Theoretical and Empirical Observations

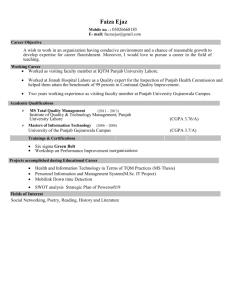

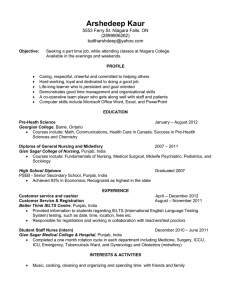

advertisement