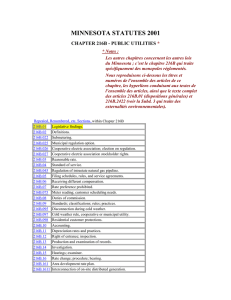

S.F. No. 901 SENATE STATE OF MINNESOTA EIGHTY-EIGHTH LEGISLATURE

advertisement