GAO HURRICANE KATRINA Ineffective FEMA

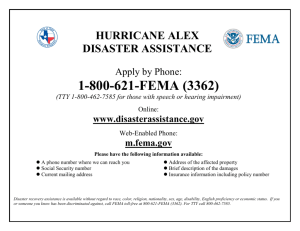

advertisement