 academic publications between 1990 and 2013 within the primary capital region cities span a range of over fifteen academic subjects, summarized in

Figure 1. In this data, Rensselaer Polytechnic Institute is affiliated with over 18,000 publications

36

and the State University of New York (SUNY) with over 12,000 publications. Therefore, publications in the capital region are significantly influenced by engineering, medicine, physics, and materials science disciplines that align with existing institutional and industrial affiliations.

Interestingly, energy is represented in the publication subjects, but is not one of the most dominant. While innovation areas are not the primary subjects of this investigation, this factor is nonetheless peculiar considering the regional energy focus.

37

Patents are another innovative activity in the capital region that indicates practical inventions with potential commercial value. New York is located in the United States, and therefore inherits national intellectual property policies. Patent aggregation in modem databases provides essential query access to records by assignee and inventor location, including details about who is developing and will benefit from inventions.

Using the PatSnap analysis tool, a query of inventors located in cities and towns within

Albany, Schenectady, Saratoga, and Rensselaer counties revealed 14,328 patents issued between

1990 and 2012. The cities and towns used in this query are provided in the Appendix. Based on these patent records, the top fifteen assignees represent approximately seventy-five percent of all patents identified, as summarized by fraction in Table 2.

Assignee

IBM

Rensselaer Polytechnic Institute

SABIC Innovative Plastics IP B.V.

Sterling Winthrop Inc.

Momentive Performance Materials Inc.

% Share

5.1%

1.5%

0.9%

0.4%

0.4%

Albany Molecular Research, Inc.

Molecular Optoelectronics Corporation

0.4%

0.3%

Total (in top 15) 75.4%

Table 2. Top fifteen patents assignees in the New York State capital region between 1990 and 2013, from PatSnap query.

Based on these patent results, there are a few high-level observations. First, on average approximately 650 annual patents were issued in the twenty-two years between 1990 and 2013, or approximately 760 patents per 1 million in population. The United States Patent and

Trademark Office (USPTO) indicates that 121,886 domestic patents were issued in in 2012, or

39

approximately 387 patents per 1 million in population. In the capital region, this reflects a vibrant pattern of innovative activity.

Second, many patents in this period were assigned to large organizations based outside the capital region. If patents assigned to organizations in the top fifteen list that are not primarily located in the capital region are removed from the regional data, then the total number of patents issued between 1990 and 2012 is reduced to approximately 3,500. This reflects approximately

160 annual patents per year over twenty-two years, or 190 patents annually per 1 million in population. Comparatively, this figure is lower than the 2012 United States average of 387 million patents per 1 million in population in 2012.

Third, when organizations in the top fifteen list that are not primarily located in the capital region are removed from the data, five assignees remain: Rensselaer Polytechnic Institute

(RPI), Plug Power Inc., Albany International Corp., Albany Molecular Research, Inc., and the

Research Foundation of the State of New York (SUNY). Both RPI and SUNY reflect key academic institutional patent influence.

Innovative capacity strategies

The capital region has significant innovative capacity that centers on academic and industry institutions. While these institutions provide economic benefits, institutionalism could reduce individual and collaborative innovation. Potential improvements could emphasize innovation outside existing institutions, programs or policies that provide qualified individuals or small ventures with access to laboratories, opportunities to collaborate with large industrial enterprises, or maker space enhancements. The most important implication is the need to leverage this innovative capacity towards regional development and growth.

2.2.2

Entrepreneurial capacity

While entrepreneurship describes many different activities, Professor Murray defines

"entrepreneurial capacity" in the context of the MIT Regional Entrepreneurial Acceleration

Laboratory program as the "ability to start and build new to the world businesses from inception to maturity," and highlights factors that influence entrepreneurial capacity cross regional stakeholders, including people such as experienced entrepreneurs, infrastructure such as business

40

incubators and parks, business funding such as investment or lending, policies such as formal incorporation procedures, facilitators such as accelerators, and entrepreneurial "culture" in the region. This definition helps to uncover the unique entrepreneurial factors, activities, and opportunities in the capital region.

Entrepreneurial capacity factors

To analyze entrepreneurial capacity in the capital region, academic, community, risk capital, accelerator, government, and entrepreneurial stakeholders were analyzed to uncover the underlying unique patterns and structures in the capital region. This activity provided important details about the mechanisms and programs that support entrepreneurship in the region.

From the academic stakeholder perspective, a key entrepreneurial capacity factor in the capital region is the deployment of people, infrastructure, funding, and capability development with programs that support entrepreneurship. Beyond traditional academic programs, institutions provide specific educational, mentoring, networking, support, recognition, competition, funding, incubation, and infrastructure resources and programs. These identified resources are summarized for four capital region academic institutions in Table 3.

Based on the regional data, there are clearly many factors in the capital region to develop entrepreneurial capacity, especially within capital region institutions. However, there are also potential organizational challenges. While there are coordination efforts, including the annual

New York State Business Plan competition, academic offerings are generally institution specific and overlap.

41

Beyond academic institutions initiatives, Empire State Development and the Business

Incubator Association of New York State identify fourteen total incubators, technology parks, and facilities that support entrepreneurship, as summarized in the Appendix. These initiatives clearly demonstrate regional intent to foster entrepreneurship, although do not necessarily indicate regional coordination or strategy across all participants.

Government programs such as the New York State Energy Research and Development

Authority provide funding for energy related entrepreneurial ventures. However, the 2013

Regional Economic Development Council awards allocated only four percent of approximately

$31 million in development funds for Albany, Rensselaer, Schenectady, and Saratoga counties directly toward entrepreneurship. This suggests that there is significant entrepreneurial funding opportunity to transform the regional economy. Finally, at least two angel investor organizations operate within the region.

Entrepreneurial activity

Aulet and Murray (2013) remarks that innovative entrepreneurship brings "new to market ideas," and emphasizes that innovations themselves are not products. Even though innovation occurs in the capital region, it is important to understand new enterprise patterns.