1973

advertisement

REDEVELOPMENT OF THE UNION PACIFIC FREIGHT TERMINAL

LOS ANGELES, CALIFORNIA

by

D. Michael Gray

Master of Business Administration

University of California at Los Angeles

1973

SUBMITTED TO THE DEPARTMENT OF URBAN STUDIES & PLANNING

IN PARTIAL FULFILMENT OF THE REQUIREMENTS OF THE DEGREE

MASTER OF SCIENCE IN REAL ESTATE DEVELOPMENT AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

SEPTEMBER 1985

D. Michael Gray 1985

The author hereby grants to M.I.T.

permission to reproduce and to distribute publicly copies

of this thesis document in whole or in part.

Signature of the author

D. MicVael Gray

Department of Urban Studies

Planning

August 9, 1985

Cert if ied by

Assistant Professor of Plannin

C i

and Re

Lynnd B.

agalyn

Estpte, Deve)cgment

Accepted by

Lawrence S. Bacow

Chairman

Interdepartmental Degree Program in Real Estate Development

MASSACHUSETTS iNSTITUTE

OF TECHNOLOGY

SEP 0 5 1985

LIBRARES

1

Redevelopment of the Union Pacific Freight Terminal,

Los Angeles, California

by

David Michael Gray

Submitted to the Department of Urban Studies & Planning in

partial fullfillment of the requirements for the Degree of Master

of Science in Real Estate Development.

ABSTRACT

This thesis is an investigation of the feasibility and

highest use for the Union Pacific Freight Terminal located in Los

Angeles, California.

The site consists of 20 acres located in an

industrial strip between the Downtown area and the eastern

Hispanic neighborhood.

The site was selected because of the

architecturally interesting brick construction, the detailing,

the potential for a joint venture development,

the potential tax

benefits, and the potential to create a Downtown focal point.

Redevelopment of the area has begun with the construction of

a

new

produce market across the street from the

site.

Development is constrained by the functionally obsolete footprint

and by a seismic ordinance which will require a $10 per square

foot investment for compliance.

Existing zoning will permit all

desired uses but the site is not located on important existing

bus lines,

a sever handicap for Hispanic residents.

The

demographics within 1 1/2 miles of the site, consist of a dense

population concentration but an extremely low median income of

$10,108.

After reviewing various potential industrial, retail and

office

uses the development program proposes a mixed use

development.

The first phase would consist of a Farmers Market

and

specialty retail services such as restaurants and

a

convenience store.

Later a warehouse store could be added based

upon the initial cash flow. In the final phase the last existing

building

is renovated into additional office space.

The

financial reward

is maximized and the risks minimized

in

the

Phase One development,

with the other phases showing marginal

returns at conservative rental rates. However the combination of

risks will make it very difficult to finance even this portion

even with the land contributed.

Because of the location, the complexity of the mixed uses,

potential

financing

problems,

and

the

poor

income

characteristics, the conclusion of this thesis is that the market

should be tested first with a Farmers Market.

The success of

this

relatively inexpensive component would

validate

the

development proposal and provide viability for a financing

request.

2

TABLE OF CONTENTS

INTRODUCTION ..............................................

.6

Site Context............

..................................

7

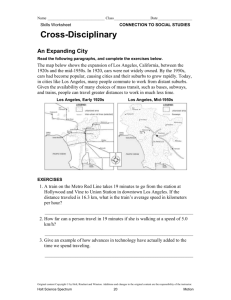

History of Los Angeles...................................7

Economic Profile: Los Angeles............................9

Redevelopment and the ProduceMarket....................11

Constraints............................................14

CHAPTER I: USE ANALYSIS....................................15

Site Attributes.......................................15

Physical............................................15

Environmental..............

.....

............... 18

Legal................

........................

........... 20

Highest Use..............................................22:

Industrial............... .

.

.

................. 22

Retail...............................................23

Office..............................................32

CHAPTER II : DEVELOPMENT PLAN.... ............................34

Cambined Mixed Use Development ................................

34

Deal Structure............ ..................

.............

36

Phased Development.......................................36

Risks..................................................39

Development Strategy.....................................40

SUMMARY ....................................................44

EXHIBITS...................................................46

APPENDIX A: CENSUS DATA................................. . .. 61

APPENDIX B: FINANCIAL PROJECTIONS...........................65

Sources of Information...................................66

Phase One................................................67

Combined Development ..................................... 76

Limited Development......................................85

. .......................... ...... 92

BIBLIOGRAPHY...............

3

LIST OF TABLES, EXHIBITS, AND APPENDICIES

Tables

Table 1

Population Camposition, City of Los Angeles, p.9

Table 2

1981 Urban Family Budget Comparison, p.11

Table 3

Existing Structures on the Union Pacific Site, p.15

Table 4

Site Timed Driving Study, p.18

Table 5

Demographic Study for Census Study Areas, p.19

Table 6

Los Angeles Seismic Rating Classifications, p.21

Table 7

Financial Feasibility Industrial Development, p.23

Table 8

Family ExpendIture Patterns Classified by Family

Income Before Taxes, p.24

Table 9

Projected Trade Area Product Demand, p.25

Table 10

Daytime Population and Projected Service Market, p.26

Table 11

Annual Los Angeles Visitor Spending, p.26

Table 12

Renovation and Proposed Construction Summary, p.34

Table 13

Proposed Use Surnary, p.35

Table 14

Comparative Financial Suinary, p.39

Table 15

Phase I Financial Suninary, p.43

Exhibits

Exhibit I

Site Location: Los Angeles Region, p.47

Exhibit II

Site Location: Downtown Los Angeles, p.48

Exhibit III

Aerial Photo Site Location, p.49

Exhibit IV

Zoning Regulations, p.50

4

Exhibit V

Predominate Use Map, p.51

Exhibit VI

Downtown East Map, p.52

Exhibit VII

U.S. Census Map: Study Areas, p.53

Exhibit VIII

Median Income Less Than $10,000, p.54

Exhibit IX

Easements, p.55

Exhibit X

Site Plan: Existing Structures, p.56

Exhibit XI

Proposed Site Plan, p.57

Exhibit XII

Development Cost Budget, p.58

Exhibit XIII

Operating Proforma Stabilized Year, p.59

Exhibit XIV

Project Assumptions, p.60

Appendices

Appendix A

Census Tract Data, p.61

Appendix B

Financial Projections, p.65

5

I.

INTRODUCTION

This thesis will investigate the feasibility of redeveloping

an

existing

California.

the

railroad freight terminal located in

This investigation will consist

terminal's site attributes,

Los

Angeles,

of a discussion

of

the demographics of the market,

an evaluation of possible uses as well as a proposal for the best

utilization

and

best

of the site.

The evaluation of the site's

use will include both rehabilitation of

structures

the

existing

and redevelopment of the entire site.

structures

are

in a

deteriorating

highest

existing

Currently the

status

partially

leased on short-term leases to local produce distributors.

The

site

was selected for evaluation because the

structures represent architecturally interesting brick

containing gargoyles and other decorative detailing.

available

by

represents

an opportunity for utilizing investment

the

time

the

these

developer,

its

inexpensive

automobile

urban center.

and

buildings

experienced

Angeles

buildings

The site is

for joint venture development minimizing the up

investment

At

existing

the age

were

greatest growth,

the

buildings

credit.

Los

Angeles

constructed,

tax

and with the availability

transportation

As a result,

of

became

a

lacks lacks the sense of a downtown

of

decentralized

more than any other major city

6

front

center.

Los

Combining

based

lack of an urban center with a transportation system

this

upon automobiles, has resulted in few affluent downtown residents

and

a

deserted

This site

an

represents

create a historic retail focal point in

to

opportunity

evening environment.

a

city

with relatively few historic buildings based upon its more recent

growth into a major population center.

Site Context

side

Pacific Freight Terminal is located on the

Union

The

Exhibit I places the site in the southeast corner of

Exhibit II, a more detailed street map, shows

the downtown area.

location

of the site in this downtown area.

visible looking north from the Santa Monica

10,

Olympic

of Alameda Street south of 8th Street and north of

Boulevard.

the

Interstate 5,

Angeles

freeway,

the Santa Ana Freeway,

Produce

It

60.

California

market

in an

is

U.S.

101,

Interstate

area,

freeway,

and the Pomona

located adjacent to

industrial

is

site

The

west of the intersection of the Golden State

just

Freeway,

east

Los

the

Exhibit

III,

approximately 1 1/2 miles from the financial and office center.

Street Address:

840 South Alameda

Legal Description:

Tract 2315

Distract Map 120 B 213

Los Angeles History

City

The

over

excess

the

of

activity,

of Los Angeles has grown at an

astonishing

past century growing from only 50,000 citizens

3 million.

This growth has been fueled by

pace

to

in

economic

the region's desirable climate, and the City's ability

7

was

Angeles

The City of the

to adapt its environment to its needs.

Neve,

established in 1781 by the Spanish governor Felipe De

and founded by eleven families who were promised their land after

homesteading for five years.

In 1849,

Army made

when the U.S.

In 1880, the

its first survey, the pueblo had 2,000 inhabitants.

Santa Fe Railroad completed its link with the Midwest and by 1890

the

events

two

years

Over the next

had increased to 50,000.

population

City's population.

increase

were critical to a tenfold

As

a result of this discovery,

Doheny.

Angeles

had become the oil center of the West.

the

beginning of construction in 1905 by William

the

City's

With

North.

economic

the

activity

in

the

The first was the discovery of oil in 1892 by

William

first

thirty

1890

Los

The second

was

by

Mulholland

water aqueduct from the Owens Valley

availability of

and

land

to

of

the

increased

water,

population

between 1920 and 1930 resulted in

By 1930 Los Angeles was the

growth from 576,673 to 1.2 million.

nation's fifth largest city.

In 1940 the City's first freeway was completed,

link

Pasadena.

with

The

new

mobility

and

a

the

six-mile

continued

availability of new sources of water from the Colorado River

California

Northern

combined

into

By 1950,

business and residential flavor.

interchange

foot

height

The

Los

was completed and in 1956,

disbursed

a four-level freeway

the removal of the

limitation paved the way for

Union

Angeles's

and

high-rise

Pacific Freight Terminal is accessible

150-

buildings.

to

this

large population concentration through the City's freeway system.

By 1980,

the population had reached 2.8 million and during 1983,

8

Los Angeles passed Chicago and became the nation's second largest

of

City

the

Department,

approximately

3,046,696.

the 1983 the population was estimated at

and

15,500

Planning

grow steadily at an annual rate

to

continues

the City

to

According

city.

According to the 1980 Census, the City of Los Angeles represented

of

40%

nearly

total

the

population

of

the

Los

Angeles

Metropolitan Area, which stood at 7,777,403.

Economic Prof ile

The City of Los Angeles has a diverse racial and ethnic mix.

and

Between

1970

persons

increased,

1980,

while

constant.

relatively

and

the percentage of Hispanic

the

percentage

Blacks

of

Asian

remained

which

The City's Hispanic population

is

located directly to the east of the Union Pacific Freight

mostly

Terminal

is

larger than any concentration of

people in the world except for Mexico City.

Spanish

speaking

This Hispanic market

this

is a key to any comercial development of this site because

population represents a primary retail and employment market

for

the area.

Table 1: Population Composition, City of Los Angeles

%Change

1970

1980

Hispanic

18.0%

27.5%

Black

17.3

17.0

(1.7)

White

Native American

Asian

60.7

0.3

3.7

48.3

0.6

6.6

(21.4)

100.0

78.4

100.00

Source:

The

52.8%

100.0

City Economic Development Office. An Economic Profile of

Los Angeles. Page 2.

Los Angeles-Long Beach SMSA is the nation's

9

largest

retail

market.

Taxable

billion

in 1982,

buying

while total county sales exceeded $31

alone represents one-third

area

billion

the

of

population,

retail sales of the three West Coast

and

power,

$13

The Los Angeles

State Board of Equalization,1982).

(California

marketing

retail sales in Los Angeles alone totaled

states

(Sales and Marketing Management Magazine, 1983).

of

Many

the nation's top industrial companies

principal headquarters in Los Angeles.

MCA,

Teledyne,

Lockheed,

Richfield,

Hughes

International.

Aircraft,

Of

Medical

American

and

70

the 100 largest firms in California,

Combined 1982 revenue for

largest industrial firms was more than

10

area's

Among these are Atlantic

Occidental Petroleum, Northrop,

Carnation,

are based in Los Angeles.

these

their

have

These same companies employed nearly 96,000 people

of

the

billion.

$95

(Los

Angeles

Times, 1983).

The

business

major

City of Los Angeles is unique among the nation's

centers

in

the extent to which its

buildings are dispersed throughout the region.

office

high-rise

Currently, there

space

is a total of 93.4 million square feet of high-rise office

in

will

the region,

add

over

and construction is under way on buildings

11.7

million square feet

of

additional

that

space

(Coldwell Banker, 1983).

Table

2

points out that the cost of living in Los

compares favorably with other major metropolitan areas.

Angeles

The cost

of living is 15% below New York City with only three Southeastern

cities lower than Los Angeles.

10

Rank

Table 2: 1981 Urban Family Budget Comparison

Metropolitan

1981

Metropolitan

Rank

Area

Area

Budget

1981

Budget

1

2

Dallas

Atlanta

$22,678

23,273

9

10

U.S. Average

Seattle

$25,407

25,881

3

Houston

23,601

11

Philadelphia

26,567

4

5

6

7

8

Kansas City

Los Angeles/LB

Baltimore

Detroit

Chicago

24,528

25,025

25,114

25,208

25,358

12

13

San Fran/Oak

27,082

Washington D.C. 27,352

14

New York

29,540

15

16

Boston

Honolulu

29,213

31,893

Source:

U.S. Department

April 1982

of Labor,

Bureau of Labor Statistics,

Redevelopment and the Produce Market

Angeles

The

of

The

Although it

of

Los

opportunities

for

City

the

mandate from the City

receives its

the CRA is actually a semi-autonomous agency.

government,

by

empowered

Agency of

in 1945 to promote

established

was

housing and jobs.

private

Redevelopment

Camunity

The

State

sources,

redevelopment law,

by

funded

public

It is

and

citizens.

and governed and advised by private

governing Board is appointed by the Mayor with the

approval

key

actions.

the

City Council which also must approve many

Redevelopment

Law

City Council members

(1945).

Community

California

Agency's authority is outlined by the

initiate

the

redevelopment process by asking the CRA staff to study a specific

and submit a plan for adoption.

neighborhood

The redevelopment

Plan enables the Agency to use tax increment financing, issue tax

exempt bonds,

acquire, develop and sell property, establish land

use controls, and pursue federal and state grants.

The

redevelopment

adjacent,

Pacific

Union

district

across

although

Alameda

it

Street,

11

not

is

Terminal

is

to

included

located

the

in

the

immediately

Central

City

Redevelopment District.

redevelopment

Tokyo

projects

tools

in

are located north on Alameda

Little

Therefore,

the

of the CRA such as tax increment financing

are

and to the northeast in

financing

Other

Street.

process of being cleared across the Alameda

the

in

as well as the site of the new produce market

site

Terminal

Exhibit III shows Union Pacific Freight

Heights.

Boyle

not available without a lengthy staff study and Council approval.

actions

the

dramatic

effect upon the site.

Produce Market.

Angeles

market

dated

to

prior

back

The

World War I and were

1970's

produce

the

buildings

existing

and

overcrowded

a

The Los Angeles Produce Market distributes

of the fresh fruits and vegetables in the United States

a substantial source of employment.

represents

and

City's

From the

redevelopment will be the catalyst to the upgrading

perspective,

of

In the late

to leave the City.

threatened

blighting influence.

40%

a

greatest impact to the site is the redevelopment of the

The

Los

have

to

of the CRA have and continue

However,

efficiency

the Eastside Industrial Area and will improve the

Mayor Bradley through his

and the sanitary handling of produce.

Office of Economic Development did not want this industry to move

south to the City of Bell,

from

the

and he obtained financing for a study

Economic Development Department of the

The

Conerce.

Department

major problem pointed out by the study

was

were

the

Produce

necessary increase in rents to finance new development.

distributors

of

used to paying annual rents of $3 to

$4

per

square foot versus the $7.80 which the proforma indicated.

Ultimately

which

would

own

an

agreement

the

land,

was worked out between

and

12

a

partnership

the

between

City

the

Developer,

Birtcher

Dealers

&

Brokers.

consist

of

capital

involves

almost $62.7 million

buildings

shell

for

and

relocation

acquisition,

costs.

administrative

Central

Alameda,

construction,

site

adjacent

cold

demolition,

Terminal (See Exhibit II).

from

the

Union

site

will

at

ending

Freight

Pacific

to

Phase One is the portion closest

This new

the Freight Terminal is currently nearing completion.

development

from

Produce Market Site runs east

The

street

the

across

and

documents

Eighth Street and Olympic Boulevard

between

site

for

improvement,

street

construction

architectural/engineering,

investment

million of public funds

$26

and

storage/warehousing

dock

total

The

private

improvements,

tenant

improvements,

and

of

and

office

site.

developed on a 28.9 acre

area

will

1986

in

The project when completed

Produce

of

the Association

529,600 square feet of new warehousing,

merchandising

project

and

Pacific,

have one negative effect on the Union

by closing off Eighth Street reducing western

Pacific

from

access

the downtown area.

The Mayor's economic development staff and the CRA were also

involved

in

Market.

This

Streets

Economic

and

is

just

the private development of a new

market

west

is

located between

of San Pedro Street.

Wholesale

Flower

and

Eighth

Seventh

The City

Develoment Administration grant invested

through

$1.5

an

million

owns the roof-top parking lot over the market building which

owned by the Southern California Flower Growers Inc,

profit association.

13

a

non-

Constraints On Redevelopment Of The Union Pacific Site

of

Redevelopment

by

constrained

factors.

several

Terminal

Freight

Union Pacific

The first

is

the

terminal

Business

V) the site is not in either the Central

Exhibit

a

nor

District

The

neighborhood.

residential

industrial

environment limits retail and office uses which would more

be

in

located

purpose

single

residential

District.

Business

is

Located in a thin industrial strip running North-South

location.

(See

the

or

neighborhoods

in

often

Central

the

This is especially true in an area of older

industrial

Loa

buildings.

strict

Angeles's

seismic ordinance requires expensive compliance reducing both the

financial

feasibility and design flexibility.

Because

of

the

neighborhoods' current image residents of other areas of the City

The

the area despite tremendous freeway access.

avoid

nearest

residential neighborhood is the Barrio or Hispanic section of Los

Angeles.

an

and

This

Capitalizing

opportunity.

opportunity

economic

ethnic neighborhood represents both a constraint

can

The

of the surrounding neighborhood are

poor

development

making it difficult to attract retailers.

of

the location

Finally,

the existing buildings fixed on the site limit site

flexibility

narrow

as well as traffic and pedestrian

buildings

of

fronting

the site,

on

flow.

increase walking distances between

and to and from parking.

back

market

ethnic

this

opportunities.

other

limit

demographics

on

planning

The

long

buildings,

Available vacant land is located at the

a long walking distance from

Alameda Sreet,

the

buildings

and without street visibility

Exhibit X).

14

(See

CHAPTER I:

USE ANALYSIS

SITE ATTRIBUTES

Physical Attributes

Structures:

Existing

acres upon which exist five buildings

footage

listed

Table 3.

in

approximately

site consists of

The

20

each containing the square

The positions

of

the

individual

buildings can be seen in Exhibit X.

Table 3: Existing Structures On Union Pacific Site

Structure

Floors

Square Ft./Floor

Total Square Feet

2

1

1

2

1

11,619

22,619

28,199

25,750

42,940

23,328

22,619

28,199

51,500

42,940

Head House

Freight House #1

Freight House #2

Freight House #3

Freight Shed

168,586

Total

The Freight Shed will not be included in the proposed development

because

it

the

exception

to

remaining

structures

with

The

be

historical

little

although

appear to be in sound

condition

of compliance with

the

City's

earthquake

The exterior walls

are constructed of brick and

structural steel interior frame and tar and

remainder

or

buildings,

discussed later.

ordinance

of

other

The

has been deferred,

maintenance

and

disrepair

interest.

architectural

with

in

is

of the site consists of unused

the

cotta

terra

gravel

rail

of

roofs.

lines,

old

deteriorating asphalt, and an old wood automobile unloading dock.

15

The

the site limiting site planning flexibility.

X,

on

structural constraint is the location of buildings

main

As shown on Exhibit

four of the existing buildings are approximately 50 feet wide

and from 200 to in excess of 500 feet long.

limit

severely

manufacturing

Not only does

this

it

also

but

or industrial use,

Parking must be

creates long walking distances for retail uses.

located

optimum

where space is available rather than to provide

construction

new

Additional

access.

is

to

confined

also

available rather than optimal locations.

expansion

the City's capital improvement plan to prepare for the

of

the

construction

under

Los Angeles Produce Market which is

across Alameda from the Union Pacific Terminal site.

Olympic

to

any

also be widened as part

will

Boulevard

project.

of

Alameda Street was widened in 1984 as part

Infrastructure:

During 1985

same

this

of

All utilities exist at the site and have been up-graded

meet future demand of an expanding produce

development

However

market.

must consider a storm drain,

sewer

&

viaduct

which crosses the site and which is shown on Exhibit IX.

Transportation:

The

primary source of transportation

Angeles is the automobile.

The City originally had an excellent

rapid transit system, the Pacific Electric.

and

long

1950's.

disbursed

distances

Since

that

Los

in

Inexpensive gasoline

lead to the demise of this

system

time insufficient density and

character have combined with an extremely

the

high

the

in

City's

fixed

rail construction cost and poor operating projections, to prevent

construction

of

a

new

mass transit

16

system.

Los

Angeles

is

the

currently

the

and densest city in

largest

States

United

A subway system, Metrorail, is in

without a fixed rail system.

the planning stage but has had substantial funding problems

the

federal

Station

government.

with

The.system would run west from

Union

along the Wilshire corridor and then north into the

Fernando

Valley.

The system is not planned to be located

near

the Union Pacific Freight Terminal and will not affect the

Another

proposed

system

running to Long Beach

using

site.

existing

upon

right-of-way could affect the site depending

railroad

San

the

route selected.

An extensive bus system does exist primarily servicing lower

income

residents.

infrequent

service

transportation

is

However,

residents,

#31

existing

the

wider

around the

Union

#68,

retail

travel on lst

areas.

A

and

similar

The main lines,

on Central and San Pedro.

which

travels

industrial areas.

these

streets

situation

exists

#60,

The only lines traveling

east and west on Olympic

#358,

primarily

are

on

and

through

The availability of bus service to the site is

essential for any retail development at this site.

are

Freight

Brooklyn

#53 and

the

for

Pacific

Alameda and Olympic are an express bus to Long Beach,

#66

Bus

use.

main east/west routes servicing

north and south.

traveling

located

and

attracted

resulting

major source of transportation

located

Terminal.

through

not

has

the

residents

Hispanic

long commuting distances and

The

Retail sales

also affected by the number of packages a customer can carry

on the bus.

17

A timed driving study was made to determine driving time

Access:

to and from the site.

minutes

the

As shown below,

5

driving access within

is in excess of 1 1/2 miles with the exception of toward

west.

the

of

this direction you run into the traffic

In

Central Business District and can only travel 1 1/2 miles.

Table 4: Site Timed Driving Study

Distance(miles)

Direction

Intersection Reached

North

East

South

West

Macy St./Union Station

Lorena St/Olympic Blvd.

41st St./Alameda Street

9th St./Broadway Blvd.

These

2.5

3.0

2.5

1.5

can

As

driving times do not include freeway travel.

be

seen in Exhibit I, the site is within convenient driving distance

of most of Los Angeles.

ENVIRONMENTAL

Land

Use:

In

April

1985,

new

a

zoning

ordinance

became

the

effective under the City's General Plan which was adopted by

City Council in June 1979.

heavy

industrial

The site is zoned M3-3 which permits

The height limitation is

development.

times the building area of the lot,

uses

three

far in excess of anticipated

and there are no required setbacks.

One parking space

is

required for each 500 square feet of building up to 10,000 square

feet and thereafter one space per 5,000 square feet.

Since lower

uses are cumulative in higher zones almost any sort of industrial

or conmercial use is permitted.

Residential development is

not

City

has

this classification.

However,

the

permitted

under

permitted

artists' conversion of warehouses into lofts north

18

of

the

Existing Zoning Regulations and Predominant Land Use

site.

be

Exhibit V,

in

seen

can

As

for Downtown Los Angeles is shown in Exhibits IV and V.

is

Terminal

the Union Pacific Freight

located in a thin Industrial strip running north/south.

The

Neighborhood:

radius

This

VI with a 1 1/2 mile economic radius highlighted.

Exhibit

according

because,

selected

was

to

the

on

shown

is

Angeles

area of Los

downtown

Land

Urban

Institute, the theoretical trade area for a neighborhood use such

as a convenience store is 1 1/2 miles.

Map

Census

States

is

miles

the theoretical trade area for a

and

radius

community

Demographic data from

by a supermarket.

anchored

mile

United

an

The 3 mile radius was included because

additional 3 mile radius.

3

same 1 1/2

the

with

Exhibit VII is a

center

Appendix

A,

Census Tract Data, is sumarized below in Table 5.

Table 5: Demographic Data Census Study Areas

1 1/2 Mile Radius

42,103

312,146

11,583

$10,108

3.6

93,286

$11,255

3.3

Population

Households

Median Household Income

Persons Per Household

Source:

3 mile radius

U. S. Department of Commerce, U. S. Census of Population

1980.

Exhibit

less

VIII

Both

$10,000.

than

predominantly

low

these

of

study

in

1980.

income residents as compared with the

The

study

area directly

19

around

is

contain

areas

income for Los Angeles and Orange Counties

household

$18,770

shows census tracts in which the median income

median

which

was

the

site

contains some of the poorest residents of the City.

reviewing

In

that

it is clear

two study areas,

the

the

primary trade area for a conmercial or retail development is

the

Going beyond this radius includes a completely

1 1/2 mile area.

different economic area, the Downtown Business District and Civic

or

Center,

substantially

cultural

and

ethnic

different

neighborhoods.

LEGAL

Legal

The

Status:

existing

the

of

owner

is

site

Upland

Industries Corporation, the real estate development subsidiary of

Union

Pacific Corporation.

their

return

term

increasing

on

short

distributors.

The

from the site which is currently rented

to

leases

small

wholesale

produce

available preferably on a joint venture

is

property

Upland is interested in

basis

and

according to Upland was recently appraised at $12 million.

with

ordinance

The

1934.

loss

regard to masonry buildings

or injury

classifies

ordinance

using the structure.

basis

and

and

a

strict

constructed

before

City of Los Angeles

purpose of this legislation is

life

of

The

Ordinance:

Earthquake

reduce

has

to reduce the risk of

earthquake

All buildings were classified on a cursory

starting with the highest risk

Terminal

buildings

Headhouse has a classification of

remaining buildings 3B.

Industries

people

buildings based upon the number of

are

being

The Union

inspected and cited for compliance with the ordinance.

Pacific

The

damage.

3A and

the

When cited under this ordinance, Upland

will have two choices.

20

They can make

all

mandated

changes within three years,

the masonry walls to the roof and floors,

to

other

make

currently

modifications.

mandated

starting

to

they can anchor

or within one year,

review

and then have 6

City

years

are

inspectors

buildings

classified

3A.

Table 6: Los Angeles Seismic Rating Classifications

Hospital/Municipal

Occupant load > 100

Occupant load > 20

Occupant load < 20

I

II

III

IV

Essential Buildings

High Risk Buildings

Medium Risk Buildings

Low Risk Buildings

Source:

Department Of Building & Safety. Division 88 Earthquake

Hazard Reduction in Existing Buildings. 1982 Edition.

During

1985 Upland Industries can expect that they will be cited

In addition to anchoring the walls, other

under this ordinance.

possible

modifications

installation

seismic

of

vertical

engineers

the

resistance

cost of these

between $4 and $12 per square foot.

$10

receiving

on

all

modifications

the

estimates

range

cost

the

for

ordinance

compliance of this

similar buildings in

places

and

area.

If

if the owner fails to

after

comply

the Building & Safety Department will

building vacated.

criminal

can

This department also has legal

and civil,

to

approximately

development of this site

an order from the City,

with the ordinance,

both

the

affects

dramatically

the

Obviously,

per square foot.

constraints

According

elements.

of the Union Pacific Terminal to be

modifications

and

Based upon a review of their

City

the

inspection,

preliminary

roof

could be strengthening of the

if the owner fails

to

order

options,

vacate.

The

Department also has the legal authority to require darolition but

21

The Department

has only required this action in nuisance cases.

square

of Building & Safety estimates domolition costs at $4 per

foot

or approximately $674,000 for the five existing

buildings.

cost for Upland Industries to delay

compliance

The

opportunity

but

not demolish is the loss of revenue on approximately

62,000

square feet at $2.40, or $148,000.

HIGHEST USE

Industrial

Surrrounded by warehouses and light industrial buildings and

the

of the heavy industrial area in the City of

north

just

Vernon,

heavy

Union Pacific Freight Terminal is currently zoned for

Industrial

industry.

the

would require the demolition of

buildings

architecturally interesting masonry

existing

the

use

existing buildings are functionally obsolete for

because

industrial

The existing configuarations, averaging 350 feet long but

use.

techniques

or

typical

office

square

floor

assembly

parallel

do not appeal to modern

feet wide,

50

only

Currently

plans.

feet is leased

to

produce

small

approximately

62,000

wholesalers.

According to Coldwell Banker & Company this

rent for approximately $2.40 per square

would

foot,

space

generating

annual revenues of $148,000, the amount the railroad is currently

charging on month to month leases.

An

option available to Upland Industries is to demolish the

existing buildings and construct new modern tilt-up construction.

According to Coldwell Banker the local market would be willing to

pay

floor

$3.70 per square foot for new space in the

area

ratio

of .5 would result

22

in

the

area.

Using

construction

a

of

square feet.

351,650

rental

potential

Listed below in Table 7 are the costs and

the

of

redevelopment

income from industrial

site.

Table 7: Financial Feasibility: Industrial Development

Per Square Foot

Land

$25.00

Site Costs

Construction Costs

Soft Costs

Total

Annual Mortgage Payment

(12.5%)(30 yrs)

6.21

Annual Gross Revenues

3.70

redevelopment is not financially

Industrial

a

combination of factors.

New industrial

less expensive land.

on

occurs

4.25

15.00

4.00

48.25

At this

feasible based upon

usually

development

location

inexpensive

supply,

rents resulting from obsolete construction and available

not support redevelopment on high land values in a downtown

will

This problem is increased by costs to comply with the

location.

seismic ordinance or to clear the site.

To compete with typical

have

to

offer additional amenities such as open space and landscaping

in

office

an

parks

area

ratio

and obtain higher rents,

the site would

which does not require set backs and has a

permitting

Therefore

development

exceeding

the

floor

ground

area

area.

industrial development of the site is not feasible

this time.

Retail

23

at

Market

Demand:

order to determine the demand

In

for

various

retail services the median annual income of the 1 1/2 mile

area,

$10,108,

Expenditure

patterns

has been compared with the Department of Labor's

Surveys.

for:

trade

Table

8 compares

different

expenditure

households located throughout the United

States,

families located in the Los Angeles and Long Beach SMSA,

and for

families

Total

with

demand

population

most

part,

an

for

income level equivalent to

the

study

retail goods and services from

the

area.

resident

in the study area is projected in Table 9.

the data for equivalent income groups to

For the

the

study

area was used to predict potential demand.

Table 8: Family Expenditure Patterns

Classified by Family Income Before Taxes

Expenditure

Food At Home

Food Away

Alcohol & Tobacco

Housing

Fuel & Utilities

Household Opns.

Household Furnishing

Clothing

Laundry

Transportation

Health Care

Non Prescription Drugs

Personal Care

Recreation

Reading & Education

Insurance $ pension

Source:

Percent Distribution

All Families

LA/LB

Income Group

14.0%

5.1

2.9

30.8

5.0

12.4%

6.1

3.2

33.7

3.2

18.1%

4.2

3.3

33.5

5.8

5.4

5.6

5.9

4.7

4.3

4.0

6.8

6.9

5.6

1.0

19.3

1.1

18.1

1.3

16.0

6.4

0.7

5.6

0.6

7.1

0.8

2.0

8.6

1.9

8.9

2.0

8.4

1.4

8.0

2.1

6.5

1.0

4.4

Bureau of Labor Statistics, Annual Expenditures and

Source of Income Survey 1972/1973. Sudocs#:L 2.3 1985.

Data was adjusted to 1980 Census Date.

24

Table 9: Projected Trade Area Product Demand

Study Area Median Income

$10,108

Total Income Study Area

$117,076,976

Percentage

Family Income

Dollars (000)

Market Area

Food At Home

Food Away From Home

Alcohol & Tobacco

18.0%

4.5

3.0

$21,074

5,268

3,746

Housing

Fuel & Utilities

33.6

4.0

39,338

4.683

Household Operations

Hamefurnishings

5.8

4.1

6,790

4,800

Clothing

5.7

6.673

1.3

16.0

7.5

0.8

2.1

6.5

1,522

18,732

8,781

937

2,459

7,610

Expenditure

Laundry

Transportation

Health Care

Non-Prescription Drugs

Personal Care

Recreation

Education

1.0

1,171

Insurance & Pensions

4.5

5,268

Daytime

Population:

Produce

Market

According

Revitalization

objective of the City in

new indirect jobs.

American

work

of

resident

Sumary,

a

primary

and

Minority employees (primarily Mexican-

Asian-American) comprise nearly 85 percent of

approximately

the

Wholesale

Angeles

and create 500 new direct

force in the produce industry.

represents

ratio

and

Program

Los

this redevelopment was to maintain 2,500

primary and 3,000 secondary jobs,

600

to the

Since the

Produce

50 percent of Census Tract

daytime population of this Census

census population was used to estimate the

daytime population of the 1 1/2 mile study radius.

25

Market

2064,

Tract

the

to

the

the

incremental

Table 10: Daytime Population and Projected Service Market

Produce Market Primary Jobs

3,000

Population: Census Tract 2064

Ratio: Primary Jobs/Population

1,348

2.2

42,103

92,626

50,523

Population Study Area

Projected Daytime Population

Daytime Population Increase

10%

5,052

$4.00

$20,208

Site Luncheon Frequency

Daily Luncheon Population

Average Daily Expenditure

Total Daily Revenues

Annualized Daytime Revenues

$5.25 million

Sources: City Economic Development Office, Office of the Mayor.

Los Angeles Wholesale Produce Market Revitalization

August 1983; Department of

Program Sunnary.

Cainerce. U. S. Census of Population. 1980.

According to the Visitor Profile,

Visitors:

Annual Report

for

1984 prepared for the Los Angeles Visitors & Convention Bureau by

CIC Research Inc.

visitor days to the City of Los

of San Diego,

Angeles totaled 264.7 million.

Dividing their total expenditures

of $8.0 Billion by the visitor days results in an expenditure

$30.19 per person per day.

day is $81,

visitors

however,

of

The equivalent group expenditure per

this is artifically low because 30% of the

stay with friends.

For those not staying with friends

the table below projects average per group per day expenditures.

Table 11: Annual Los Angeles Visitor Spending

Dollars/Day

Expenditure

$71

27

Lodging

Meals Out

10

Alcohol

24

17

15

41

$205

Amusements

Transportation

Shopping-Food

Shopping-Non Food

Grand Total

Source:

Percentage

35%

13

5

12

8

7

20

100%

CIC Research Inc. Visitor Profile, Annual Report, 1884.

26

The total amount of potential visitor purchasing power for a

to

restaurant and retail'center could attract visitors

festival

the

largely deserted downtown site in the evening.

use

oriented

site

oriented

A tourist

extent upon the type of development.

great

a

to

of the Union Pacific Freight Terminal depends

development

attract visitors to

the

the

proposed

The

site.

local

the

which is oriented primarily toward

plan

development

a

toward the Hispanic population to the east of

not

would

However,

does not rely on revenues from visitors.

market,

Store:

Convenience

location

franchise

Corporation

Southland

criteria,

according

to

its

located

at

the

looks for sites

entrance to a residential neighborhoods containing at least 1,000

residential homes within 3/4 of a mile from a potential site.

A

7,200

7-

the

of

pioneer

convenience store with approximately

stores throughout the nation,

corner

lot on which to build a free standing 2,500

building.

and

area

criteria.

at

With 42,000 people located within the 1 1/2 mile study

over 11,000 households, the area more than

for

contains

Food At Home (see Table 9).

numerous

small

liquor

The

the

Projected

area

stores

liquor

Across Olympic from the site for example

store selling convenience items and

delicatessen.

annual

surrounding

small independent markets and

carrying grocery items.

a

this

meets

Assuming that convenience retailers project their rent

rent, a retailer would have to capture 5.7% of

is

foot

square

5% of revenues, for a 2500 square foot store and a $24

Demand

a

also prefers

Southland

Eleven

containing

These small retailers operate in run

27

a

down

fronts providing less selection at a higher margin than

store

the

Based upon the limited competition,

new convenience store.

a

and

Home,

available

expenditures of $21 million for Food At

projected

rent only requiring a retailer to capture 5.7% of

available

market,

a

the

the site represents an attractive site for

a

The only negative is

convenience store combined with other uses.

non-residential nature of the surrounding neighborhood which

the

is more than overcome by the daytime employment population. Other

negatives

such as Southland's desire for a free

parking can be resolved with an

adjacent

and

standing

store

appropriate

site

Despite these negatives, the site represents an excellent

plan.

in

Store

convenience store such a 7-Eleven

a

for

opportunity

conjunction with other uses.

potential

They

site.

expenditures of $26.

42

also

look for weekly

power than required by the Safeway criteria.

expenditure

person

42

the

by

then

thousand

inhabitants

only $9.63 per person,

of

per week.

more

additional

a

food

purchasing

dividing

However,

results

far below

weeks

in

the

a

population from higher density would

and

weekly

$26

The 1 1/2 mile area currently contains

two Safeways and an independent market.

supermarkets,

the

person

per

food expenditure of $21 million by 52

potential

of

As above, the 1 1/2 mile study radius with

thousand inhabitants contains substantially

the

supermarket

selecting

25 to 30 thousand people within 2 miles

for

looks

sites

Safeway Stores in

Stores:

Neighborhood

per

three

Although

compensate

for the small per capita expenditure, the better locations of the

existing

supermarkets makes neighborhood stores a poor

28

use

for

the

are

Thus,

Area.

Industrial

better

are

the existing stores

these

With most of

to service the existing residents.

located

residential

in

located

while the Union Pacific Freight Terminal is in the

neighborhoods

East

stores

existing

The

site.

residents also dependent upon pedestrian or bus transportation it

successful

very difficult for a supermarket to be

be

would

at

this site.

Farmers Market:

see

In the surrounding neighborhood, it is common to

individuals selling fruits and vegetables in vacant lots

store fronts.

small

the

as

well

that

predicts

The density and total dollars available as

Hispanic

a

farmers market would

for

market

of

this

Although the local capture

rate

At Home within the 1 1/2 mile radius or 9.1%

is very high,

is

existing

much

District

is

Therefore,

Market.

closer to the Hispanic population than

farmers

Central

across

Hispanic residents are currently traveling

site to reach the Grand Central

Grand

excellent

Market the site would have to capture 75% of the

Food

site

an

represent

markets

air

With 33,000 square feet available for a

market within a 3 mile radius.

the

open

of

cultural history

development opportunity.

Farmers

or

Los

market located in Downtown

Market,

on

Broadway

currently servicing primarily

Angeles.

Hispanic

only

The

Business

Central

the

in

the

the

customers.

The location adjacent to the new produce market also makes this a

natural

represent

location

for

a

Farmers

Market.

This

an excellent opportunity for merchants in the

Market to sell directly to the retail customer.

marketing

market

of

space to produce merchants in

29

the

would

Produce

The renting and

Union

Pacific

also

would

Terminal

create

demand

other

for

in

uses

the

development such as the restaurants and office space.

farmers

California Direct

The

market.

operating

markets

have

and the San Fernando Valley.

allows

Burbank,

Although these

fruits

and

the proximity to the

Los

the advantage of selling vine ripened

directly to the consumer,

vegetables

in

one day per week have developed

Gardena,

Pasadena,

Act

Marketing

Starting in 1978 Farmers

growers to sell directly to consumers.

Markets

"certified"

also the alternative of developing a

is

There

Angeles Produce Market and potential for developing cross traffic

a

comercial market cooperating

points

to

retail

opportunities

the

for the Los Angeles Wholesale

tenants

However,

to

order

in

must be carefully selected and mixed

A

Market.

site.

market represents the best use for this

farmers

offering

and

with

a daytime lunch market as well as meeting the demands of

promote

the adjacent Hispanic population.

Restaurants:

The density of population and availability of

$5.3

for food away from home from the residential population,

million

combined with a potential annual daytime demand of $52.5 million,

will support a substantial number of restaurants.

appear to utilize numerous small

residents

and

Brooklyn

have

site.

and

stands located along

taco

avenues.

locations

Four

Central,

Local Hispanic

mexican

San

restaurants

Pedro,

1st,

regional or national fast food

in the area but only McDonalds is close

and

chains

to

the

The other chain locations are: Winchells, Pioneer Chicken,

Carl's

Samboe's,

Hamburgers.

Two

Seasons

coffee

shops, formally

are located in the study area, one of which is located

at Olympic and Alameda.

Two medium priced restaurants are

30

also

located

this

at

Salvatore's,

Hofbrau.

a

expensive

more

Sam's

quality

higher

and

the

Just to

is located nearby at Olympic and Soto.

restaurant

and

the Gala Restaurant

intersection,

north at 3rd Street is the Little Tokyo restaurant area and there

are

market.

produce

existing

adjacent

to

the

The most popular restaurant

in

the

restaurants

Chinese

also

Pedro

on San

Central.

Produce Market is Vickman's a restaurant on 8th west of

This

popular

restaurant

those

matching

a

market as

to

the

luncheon

employees

of

the

produce

available

in

the

Head House,

of

feet

square

have

would

1/2

mile

to

additional demand is the large number

potential

there

customer

is

also a large

number

of

An

area.

study

"Coffee

of

which service manufacturing companies in the

evening

Center.

and

customers

8,133

With

the development

Home within the 1

From

Away

indicator

the

as

6.8% of the available market from daytime demand and the

capture

Trucks"

market.

well

restaurants

type

as well as one or two better cafe

type

food

business of higher quality fast

appealing

Food

could

The Union Pacific Freight Terminal site

luncheon

restaurants

the

of the produce market and staying open for

luncheon market.

attract

2:00PM

until

midnight

operates from

In

area.

affluent

more

Music

who pass the site on their way to the

The tenant mix is critical to establishing a mixed

marketplace

which

will appeal to both daytime office

use

employees

as well as Hispanic residents.

Discount

are

Department Store:

Two discount type department

located northeast of the study area.

stores

Zody's is located

1st and Mott Street and the First Street Store is located at

31

at

lst

and Rowan Street.

These two stores, combined with a large Sears

store located adjacent to their warehouse at Soto and Olympic and

of

east

just

better

are

Terminal,

the Union Pacific Freight

Combining

located to service the residents of the neighborhood.

the less desirable location of the Union Pacific Freight Terminal

with

the

or discount department store is

department

use

not a good

a

that

limited disposable purchasing power indicates

for

this site.

represent a excellent site for a

The location does, however,

warehouse

since

access

are

stores

freeway

Warehouse stores primary criteria is

they

appeal to a customer willing

for their lower 12% gross margin.

exchange

Azusa

store.

travel

to

Existing

warehouse

located in Burbank 15 miles to the Northwest and

in

area.

a similar distance to the Northeast of the Downtown

This site has excellent access to the west, south, and east.

availability

in

of low cost space will be used as an inducement

The

to

attract the traf f ic created by these high volume operations.

OFFICE DEVELOPMENT

The

industrial

area surrounding the site and

the

Market is totally lacking in high quality office space.

consists

almost

exclusively

manufacturing buildings.

older

of

Produce

The area

industrial

Without required setbacks there is

landscaping or other office amenities.

and

no

There is a perceived need

for office space for the ancillary services of the Produce Market

such as insurance and product brokerage.

Through landscaping and

the restoration of the architecturally interesting building there

32

is

an opportunity to lease Class B office space.

addition

will

to

have

its location adjacent to the produce

the advantage of being part of a

mixed

making available additional services to tenants.

33

The

site,

market,

use

in

also

project

CHAPTER II: DEVELOPMENT PLAN

COMBINED MIXED USE DEVELOPMENT

The

development

redevelopment

of

plan

the Union Pacific Freight Terminal proposes

Market,

mixed use development consisting of a Farmers

retail

including

space,

and a

on a phased joint

lease basis.

ground

consist

which

wholesale warehouse store.

of

Of the 20

or

venture

office

acres,

Olympic

an adjacent parcel located along

Boulevard

the existing and proposed new construction are as follows:

Table 12: Renovation and Proposed Construction Summary

Square Feet

Head House

Specialty Retail (1st Floor)

Office (2nd Floor)

Freight House #1

Specialty Retail

Freight House #2

Farmers Market Storage/Refrigeration

Freight House #3

11,619

11,619

22,619

28,199

51,500

125,556

Office

Total Existing

New Construction

Farmers Market

Warehouse Store

Total New Construction

55,000

100,000

155,000

Grand Total

280,556

34

shed,

Proposed uses and

might be acquired later for expansion.

Existing Structures

16

subordinated

the freight

The remaining 4 acres,

a

specialty

services,

food stands and convenience

acquired

be

would

the

of

analysis

and the financial

Table 13: Proposed Use Sumary

19.6%

Farmers Market

55,000

Retail

office

Wholesale Store

34,238

63,119

100,000

12.2

22.5

35.6

Storage/Refrigeration

Total

28,199

280,556

10.1

100%

This

Combined

cost

of

million,

$23.2

stabilized year,

the

The cash flow in

$2.4 million, represents an 10.3% return on the

total project cost.

Assuming a permanent financing interest rate

the cash flow will not support 100% of the project cost.

of 13%,

the cash flow with a 1.3 debt coverage ratio and

Capitalizing

capitalization

ratio,

million

$14

support

indicates

that

of debt or approximately the cost

project,

contribution

combined with Upland Industries land

finance a joint venture development.

the

of

This investment

the developer would have to invest $3.7 million.

be

a

would

project

the

To provide sufficient cash flow for the

improvements.

would

$13.6

of

improvements

consisting of

project

total

Mixed Use Development will have a

million and a land value of $9.6 million.

12%

Percent

Square Feet

Use

to

A portion of the developers

investment would be used to reduce Uplands land carrying value to

increase

level.

acceptable

Uplands internal rate of return to minimum

Pre-tax

The

Rate of Return

Internal

with

for Upland and the developer and the deal

investments

the

above

structure

The project

discussed below are 9.75% and 9.44% respectively.

has a high ratio of the land cost to the total project cost, 29%.

This confirms the high valuation of the property relative to

its

view

the

redevelopment

increase

value.

From

an

after-tax

point

of

in the operating cash flow from tax shelter is not able

35

The tax

to overcome the tax liability when the project is sold.

benefits

reversed in later years.

than the pre-tax IRR.

on

If tax benefits from investment tax credit

the

tax

could

qualify for a 20% investment

tax

credit.

This

utilized

tax credit of $2.7 million could be sold or

improve the conservatively presented after-tax

the

law,

structures are maintained in

investment

is

As a result, the after-tax IRR is lower

historical

project

to

this

increase cash flow in the early years but

do

As

returns.

presented in the analysis, the After Tax Internal Rates of Return

are 7.3% for Upland and 4.7% for the developer.

DEAL STRUCTURE

The

financial

contributes

projections assume

Industries

Upland

Of the available cash flow,

80% is disbursed against the cumulative preferred and 20%

When sold, say in ten years, Upland would receive the

cumulative preferred return.

to

developnent fee,

a

to the

land value plus 50% of the sales proceeds in excess

current

received

8%

and a 50% interest in the cash flow

excess of its preferred return.

developer.

a

its land into a joint venture in exchange for

cumulative preferred return,

in

that

its

The developer receives in addition

Upland

has

and then a 50% interest in

the

20% of the cash flow

its cumulative return,

until

additional sales proceeds.

PHASED DEVELOPMENT

Assuming

investment

in

that

the

the

his

developer wishes to minimize

project,

the controlling

equation is the amount of land acquired upon which the

36

in

variable

cash

the

preferred

on

performed

the

relative

financial

second

returns

from

analysis

was

the

scaled down development where

a

analysis is hereafter referred to as the

This

renovation of Freight Houses #1 and #2 into retail,

and

office,

Proposed Site Plan of the entire

a

and

is

project

This development would

contained in Exhibits X and XI.

consist

approximately 6 acres of the total of 16 acres planned to

acquired in the Combined Development.

the

the

A site plan showing the locations of the existing

storage space.

of

Phase

Phase One includes the Farmers Market and

One development.

structures

developer's

This development could subsequently be

investment is minimized.

expanded.

a

Therefore,

uses.

specific

well as

applicable, as

is

return

be

Phase One would consist of

construction of the Farmers Market to be located between the

House and Freight Houses #1 and #2.

Head

permanent

display sheds.

market

feet

square

of

leasable

landscaping

Extensive

along

renovated

be

would

houses

and

space

with

the

These sheds

to

the

freight

The existing

add

will

33,000

structures.

existing

eating areas are

of

construction

included

in

this

development.

and

Eliminated from the development are the warehouse store

additional office space in Freight House #3.

and

attention

Development

In order to attract

customers to the development site,

would

lease newly constructed space to a

store retailer at less than the developers cost.

store

the

warehouse

The warehouse

would require approximately 2.5 acres with an additional 4

acres for parking.

This scaled down development would be

at servicing a local market with convenience services.

has

Combined

a

total

project

cost

of

37

$12.6

million

aimed

Phase One

consisting

of

The

in the stabilized year

flow

cash

$9.0 million and a land cost of

of

improvements

elimination of the warehouse store,

$1.6

is

a subsidized

million.

$3.6

The

million.

combined

use,

with greater density of development results in an increase in the

Capitalizing the cash

return on the total project cost to 12.3%.

flow

$9.0 million,

similar amount of debt,

the

The

improvements.

resulting

equivalent to the cost of

Upland

to

return

preferred

reduced

the

with

the smaller land acquisition combined

from

a

indicates that the development would support

above,

as

reduces

greater return on investment without the warehouse store

the developers investment to $769,000 and substantially increases

the

Internal

Pre-tax

Rates of Return to both

the

and

Upland

developer to 13.8% and 29.1% respectively.

the

However,

increases

substantially

the

reduces traffic to the site.

12%, combined

hard

risk

project

of the

it

because

The extremely small gross margin of

with a broad product mix of food as well

and soft goods,

store

warehouse

the

of

elimination

as

both

attracts price conscious customers from

a

wide area willing to travel to take advantage of prices which are

Discount Retailers and 35% below

15%

below

The

warehouse

perishable

store

its

thin

margin

does

carry

not

food products which is a natural use combined with

Farmers Market.

normally

with

Stores.

Department

limited

a

With their limited margin warehouses stores are

to

less expensive space unless the

space

is

subsidized, as proposed here.

A

of

third financial analysis was performed with the

the office space in Freight House #3,

38

addition

again eliminating

the

The

store.

warehouse

office space

additional

aimed

is

at

This additional space

businesses servicing the produce industry.

can be developed after the successful leasing of the office space

Phase

in

to

similar

is

The result of this financial analysis

One.

the results in the Combined Mixed

Use

very

Development.

Mixed

Combined

The

Internal Rates of Return are similar to the

Use

Development with increased developer investment required

the

finance

analysis

larger

land

acquisition.

The

of

results

this

Limited

shown below in Table 14 identified as the

are

to

development.

Table 14: Comparative Financial Summary of Phased Development

Land Cost

Improvements

Total Project Cost

Stabilized Cash Flow

$3,612

9,002

12,614

$9,687

13,637

23,324

$6,598