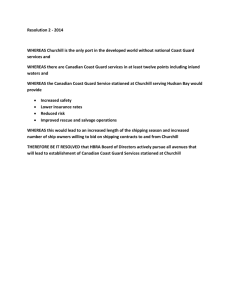

GAO COAST GUARD Progress Being Made on Deepwater Project,

advertisement